Data science, banking, and fintech

In this report, author Cornelia Lévy-Bencheton examines the disruptive megatrends taking hold at every level and juncture of the financial ecosystem.

Long considered an impenetrable fortress dominated by a few well-known names, the banking and financial services industry is currently riding a giant wave of entrepreneurial disruption, disintermediation, and digital innovation. Everywhere, things are in flux. New, venture-backed arrivals are challenging the old powerhouses. Banks and financial services companies are caught between increasingly strict and costly regulations, and the need to compete through continuous innovation.

How does an entire industry remain relevant, authoritative, and trustworthy while struggling to surmount inflexible legacy systems, outdated business models, and a tired culture? Is there a way for banks and other traditional financial services companies to stay on budget while managing the competitive threat of agile newcomers and startups that do business at lower costs and with better margins? The threat is real. Can established institutions evolve in time to avoid being replaced? What other strategies can protect their extensive infrastructures and win the battle for the customer’s mind, heart, and wallet?

Financial technology, or fintech, is on fire with innovation and investment. The movement is reshaping entrepreneurial businesses and shaking the financial industry, reimagining the methods and tools consumers use to manage, save, and spend money. Agile fintech companies and their technology-intensive offerings do not shy away from big data, analytics, cloud computing, and machine learning, and they insist on a data-driven culture.

Consider a recent Forbes article by Chance Barnett, which quantifies fintech startup investments at $12 billion in 2014, quadrupling the $3 billion level achieved a year earlier. Adding to the wonderment, crowdfunding is likely to surpass venture capital in 2016 as a primary funding source. And people are joining the conversation. Barnett writes, “According to iQ Media, the number of mentions for ‘fintech’ on social media grew four times between 2013 and 2014, and will probably double again in 2015.” All of this activity underscores how technology is rattling the financial status quo and changing the very nature of money.

In this report, we examine the disruptive megatrends taking hold at every level of the financial ecosystem by covering:

-

An overview of the current banking industry

-

Key participants and primary targets for fintech disruption, including lending, payments, money transfer, wealth management, trading, blockchain, and cryptocurrencies

-

Adaptive strategies of traditional financial organizations

Yesterday’s Bank: A Rigid Culture, Strapped for Funds

Established banking institutions are strapped. The financial meltdown in 2008 questioned their operations, eroded trust, and invited punitive regulation designed to command, control, and correct the infractions of the past. Regulatory requirements have drained budgets, time, and attention, locking the major firms into constant compliance reporting. To the chagrin of some, these same regulations have also opened the door for new market entrants, technologies, platforms, and modalities—all of which are transforming the industry.

For traditional banking institutions, focus and energy for innovation are simply not there, nor are the necessary IT budgets. Gartner’s Q3 2015 forecast for worldwide IT spending growth (including all devices, data center systems, enterprise software, IT and Telecom services) hints at the challenge banks face: global IT spending is now down to -4.9%, even further from the -1.3% originally forecast, evidence of the spending and investment restraint we see across the financial landscape.

With IT budgets limited, it is hard to imagine banking firms easily reinventing themselves. Yet some are doing just that. Efficient spending is a top strategic priority for banking institutions. Many banks are moving away from a heavy concentration on compliance spending to instead focus on digital transformation, innovation, or collaboration with fintech firms. There is a huge amount of activity on all fronts. To begin, let’s review the competitive landscape of prominent fintech startups.

Lending and Payments: The Behemoths

To say there is no innovation in the banking world would be a gross misrepresentation. But most of the innovation is taking place around the periphery of the financial mainland, not so much in core banking. Our first observation is clusters of venture-backed investing in transactional fintech. Credit, with its inclusive functions of lending and payments, is the mainstay pillar of the banking world and has been since the earliest times. Consumers will always need credit and will always need to make payments. The sheer importance of credit and the huge volume of lending and payments transactions worldwide make it a primary target for opportunistic entrepreneurs. Even capturing a small slice of that huge revenue pie is alluring because it promises a profitable business.

NextGen Lending

A unique array of disruptors is jockeying for position, leapfrogging over debit and credit card processes, accelerating transactions with tap-and-go technology, reducing the need for (if not altogether eliminating) cash, and reinventing financial services. While shaking up the tired banking space with fresh competition, some new entrants are even providing a special way to impact the space for social good, educating consumers and welcoming brand new segments. They are indeed taking a bite out of legacy banking’s market share and profits. Some notable examples are listed here:

- Lending Club and Prosper

-

Leading the way are companies like Lending Club and Prosper, both San Francisco–based peer-to-peer (P2P) lending companies billed as “marketplaces.” As financial intermediaries rather than bankers, they have created a Match.com–like model for lending, matching best of fit savers scenarios with correspondingly appropriate investors. Individual consumers and small businesses alike can lower the cost of their credit and enjoy a better experience with less wait time compared to traditional bank lending. Investors (or savers, as they are now called) benefit from an advantageous risk-adjusted return.

What is truly original about these new firms is their sophisticated data mining and analytics techniques. To gather information about a given applicant, they sample from a wide pool of information sources, including social media profiles, employment history, GPA scores, and modeled future earnings potential. Rather than rely solely on financial or credit history, these lenders focus on applicants’ current finances and future potential to score their likelihood of being good borrowers. This big-data-meets-lending method reduces risk and optimizes best available rates for individuals or small businesses interested in loan consolidation, borrowing, or investment opportunities.

- Funding Circle

- This UK “marketplace” for loans follows the same operational and business model as Uber and Airbnb, where firms do not carry inventory or merchandise but rather connect thousands of people using nothing more than their own platforms and networks. Similarly, Funding Circle operates in a P2P mode without balance sheet inventory and without taking on risk. Its value is in connecting participants (investors who want to lend money) with businesses that need capital. Not bound by reserve requirements, Funding Circle has loaned more than $1.2 billion in the past five years to thousands of businesses in the UK and the US. Per Liat Clark in Wired Magazine, the main benefit comes down to reserve requirements. If a bank wants to lend $100 billion a year, it would need $10 billion in capital. Because Funding Circle does not need this capital up front, it “creates incredible amounts of efficiency,” says Funding Circle cofounder Samir Desai.

- Kreditech

- Kreditech is a German company, not yet operating in the US, that has come up with an original way of scoring individual creditworthiness. They offer loans to individuals based on an analysis of their online data, scored algorithmically. Like Lending Club and Prosper, they do not rely solely on traditional credit rating information. Kreditech focuses on lending money to consumers who are without a credit score and who consequently don’t qualify for credit under traditional reporting mechanisms.

- Kabbage

- An online financing and data company, Kabbage has simplified the manual bank loan application process, offering online financing to small businesses and consumers remarkably quickly. Using online social data and other tools for its underwriting decisions, Kabbage has helped thousands of customers who might otherwise face hurdles when financing through traditional. Originally launched in the UK, Kabbage’s analytics include sources such as business checking accounts, UPS shipping data, and consumer details from large ecommerce sites such as Amazon, eBay, and Etsy.

Additional entrants trooping in to take advantage of credit lending opportunities are such nimble marketers as OnDeck, ZestFinance, Fundbox, Planwise, Currency Cloud, Affirm, and Banking Up.

Payments—Safety First

Because payments touch virtually every sector of the economy, it is critical to provide security. A big hit with consumers is the fraud-fighting Europay, MasterCard, and Visa (EMV) chip that is becoming ubiquitous as it finds its way into the US credit card industry. Ron Mazursky, Director of Strategic Initiatives at Jack Henry & Associates and an expert in payment systems and banking, recognizes the chip as “the next generation against counterfeit fraud in credit and debit cards at point of sale.” The chip has been incredibly successful in Europe, with 90% of credit card terminals being EMV-enabled. A squareup.com article reported the UK has seen a 70% decline in counterfeit transactions since adopting EMV, or chip, cards. Canada reports that losses from counterfeit, lost, and stolen cards dropped from 245 million Canadian dollars in 2008 to 111 million in 2013. Meanwhile, credit card fraud is trending up in the US, where fraudsters have congregated because they can’t hack the chip cards used abroad. We can expect to see some needed improvements in this area. The US lost over $5.3 billion to credit card fraud in 2013, up 14.5% since 2012.

The EMV’s claim to security fame relies on a tech feature—it houses a microprocessor chip that protects the card’s owner by blocking the capture of the account number at the point of sale and using a surrogate. The EMV protocol is fast becoming a global standard providing greater protection against the use of stolen account numbers.

Another development in the battle against fraud is biometrics, sophisticated tools to authenticate true cardholders. Per Mazursky, “The main biometric tools being developed and tested are fingerprint scanning, voice ID, photo ID and retina scanning, and we are seeing these applications grow due to improvements in technology and the proliferation of smartphones.” The new iPhone 6, for example, comes equipped with fingerprint ID technology. Mazursky continues, “A number of large banks have already implemented biometrics to identify bank customers, including USAA, BBVA, and others.”

At the 2015 Money2020 show in Las Vegas, biometrics was a hot topic. This market is forecast to be worth over $117 billion by 2020, according to research firm Acuity Market Intelligence. Vendors vying for a share of that revenue and looking to attract would-be buyers were in Las Vegas to showcase their offerings to over 10,000 attendees.

Cash Avoidance

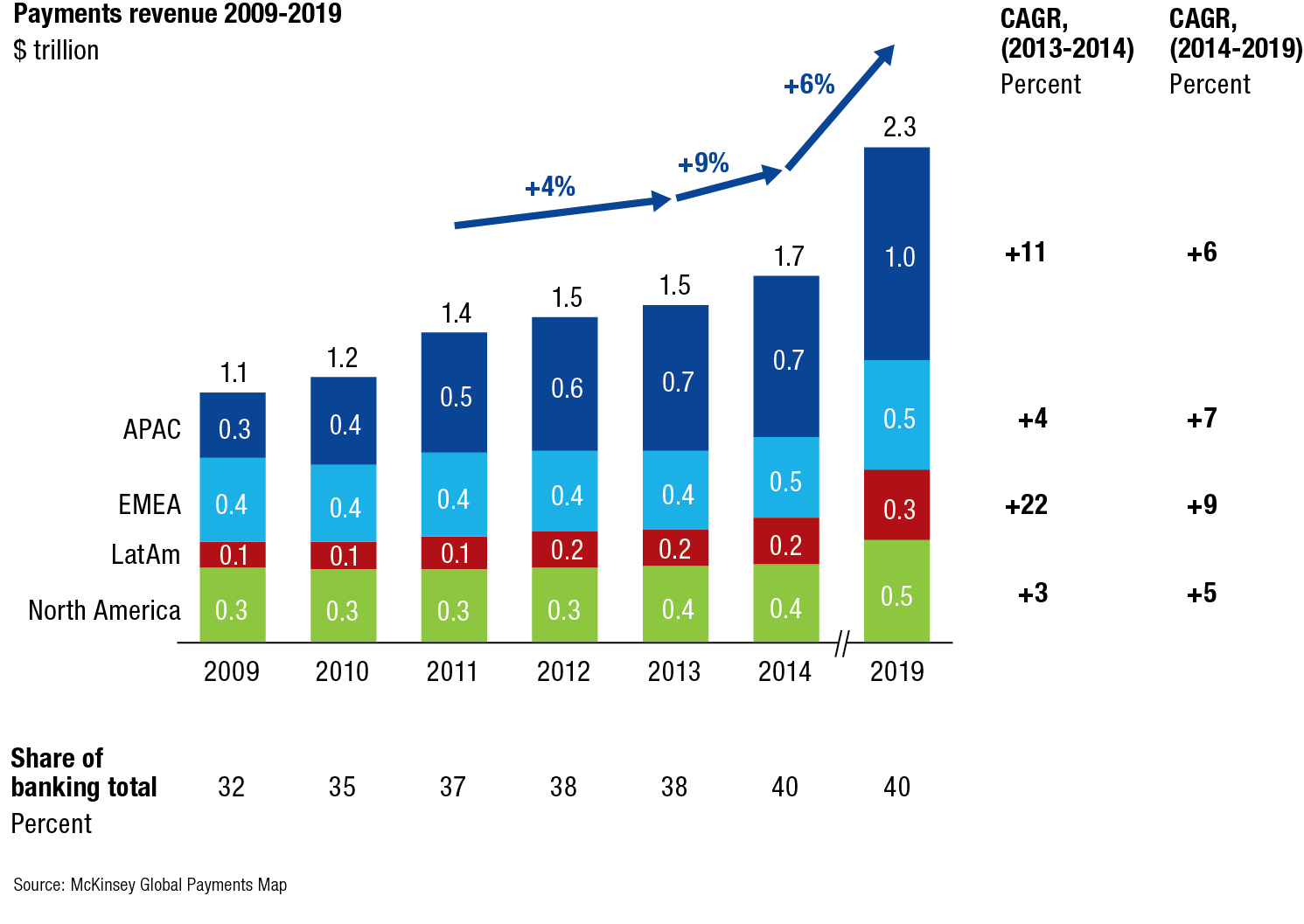

As a fundamental financial activity, global payment transactions constitute an enormous, growing, and profitable area of banking. The average consumer’s banking relationship is dominated by making payments. Consumers often interact with their banks several times a day on payment-related matters, such as paying bills, buying financial products, or checking on a payment status. The frequency of these interactions make payments an excellent platform for cross-selling other financial services—it is not surprising that the payments sector is under disruptive assault, and that so many fintech upstarts are diving into the payments feeding frenzy. According to a McKinsey Global Payments Report (see Figure 1), global payments grew 9% in 2014 and are expected to grow 6% per year for the next five years, compared to the 4% growth experienced in the preceding few years.

Online payments

While the systemically important financial institutions (SIFIs) were riveted by the financial calamities of 2008 and the enduring regulatory aftermath, startups and new market entrants from Silicon Valley crept onto the financial scene. PayPal may have started the online payments revolution in the late ’90s, but its many followers today are looking to shake things up in a big way.

Most notably, there is Square and Stripe. These companies have extended technology to physical payments and other value-added services for merchants and consumers, and thus have established roots in a market that banks used to dominate. They have raised the bar, changing customer expectations about banks, probably forever.

Founded in 2009, Square offers diverse aggregator and mobile payment services. Its Square Register allows individuals to handily enter card details or swipe their card through the Reader, a small plastic device that plugs into the audio jack of a supported smartphone or tablet, to read the magnetic strip. The platform, whose name implies “square up” as in settling transactions or “fair and square,” is also notable as its cofounder, Jack Dorsey, is cofounder and CEO of another Silicon Valley heavyweight—Twitter. Fast, easy to use, and easy to learn, Square allows merchants to accept payments within the same day.

Stripe is a five-year-old payment processor, already valued at $5 billion, which boasts customers like Facebook, Twitter, Apple, and Kickstarter. Stripe’s ingenuity is that it solves a real-world, practical problem that merchants around the world face—how to improve online conversions. While consumers spend more and more time browsing on their mobile devices, their actual mobile-purchasing patterns track lower. Stripe provides a cleaner, clearer purchasing experience for the online consumer at point of purchase. Its social media play is using “buy buttons” on Facebook, Pinterest, and Twitter. With an ambitious goal of doubling in size and expanding into global markets, Stripe takes a unique approach to banks: it is working with them, not against them. Currently, Stripe is engaged with American Express on a single-password solution for payments made across multiple channels. It is also working with Visa, which has invested in Stripe, to explore ways to drive a better customer experience.

Other eager entrants crowding into the payments space include WePay, Clinkle, Dwolla, Flint, Mint Bills, and Zipmark.

Money transfer

Money transfer has historically been done through Western Union and MoneyGram. The last several years have seen the rapid introduction of P2P money transfers using online or mobile technologies. Consumers, already familiar with PayPal (the largest P2P service) and SquareCash, quickly warmed up to new providers like Venmo, Popmoney, and Dwolla.

Venmo, now owned by PayPal, offers a way to send money from person to person through the Web. Linked through mobile devices to a customer’s bank account, which is a popular feature among millennials, there is no fee if the money transfer is done through a debit card. Popmoney is one of the largest P2P providers and is owned and operated by Fiserv. Financial institutions offer Popmoney as a service to customers on their checking account, but at times rebrand it or refer to it as an institutional service. Dwolla provides an online payment system and mobile payments network at an attractive rate. It is very active in the bitcoin transactions space.

These companies are all firmly planted in the fintech transaction space, outside traditional banking. They supply a peripheral financial service that challenges our standard consumer banking habits like using ATM cards, checks, and even cash.

Does all this activity forecast the demise of cash? It may be too soon to tell. But with so many smart cards, mobile payments and other devices for facilitating cashless transactions, and products like Apple Pay and Google Wallet, the popularity of cash may very well be on the decline. Money itself is being reinvented by artificial intelligence and machine learning.

Value Delayed, Not Denied: Money Management

Another category of fintech firm, for money management, aims to provide full value in the future with increased adoption. Unlike the transactional group described above, where there is a fast exchange and clear growth in the present, this group of nontransaction-based firms is expected to provide its fullest benefit in the future. More time is needed to record their value to the consumer and financial impact on the industry.

Automated Investment Services

In the past, financial advisors managed relationships with their clients via one-to-one communications. That relationship has been a central feature of the wealth management and investment advisory product offering. Now, wealth management is becoming an automated process, changing things drastically. Sometimes referred to as robo-advisors, these automated investment services appear to make investing easy, less expensive, and even fun. With lower fees, they use automation to select investments that meet clients’ risk tolerance and growth goals. They are increasingly popular, especially among millennials, and vary by cost, account, investment types, and taxes. Some leaders in this space include the following:

- Betterment

- One of the bigger names in the space is New York–based Betterment, which in 2014 raised $32 million in a Series C round that included such investors as Citi Ventures and insurer Northwestern Mutual. For less complex portfolios, algorithms can determine the appropriate level of risk in bringing investment services to an underserved market. Even established investment advisory firms like Charles Schwab and Vanguard now offer complementary automated advisory services with their traditional offerings, thus extending their platforms to a wider group of clients.

- Wealthfront

-

Another big player in the automated advisory services space is Wealthfront. Founded in 2011, it now has $1 billion under management of its proprietary algorithms. Its CEO, Adam Nash, claims that the company’s growth is driven by millennial investors who are accustomed to software-based services and who don’t believe that star investment managers can outperform the market. Wealthfront account minimums start at only $500.

Mindful of the successful growth of these upstarts, old guard firms like Vanguard and Charles Schwab launched their own robo-advisors earlier this year. After only a few months, they now have assets under management (AUM) of over $20 billion. Because of their massive scale and full technology stack as mature institutions, they can match or undercut competing prices and offer a wider array of services that are nearly impossible for newcomers starting from scratch.

Other firms engaged in automated advisory services include MintBills, WiseBanyan, Blooom, FutureAdvisor, Personal Capital, and Motif Investing.

Exchanges and Traders

The trading world is not exempt from disruption. A thriving group of fintech companies surrounds exchanges, hedge funds, banks, and proprietary trading firms. Concepts like fairness, simplicity, and transparency—prevalent in the fintech space—are edging out the complex, complicated, and fragmented setups of incumbents. Move over NYSE and AMX. The IEX Group, for example, filed with the SEC in 2014 to become a public stock exchange and has received both endorsements and investments from major players eager to improve the structure of exchanges. Led by Brad Katsuyama, IEX aims to level the playing field between high-frequency traders and ordinary traders. The firm was featured in Michael Lewis’ 2014 best-seller Flash Boys, which raised questions about the fairness of automated trading exchanges catering more to the interests of financial intermediaries than the investors and corporations the market was designed to serve.

Then there is LiquidLandscape, a San Francisco–based fintech business launched in 2014, which invites traders to “start a conversation with your data.” Founders Margit Zwemer and David Lin melded their joint backgrounds in information systems, finance, math, statistics, and economics to build fast, flexible, and intuitive real-time data tools for financial markets. LiquidLandscape features an engaging visual interface inspired by social media and gaming, but fueled by big data technology. Initially targeted at traders, LiquidLandscape, per Margit, “is now more widely promoted inside banks incorporating risk management and other operational functions, as well as retail lending and credit card data.” Figure 2 shows some of the common questions to be answered and decisions to be made when a startup like LiquidLandscape approaches a new market opportunity.

Other firms rocking the financial trading boat include Robinhood, whose mission is to make free trading available for everyone, thus democratizing the markets. Meantime, Quantopian is turning ordinary people into hedge fund managers with their crowdsourced hedge fund managers and freelance quantitative analysts who develop, test, and use trading algorithms to buy and sell securities. And Anova Technologies concentrates on network connectivity solutions to optimize latency and capacity.

Blockchain, Bitcoin, The Cryptos

We are witnessing the dawn of a new age of technological distribution, automation, and growth. Progress in the tech space has shifted us into the era of the blockchain. This technology revolutionizes the way we account for ledger-based transactions and encourages us to rethink the role of central banks and other intermediaries, as well as the protocol for trust and fiat currency, peer-to-peer networks, and shared control. Blockchain introduces new flows of value, impacts regulatory frameworks, and opens up a world of potentially new applications. Founded by Nicolas Cary, Ben Reeves, and Peter Smith about seven years ago, it represents the next phase of the Internet’s evolution—the age of decentralization. A profound new distributed database ledger, blockchain’s key element is a hash or bulletproof code that keeps information secret. The technology has given birth to a host of cryptocurrencies, the most prominent of which is bitcoin.

R3, the consortium working on a framework for blockchain technology in global markets, now boasts 22 prominent financial institutions. Development could not only spur further use of blockchain in the financial sector, but also cut regulatory costs substantially because of its transparency. “For emerging markets, blockchain technology adoption promises a boost to the standard of living to many of the unbanked in countries where, in many cases, good centralized banking systems do not exist,” says Susan Joseph, a practicing lawyer turned strategy consultant, adviser, and entrepreneur with an expertise in all things fintech. “Access to financial services should improve. However, its application does not stop with finance because the need for a transparent, trustworthy digital record is huge.”

Witness Greece. Facing a devastated drachma and an inability to repay its staggering debt, the country agreed to test the first-ever digital currency ecosystem in the summer of 2015 on the remote, pine-covered island of Agistri. The pilot has ended, but the experiment resulted in a host of dos and don’ts for developing a digital currency infrastructure. Clearly, blockchain is not yet ready for primetime, but holds much promise.

Witness voting and wills. Susan brings forth her law training to reimagine additional uses of blockchain in the future: “Voting could be tested in small chunks side-by-side with the regular voting machines to demo its integrity and then perhaps the technology will be purchased by a government for an official voting operation.” Susan continues, “Another way to expand its sphere of influence is through wills. From a legal standpoint, these documents need to be timestamped and trustworthy. They could reside on your personal blockchain. When the need arises to probate the will, it could be accessed, trusted, and automatically probated through smart contracts executed on the blockchain because of the confidence and certainty now made possible through this technology. For the idea to gain traction, probate laws would have to be modified but as an orderly process and business template, wills could jumpstart a whole new use.”

Canadian-based entrepreneur, William Mougayar, a noted blockchain expert, investor, 4X entrepreneur, and board member at OB1, has constructed an infographic depicting the Wild West blockchain ecosystem. Figure 3 shows 268 nontraditional financial companies in the global supply chain. Some of these firms are offering solutions to existing players while others are competing with them. How all of this will shake out remains to be seen.

Going Bankless

Technology is transforming banking—it is shrinking some areas, eliminating others, and radically changing still more. Certain areas of banking are self-organizing, leaving no fingerprints on the creative ways they are responding to enduring market and consumer demand. The bank, with its network of brick-and-mortar branches, is becoming expendable while cash becomes, for some, an inconvenience.

The Non-Bank Bank

As Bill Gates said years ago, “Banking is necessary. Banks are not.” Brett King certainly agreed with that notion when he founded Moven in 2011 and wrote Breaking Banks in 2014. Moven’s mobile-centric banking app puts banks in the palm of the consumer’s hand—literally. It coaches users on how to better save money and essentially bypasses the need for brick-and-mortar branch establishments. Another disruptive technology firm leveraging the growth of mobile tech and the omnipresent smartphone, Moven reinvents the basic checking account and the fundamental relationship between the bank and its customer.

Toronto-Dominion Bank Canada recently partnered with Moven. The arrangement hints at the strategic direction some banks are taking with respect to responding to customers’ current and anticipated needs. The bank’s strategy behind their partnership is to build mutual strength and stability, create alliances where they lack scale, and take advantage of market share.

Another “non-bank” bank is Simple. This group originally partnered with several banks to provide a graphical user interface, but was purchased last year by BBVA (Banco Bilbao) and is now being integrated into their worldwide operations.

These firms unsettle the standard banking habits to which we as consumers have become accustomed—habits like maintaining checking and savings accounts, and even using physical checks. This begs the question: what’s left of banking when mobile tech puts banking in the palm of your hand?

Shadow Banking

Banks are no longer the only game in town. If banks can no longer provide credit with the necessary ease to fuel economic growth, then the market has sought—and found—other credit models and lending alternatives that will. Witness the phenomenal growth of the shadow banking market outside, alongside, and sometimes even within, the regulated bank lending industry. The term “shadow” indicates that their loans are not regulated in the same way as conventional bank loans. Fueled by restrictions in the traditional lending space and stringent Know Your Customer and AML compliance, shadow banking offers more accessible options and better costs than the traditional banking route. A top international banking executive, who agreed to be interviewed on condition of anonymity, estimated that the shadow banking market is now valued at over $80 trillion. According to a recent Bloomberg article by Ambereen Choudhury, the shadow banking system could take an $11 billion bite from traditional lenders’ profits over the next five years. This is an example of a successful strategy to circumvent regulation and deliver value in both product and service to consumers worldwide.

Rebuilding Core

Fundamentally, banks need to retool. They need clean data in a reliable architecture to mitigate operational risk and meet their reporting and stress test requirements. While system replacements may not be feasible, upgrades are on the uptick. Deenar Toraskar, a well-recognized expert in market risk and big data solutions architecture, and principal at Think Reactive, summarized the magnitude of the predicament: “The data required by the regulators do not fit the relational model any longer. Traditional systems and architectures, current databases, middleware, messaging, and design patterns simply cannot cope with the new regulations imposed and the data reporting requirements, which are on an order of magnitude increased.”

Deenar clarifies that the situation is not necessarily hopeless, as other companies—Google, Facebook, Twitter, Yahoo, Netflix—have all tackled big data problems successfully. “Sometimes, it is hard to translate these technologies into the banking domain where the need for zero data loss and eventual consistency is not always sufficient; and banks have typically not been strong in adopting the open source model.”

London-based Elizabeth Lumley, who was part of Innotribe’s first Power Women in FinTech Index and is currently managing director of Startupbootcamp FinTech, offers a potential solution. “To transform the industry, there needs to be a massive overhaul in core banking,” she said.

Legacy systems are not the only issue. There is legacy mentality as well, which translates to a gap between today’s banking practices and today’s expected consumer practices. Lumley notes that disconnect often begins at the front door—in the procurement department. “The best way to change the culture of banking is to overhaul the procurement department,” she says. “These gatekeepers limit access to outside vendors and suppliers proposing innovative products and services and who have a lot to offer, embedding new services into the financial entity or piggy-backing onto existing ones. But when you need five years of P&L, preferred vendor status and a long list of other requirements, it gets impossible. I heard an example where a major bank lost out on a promising supplier who pulled out of a deal because the bank was too old fashioned, too traditional, and couldn’t be dealt with!”

A clever workaround, says Lumley, is for banks to “partner with innovation labs, establish direct associations with them, or build innovation centers in-house to fund innovation drives. This is separate from the main bank IT departments—letting banks take advantage of new agile technologies without it impacting the core bank IT budget.”

And they are doing just that. To keep pace with the breathtaking velocity of innovation in the tech space, banks have moved outside their comfort zone. UBS has opened a dedicated innovation lab in London to become a closer participant in the new ecosystem and collaborate with upstarts, startups, and the investor community. Credit Suisse has backed The Anthemis Group to scout digital talent. Goldman Sachs has open sourced its proprietary GS Collections code, looking to make improvements and identify programming talent. JPMorgan opened a technology hub in the UK to identify fresh tech talent, especially female engineering students, and has adopted an agile methodology as a best practice for tech projects. Both HSBC and Santander are investing: they have created separate funds that provide capital directly to fintech startups. All of these initiatives modernize and strengthen their brands.

Tech Is Coming for Banking

It would be a narrow view to assume that the best and the brightest people, innovations, and technology only come from within an organization. Forging partnerships and closer ties with the outside world, and looking to fintech firms for inspiration and guidance is sensible, adaptive behavior. Working with outsiders provides a learning experience that prompts cultural transformation or, at a minimum, cultural shifts.

The rigid culture of banking, with its traditional silos of products, isolated operating groups, and humdrum mentality, is changing. Looking around for progressive industry leaders, we can identify Lloyd Blankfein, CEO of Goldman Sachs, who now unabashedly describes Goldman Sachs as “a technology firm.” Discussing the future strategic direction of the firm with Michael Bloomberg in a recent interview on Bloomberg News, Blankfein said, “Twenty-five percent of our employees work in technology and it doesn’t stay still: you need technology to drive the business, to comply the business, to make sure the business is risk-managed.”

One senior regulatory and compliance specialist, who spoke on condition of anonymity, reacted to Blankfein’s sentiment by saying, “Banks have always been reliant on technology, but thinking this way changes their identity, helps people think in a completely new way. It changes their culture.”

Rebrand, reposition, and rethink are the transformative mantras of a winning strategy. Will banks and other incumbent financial services companies heed the call? We’ll know soon enough.