2017 Design Salary Survey

Tools, trends, titles, what pays (and what doesn’t) for design professionals

Mosaic. (source: Jan Hrdina on Flickr)

Mosaic. (source: Jan Hrdina on Flickr)

Executive Summary

THE 2017 O’REILLY DESIGN SALARY SURVEY explores

the landscape of modern design professionals, giving details

about their roles and how much they earn. The results are

based on data from our online survey that collected 1,085

responses. We pay special attention to variables that correlate

with salary, but this report isn’t just about money—we present

a range of information, including the popularity of design

tools, tasks, and organizational processes.

In what is now our second salary survey, we find some

consistency as to what matters in the

field of design: that the better-paying

design jobs tend to concentrate in tech

centers; that experience matters more

than age; that knowing more tools,

working with more people in a wider

variety of roles, and working for larger

organizations all correlate with higher wages. And, in a sign

that some things in the design world resist change (in some

cases, whether we like it or not), we still see women making

less than men and that most designers still use pen and paper

as their primary design tool.

Note

Designers reporting no process earn the least

Some key findings include:

-

The West Coast (CA, WA, OR) has the highest salaries—

salaries are high even relative to those states’ per

capita GDP -

Healthcare, banking, and computers/hardware

respondents report the highest salaries -

Respondents from large companies report higher

salaries -

Agile is the most popular design process; however,

those using LeanUX or a hybrid of

different processes earn the most -

Designers reporting no process

earn the least -

Higher earners use a wider

selection of tools -

For prototyping and

wireframing, salaries are highest

among those that use Sketch

We hope that you will find the information in this report useful. If

you can spare 5–10 minutes, please go ahead and take the survey

yourself.

Introduction

FOR THE SECOND YEAR RUNNING, we at O’Reilly Media

have conducted a survey for designers, gathering information

about their compensation and details about their work. This

year, 1,085 people from 48 countries took

the survey. Respondents are mostly UX,

product, and graphic designers, but there

are also a fair number of developers and

other professionals involved in product

design. The survey was conducted online,

collecting responses from December 2015

to December 2016.

Note

1,085 people from 48 countries took the survey.

While typical for online surveys, the methodology we used

of a self-selecting, uncontrolled respondent pool can lead to

less than ideal results. However, the broad range of respondents’

geographies, industries, and company sizes helps

mitigate the issues associated with a small, narrow sample.

Throughout the report, we quote median salary statistics for

various groups of people, such as those respondents who

used a certain tool or came from a particular industry. Since

these figures can be misleading if the

variable in question correlates with geography

or experience, we also sometimes

quote a median “adjusted” salary.

Technical details are in Appendix A: Adjusted Median Salary.

Note

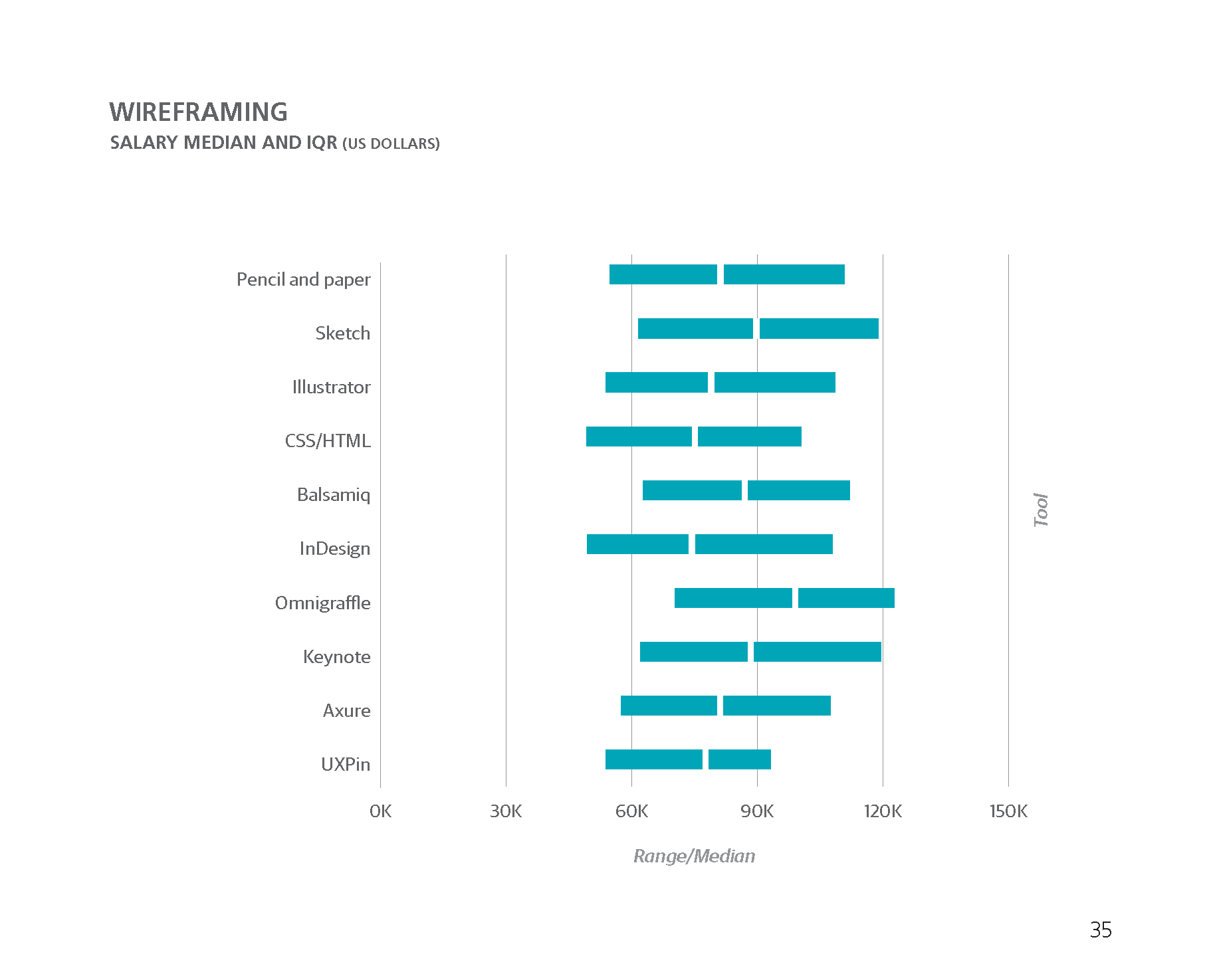

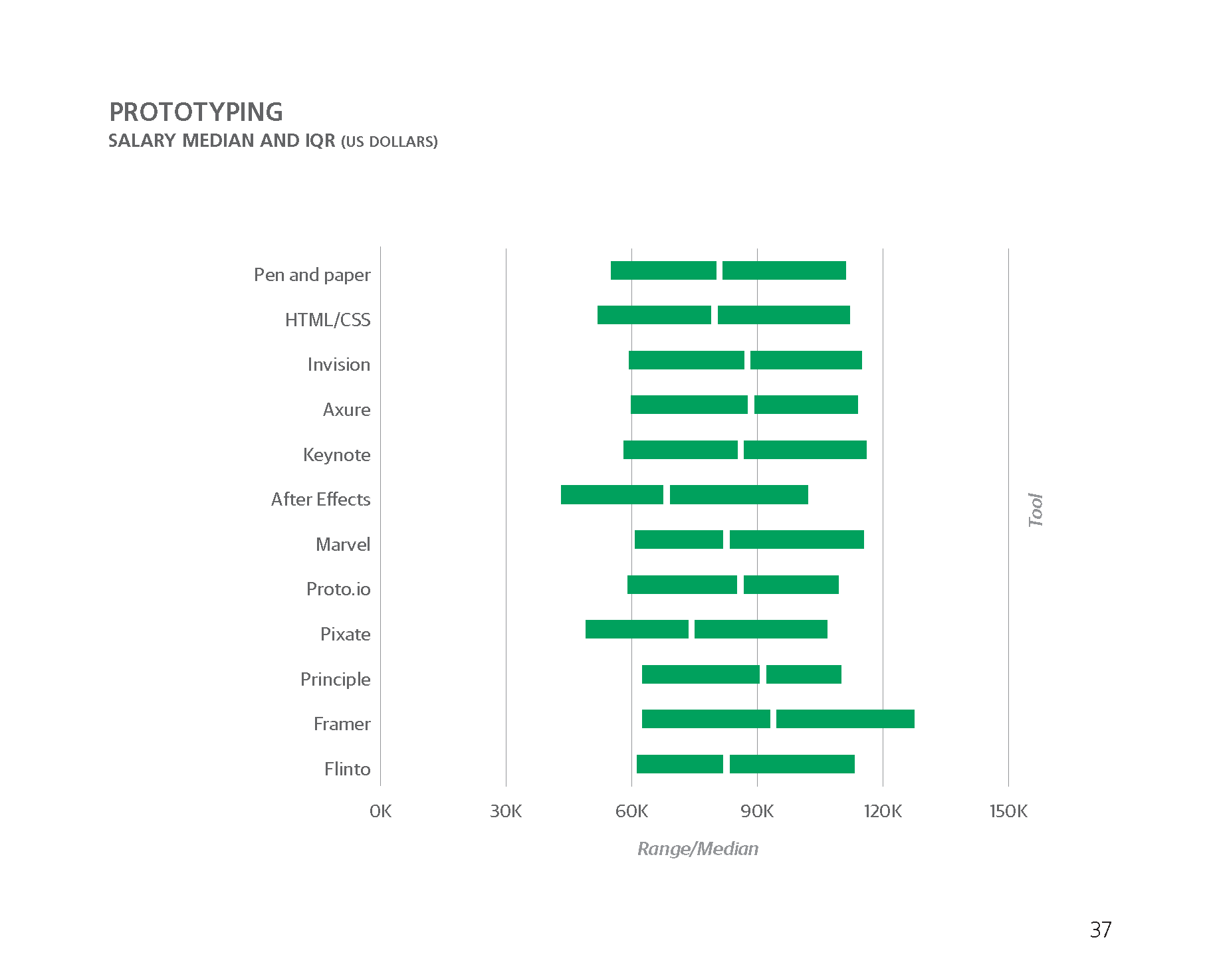

In the horizontal bar charts throughout this report, we include

the interquartile range (IQR) to show the middle 50% of

respondents’ answers to questions such as salary. One quarter

of the respondents has a salary below the displayed range,

and one quarter has a salary above the displayed range.

Salary Overview

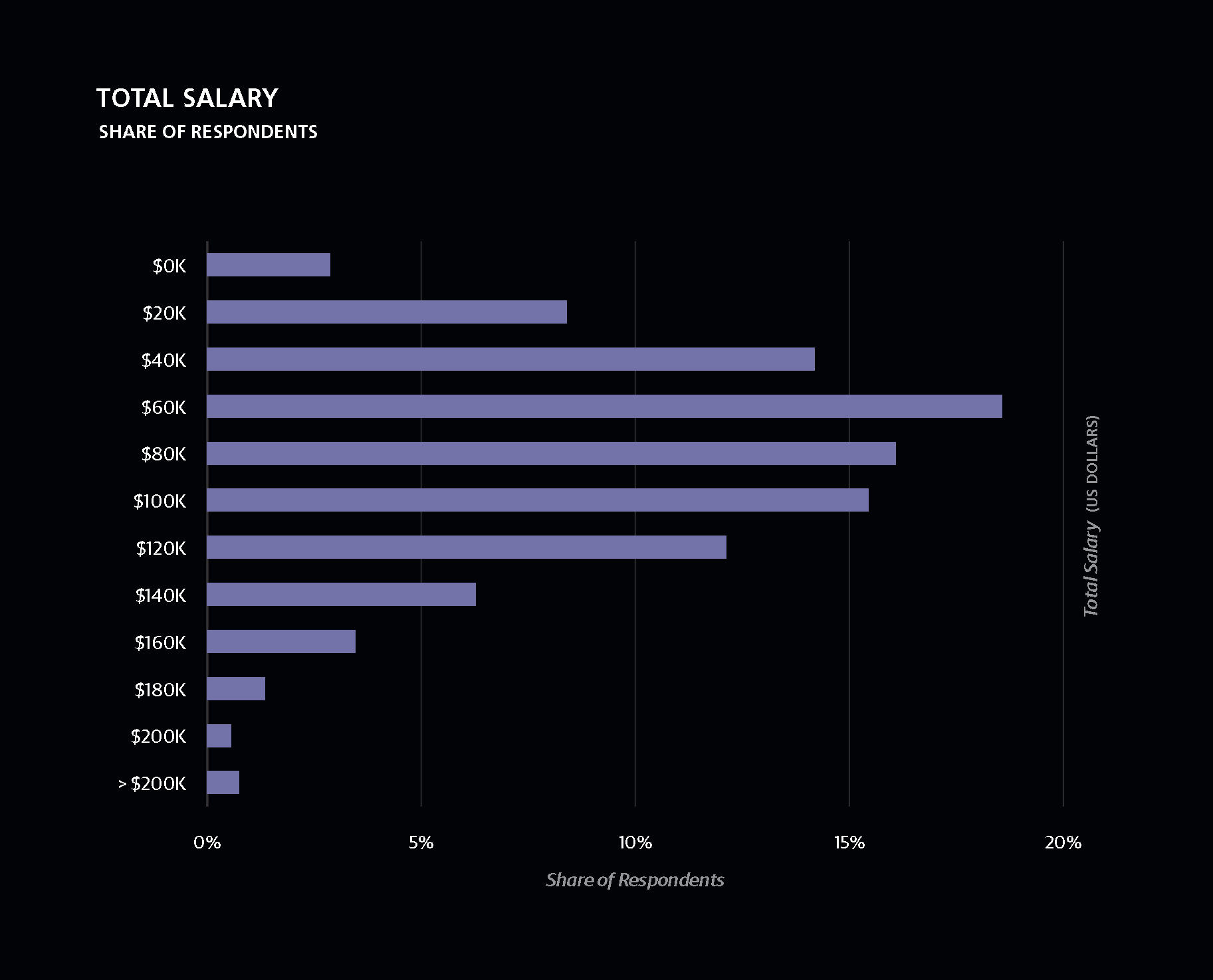

THE MEDIAN SALARY OF THE ENTIRE SAMPLE IS $77K,

with the middle half earning between $50K and $109K. This

“middle half” statistic is called the “interquartile range,” and

we show it in many of the graphs to give a sense of the salary

spread for various groups of respondents. The spread is very

broad, but this isn’t surprising given the diversity of professional

backgrounds among respondents and the fact that they

come from locations with very different overall wage levels.

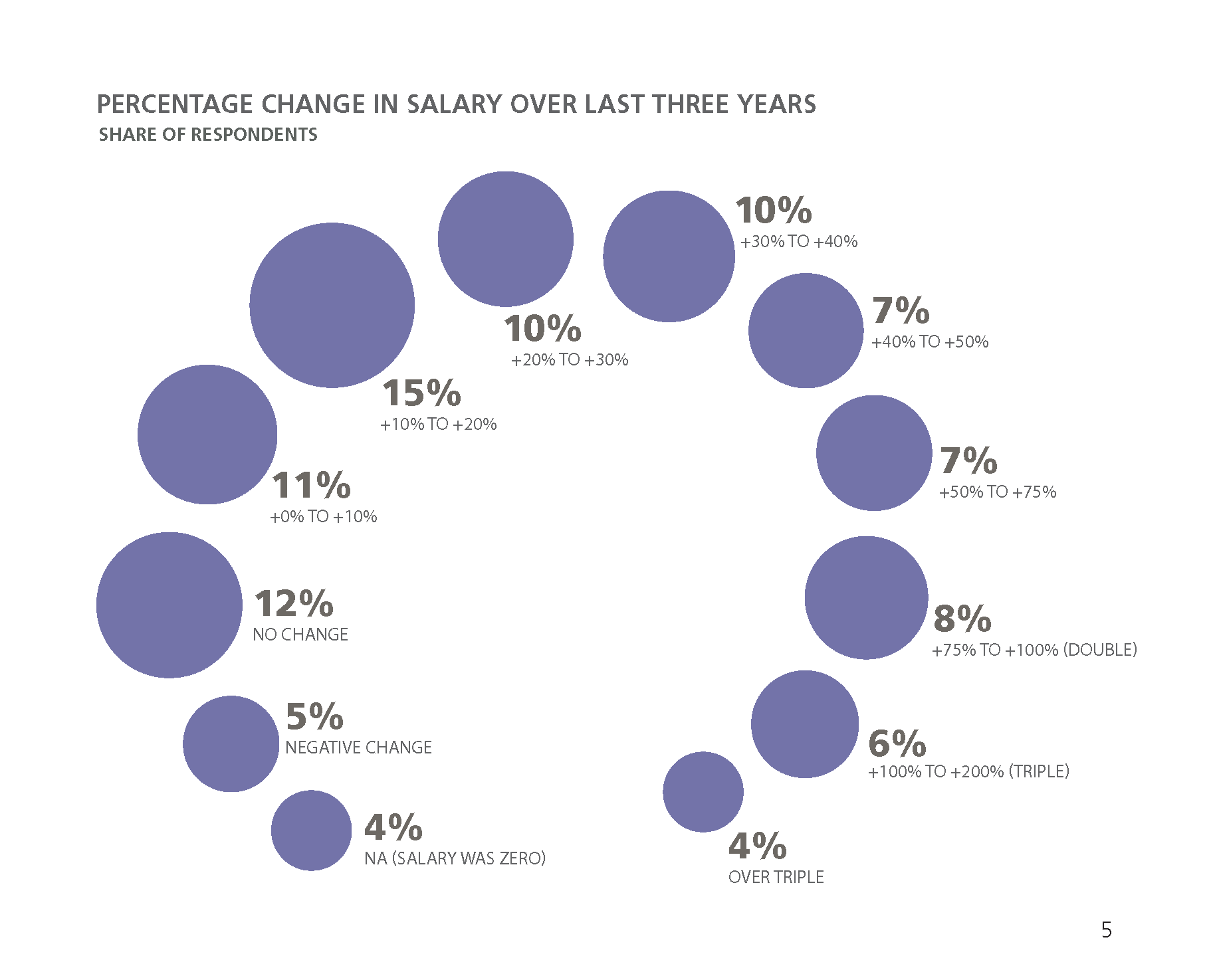

Most respondents report some gain in salary over the past

three years, and about 10% of the sample saw their salaries

double. Another third has wage growth of 30% to 100%

(also across the last three years). Respondents who have no

wage growth tend to have lower salaries (median of $50K),

but otherwise there’s no clear pattern between salary growth

(as a percentage) and current salary.

Geography

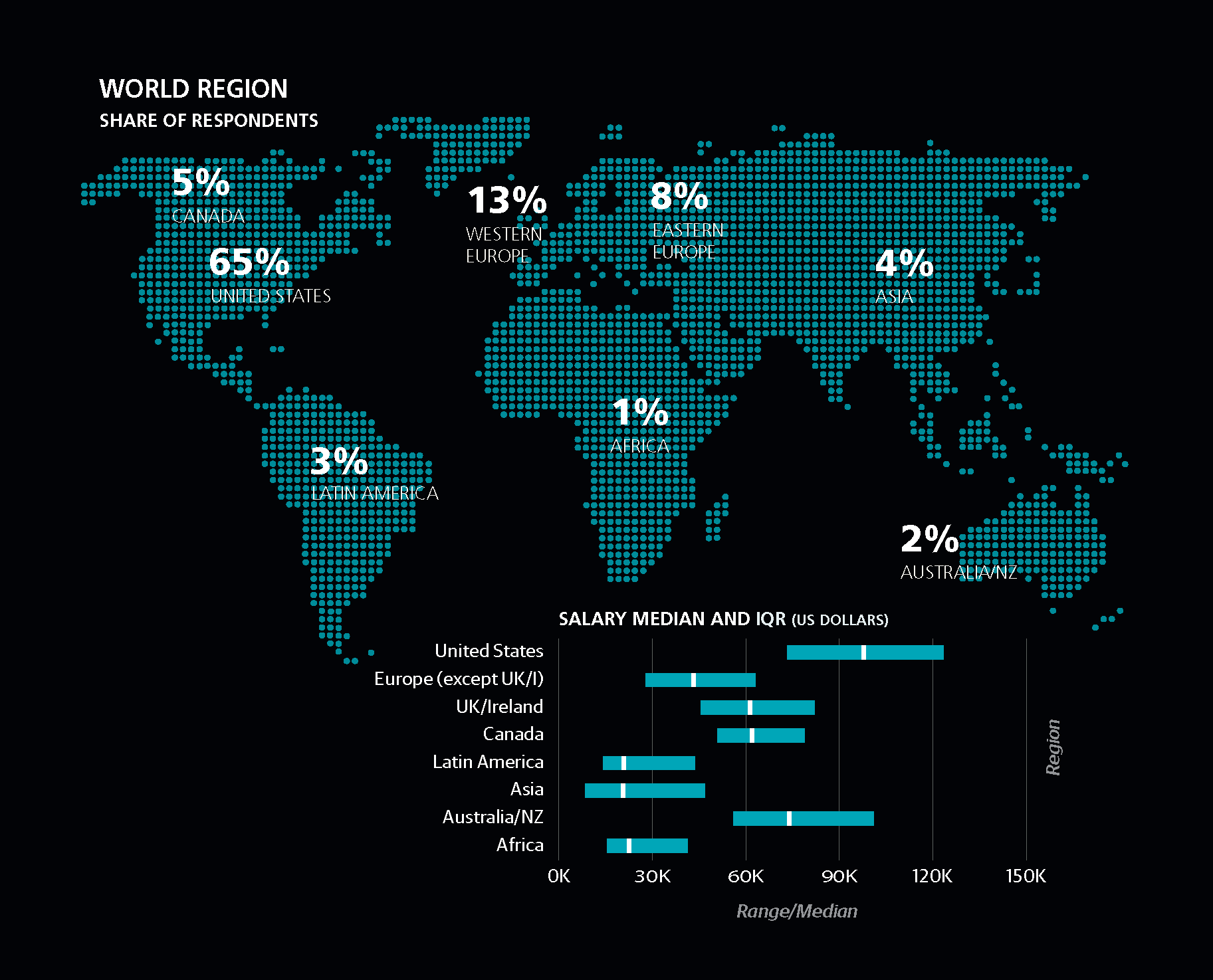

TWO-THIRDS OF THE SAMPLE IS FROM THE UNITED STATES,

and 20% is from Europe. After the US, the most well

represented countries in the sample are Canada (5%), the

United Kingdom (4%), Germany (2%),

Russia (2%), and Australia (2%).

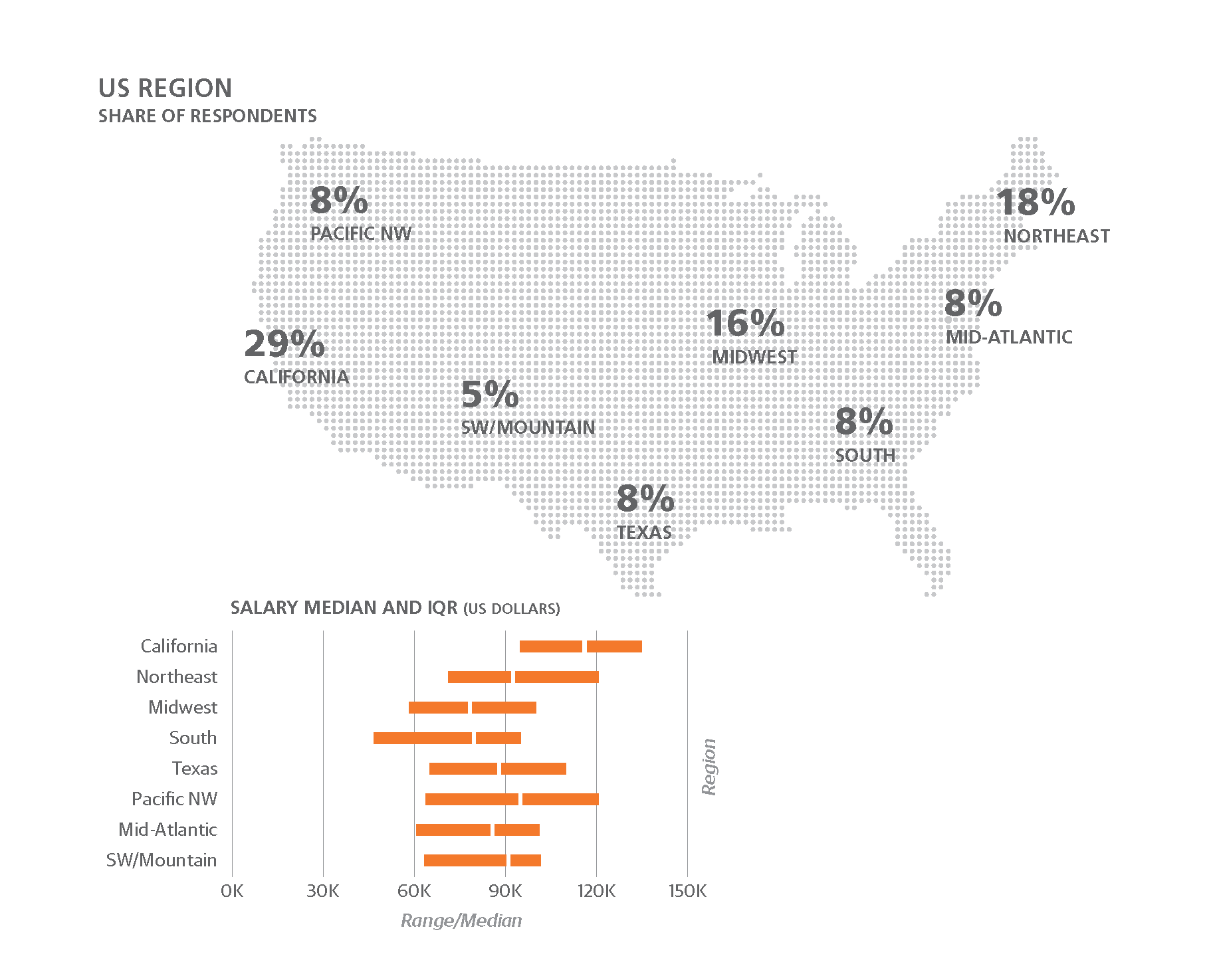

For US-based respondents, a disproportionate

share comes from the

West Coast: 37% of the sample is

from California, Washington, and

Oregon (states containing only 16%

of the US population). New York and

Massachusetts also have disproportionately high response rates.

The skew in the geographic distribution of respondents likely

reflects that the O’Reilly audience and design-related jobs tend to

concentrate in tech-centric coastal cities.

Salaries vary sharply across geography; however, in most

cases, country and state variations mirror the local economy.

Per capita GDP is a good predictor of salary, although some

countries in Western Europe, including

Italy, the Netherlands, Spain,

and Portugal, have lower than

expected salaries—likely reflecting

how different recovery rates from

the 2008 recession and different tax

and social safety net regimes affect

wages. In the US, the West Coast

states (CA, OR, WA) have higher salaries relative to their per

capita GDP, which, combined with their higher response rates,

may indicate a relatively high demand for design jobs on the

West Coast, helping to push up wages.

Note

In most cases, country and state variations mirror the local economy.

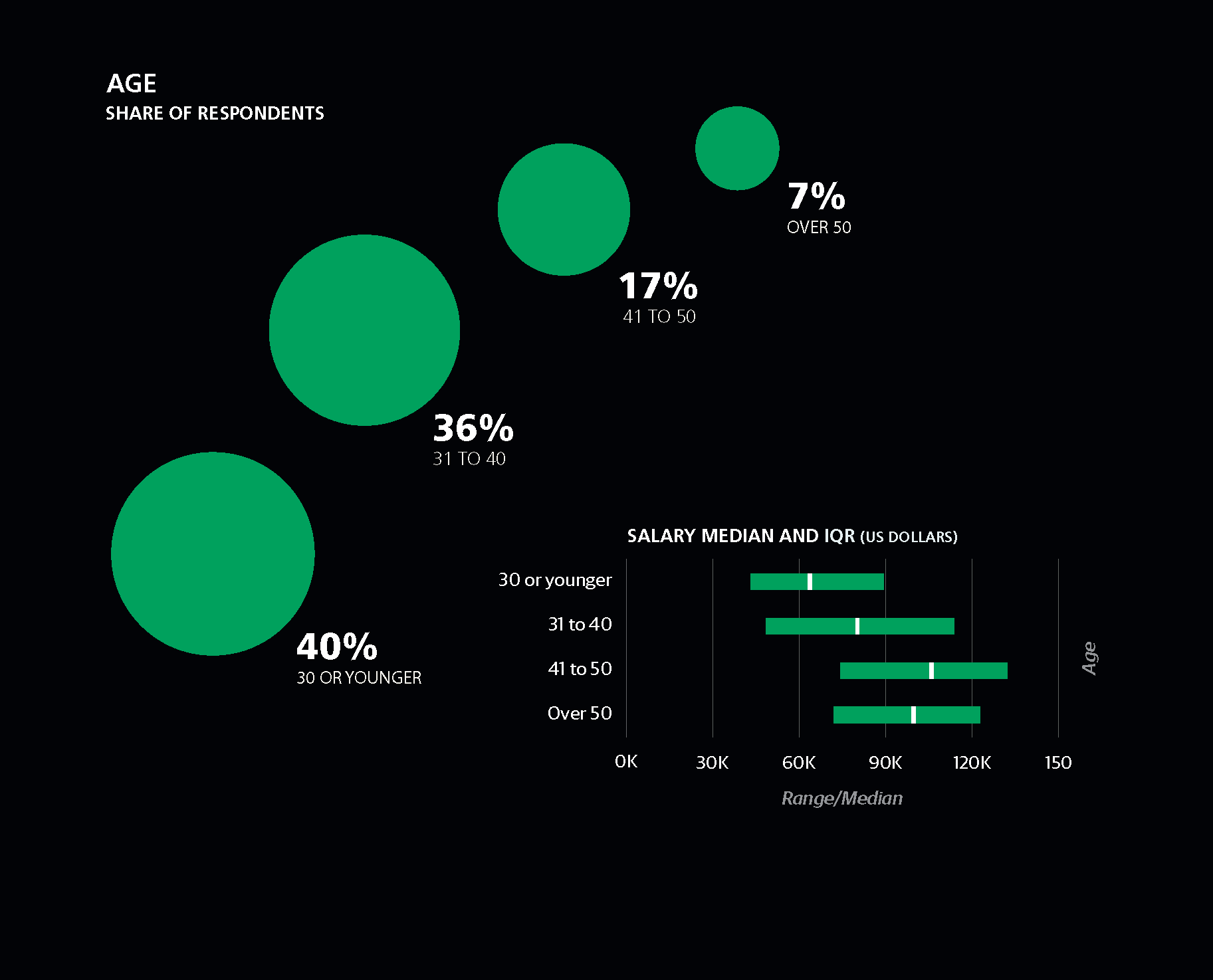

Age Versus Years of Experience

THREE-QUARTERS OF THE SAMPLE IS BETWEEN 26

AND 45, with about an eighth younger and an eighth

older. Salary generally increases with age until age 50,

where we see the 7% of the sample

who are over 50

report a slightly lower median salary

than respondents in their 40s.

Note

The 7% of the sample

who are over 50 report

a slightly lower median

salary than respondents

in their 40s.

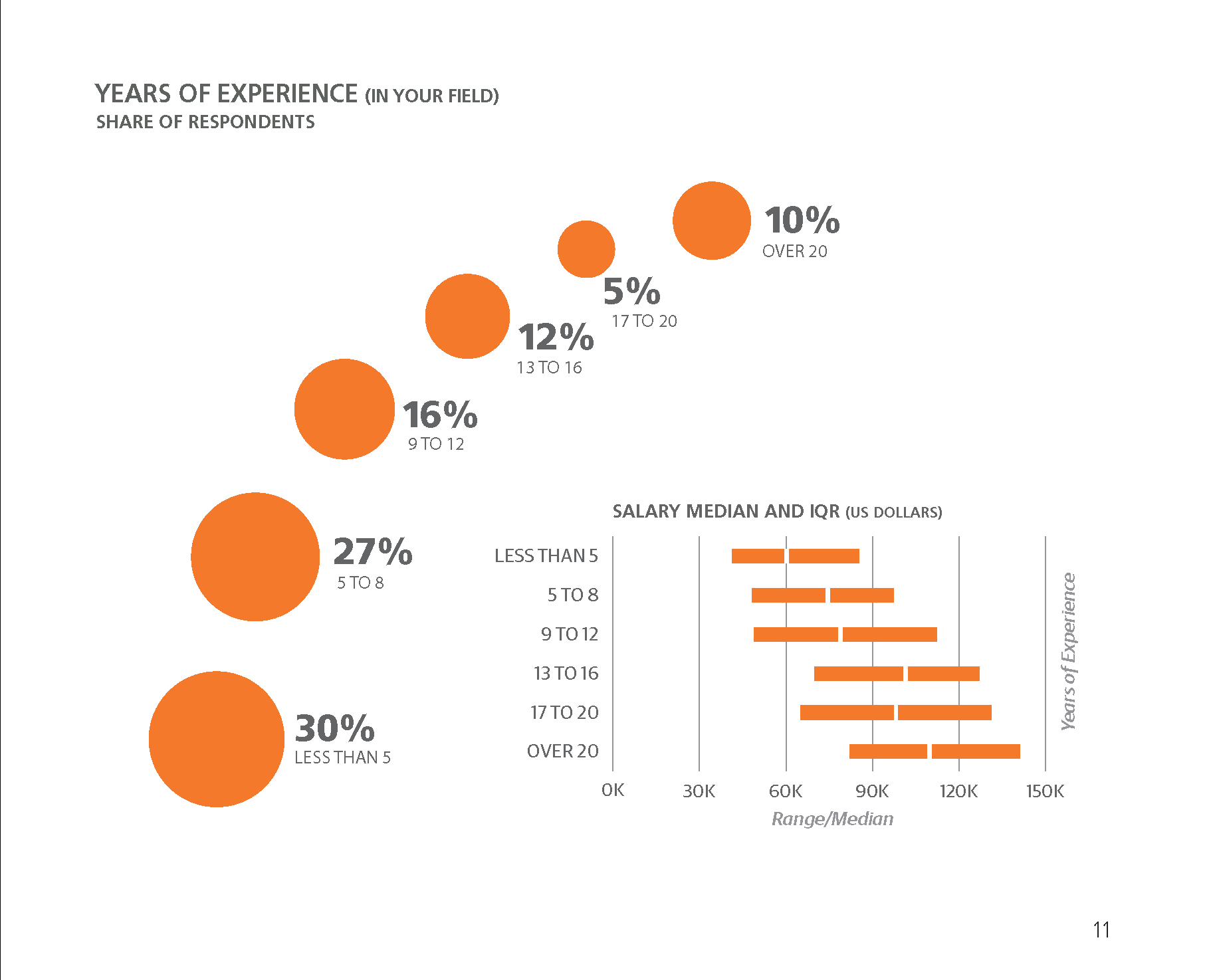

Respondents were also asked how

much experience they have, and, as

expected, salary increases steadily

with years of experience, although

only up to a point: respondents with

20–25 years of experience earn more

(median: $118K) than those with

more than 25 years of experience ($101K). After we factor

in years of experience, age doesn’t make any difference in

salary among respondents aged 31 to 50. Holding experience

constant, respondents younger than 30 do make a

little less, but the difference isn’t as much as the age medians

would suggest.

The lesson of age and years of experience tells us that we should

be careful about confounding variables affecting our interpretations:

being older (without anything else happening) may not

increase your salary (at least not after

30), but having more experience will.

While this example is fairly obvious,

others are not, and in this report, we

make an effort to avoid this same

problem in more subtle contexts by

occasionally referring to an additional

metric we call “adjusted median.”

The adjusted median blocks the effects

of geography and experience—creating

a metric that estimates what the median

would be if the respondents all came from a fixed location

and all had the same experience—to make comparing factors

more reliable. Appendix A contains additional details on the

methodology. To illustrate, we show each five-year age category

between 31 and 50 with an adjusted median salary of $80K,

those between 26 and 30 with $73K, and those between 51

and 60 with $68K–$69K.

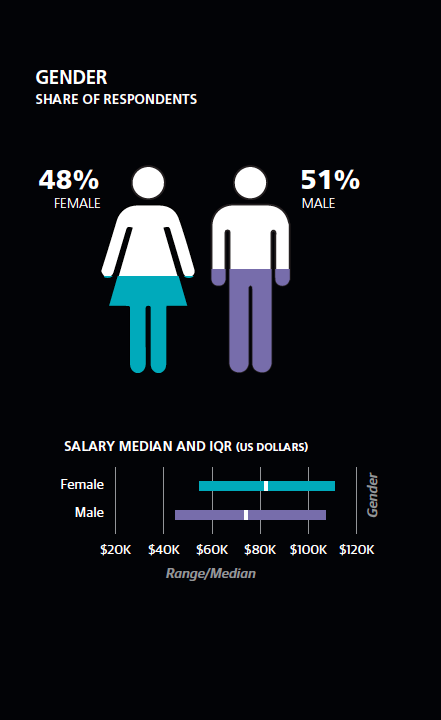

Gender

THE SAMPLE IS SPLIT FAIRLY EVENLY BY GENDER. The

median salary of women in the sample is $82K, higher than

the median salary of the men, which is $74K. However, the

adjusted median salary of women is about $4K lower than

the adjusted median salary of men. The discrepancy is accounted

for by the fact that women in the sample are disproportionately

from places with higher wages. In almost every

geographic region (adjusting for experience), men are paid

more than women on average, even at the same experience

levels.

Men and women are equally likely to have received a raise in

the last three years, but men are slightly more likely to receive

a bonus: 46% of men in the sample received a bonus, while

only 41% of women received one.

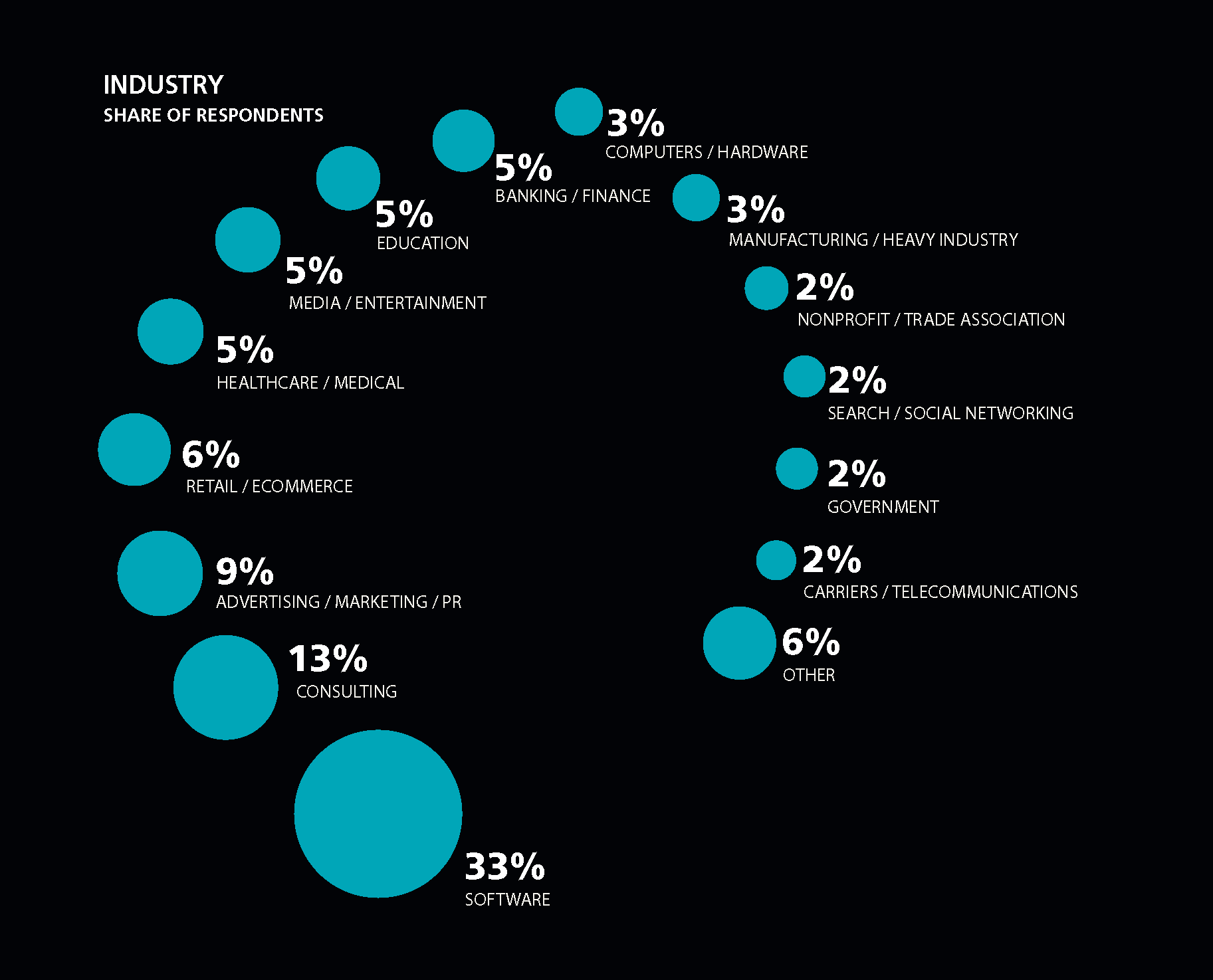

Industry, Company Size

RESPONDENTS COME FROM

A VARIETY OF INDUSTRIES:

software is by far the most common,

with about a third of the

sample, followed by consulting,

advertising/marketing, and retail/

ecommerce. There are variations

in salary among industry, although

many of the differences diminish once we calculate the

adjusted median salaries. When adjusted for experience and

geography, healthcare, banking, and computers/hardware

all have median salaries of about $89K, compared to an

adjusted median of $74K for all other industries. Search/social

networking is even higher, with a median salary of $127K (the adjusted median is also high:

$96K), although this is based on

just 2% of the sample.

Over one-third of the sample come

from companies with no more

than 100 employees, and another

quarter come from mid-sized companies

(in the 100–1,000 employee

range). Salary does appear to go up with company size: from a

median of $63K for 2–100 employee companies, to $96K for

companies with over 10,000 employees. Again, these differences

shrink slightly once we block out experience and geographical

effects, but the 10,000+ group still shows an adjusted median

salary of $10K–$15K higher than the other groups.

Note

Healthcare, banking, and

computers/hardware all have

median salaries of about

$89K, compared to an

adjusted median of $74K for

all other industries.

Coding Time, Programming Languages

ONLY 43% OF THE SAMPLE reports that programming

plays some role in their work. The other 57%, in fact, earn

more, with a median salary of $83K (coders earn a median

of $69K). However, this difference all but disappears when

we adjust the salaries, since the

distribution of respondents who

code vary greatly over geography.

For example, 58%–59% of

respondents from Europe and Asia

say that they spend at least some

time coding, while only 30% of

respondents from California code.

Combined with a review of the

2016 Design Salary Survey, we

don’t see code having more than a

noisy impact on salary.

Note

58%–59% of respondents

from Europe and Asia say

that they spend at least

some time coding, while

only 30% of respondents

from California code.

Among those that do code, most report spending at most 8

hours/week on the task, while only 9% of the sample report

that they code more than 20 hours/week. The group with

the highest adjusted median salary is the one that spends

1–3 hours/week, although the salary

differences are fairly minor.

As for language choice, by far the

most popular language is JavaScript

(31% of the sample), with Python

and Java coming next, with 8% and

7% shares of the sample, respectively.

Swift users tend to have high salaries:

their median of $95K is far above the

sample-wide median, and this margin

is decreased but still significant after

geographical adjustment.

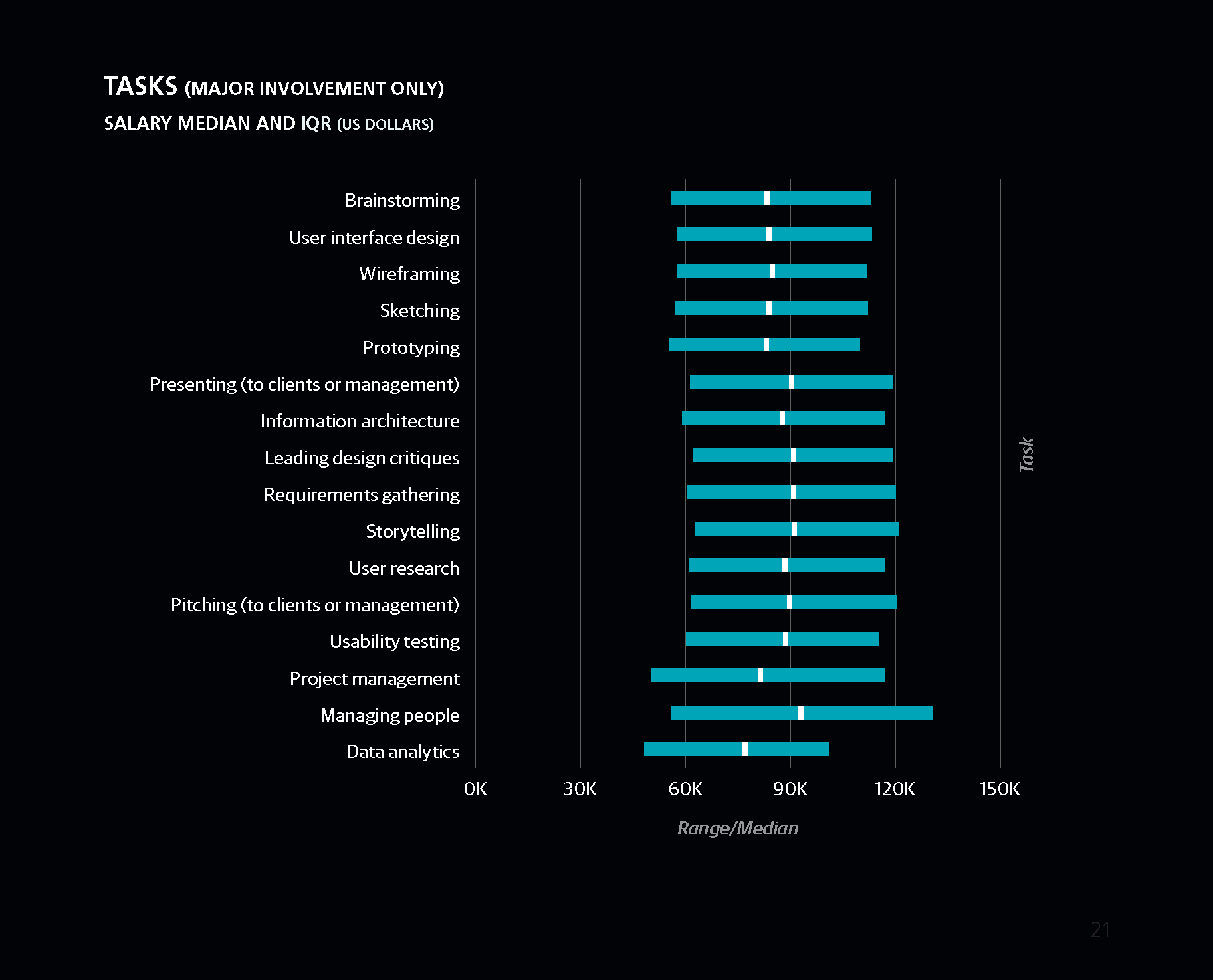

Tasks

A SET OF QUESTIONS ON THE SURVEY asks respondents

whether they engage in certain tasks, either with “major” or

“minor” involvement. Some tasks are nearly universal, such as

brainstorming (74% major involvement, 21% minor involvement)

and user interface design (64% major, 25% minor), and

others are relevant to a much

smaller subset of the sample, such

as managing people (25% major,

35% minor) and data analytics

(13% major, 46% minor).

We found three highly correlated

tasks (wireframing, prototyping,

and sketching), meaning that respondents

who do one are more

likely to do another. These are

among the most common tasks,

each with 85%–-87% of the

sample (major or minor involvement),

while 93% are involved

in at least one of the three. The 40% of the sample that

has major involvement in all three tend to earn aboveaverage

wages (median: $87K). After adjusting the medians

for experience and geography, this discrepancy holds.

A second set of tasks also correlates with one another:

pitching, presenting, requirements gathering, leading design

critiques, managing products, and managing people. For each

of these tasks except product management, respondents

who have major involvement earn more than those that do

not. The differences in adjusted

median salaries are similarly

significant, around $10K for each.

While product management

does correlate with these

other tasks (in particular, with

managing people), it doesn’t

correspond to a boost in salary.

While the median salary of

those who manage products

is higher than those that do

not ($81K versus $76K), this

difference disappears when we

adjust the salaries for experience

and geography. Furthermore, respondents who have major

involvement in product management but do not have

major involvement in managing people, have below-average

salaries ($9K difference in adjusted median salary).

Note

Respondents who have

major involvement in

product management but

do not have major involvement

in managing people have

below-average salaries.

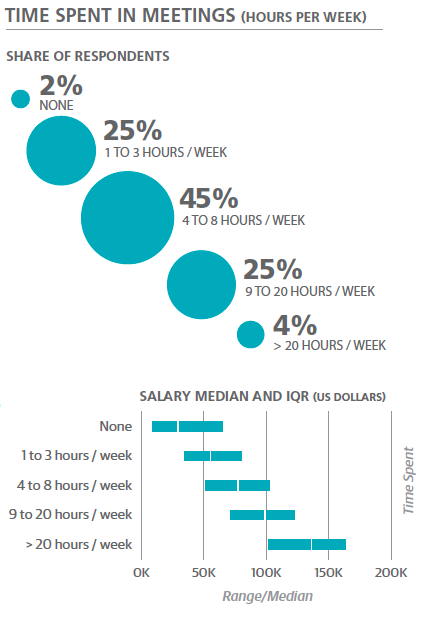

Meetings

MEETINGS ARE A PART OF MOST DESIGN PROFESSIONALS’

WORK WEEK: 94% of the sample spends between 1 and

20 hours per week in meetings. As we’ve seen in past salary

surveys, those who attend more meetings earn more. An

effect we see even after adjusting for experience.

Respondents from the US tend to spend more time in meetings

than those outside of the US. Among US-based respondents,

33% spend at least 9 hours per week in meetings,

while this figure is only 20% for non-US respondents.

As we would expect, meeting times vary dramatically with job

title. VPs and directors spend the most time in meetings, followed

by project/product managers. UX designers and product

designers each spend about seven hours in meetings per

week, on average, while software developers/engineers and

graphic designers only spend about four hours on average.1

1Note that these are rough average figures, since the original survey data was collected in binned ranges.

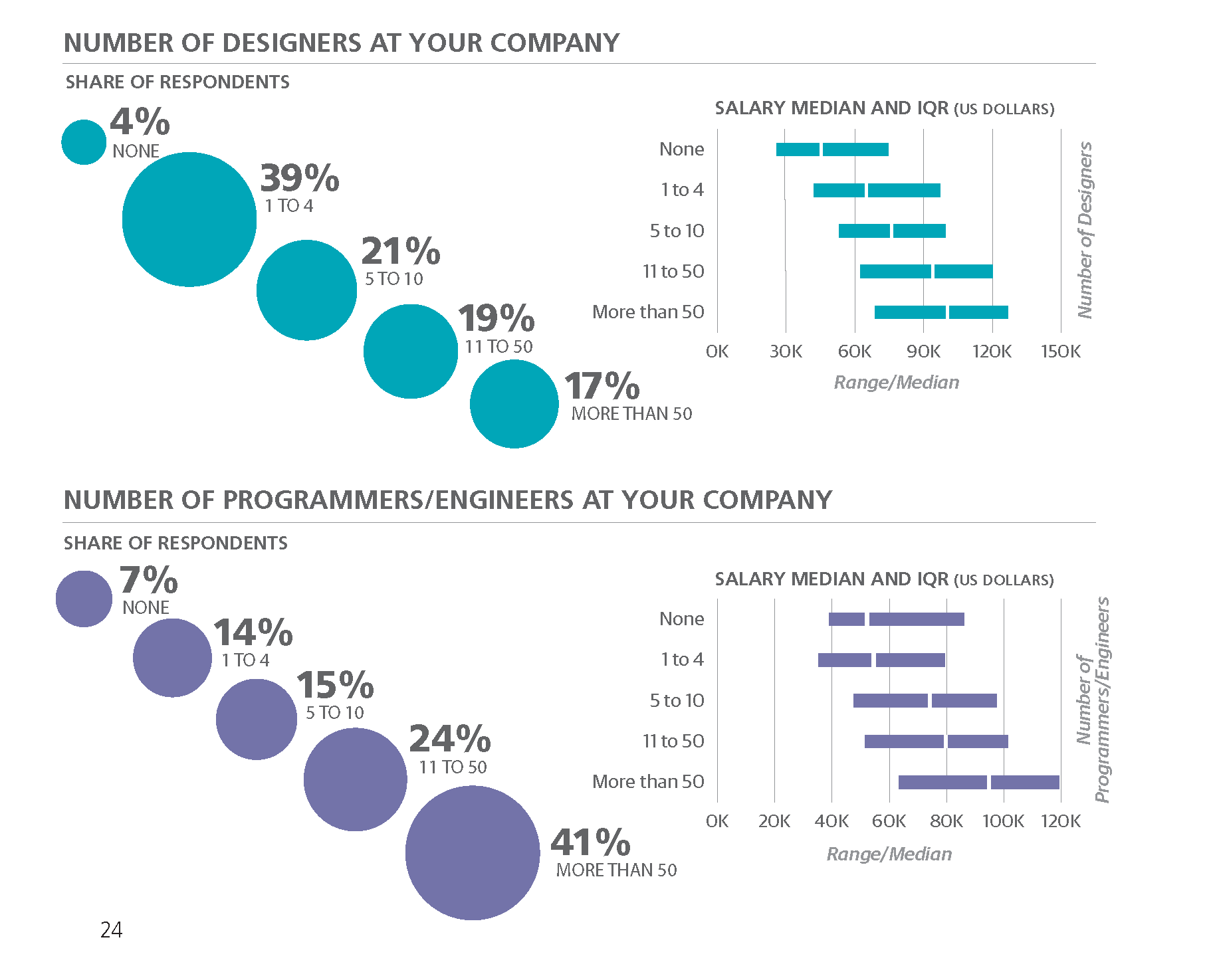

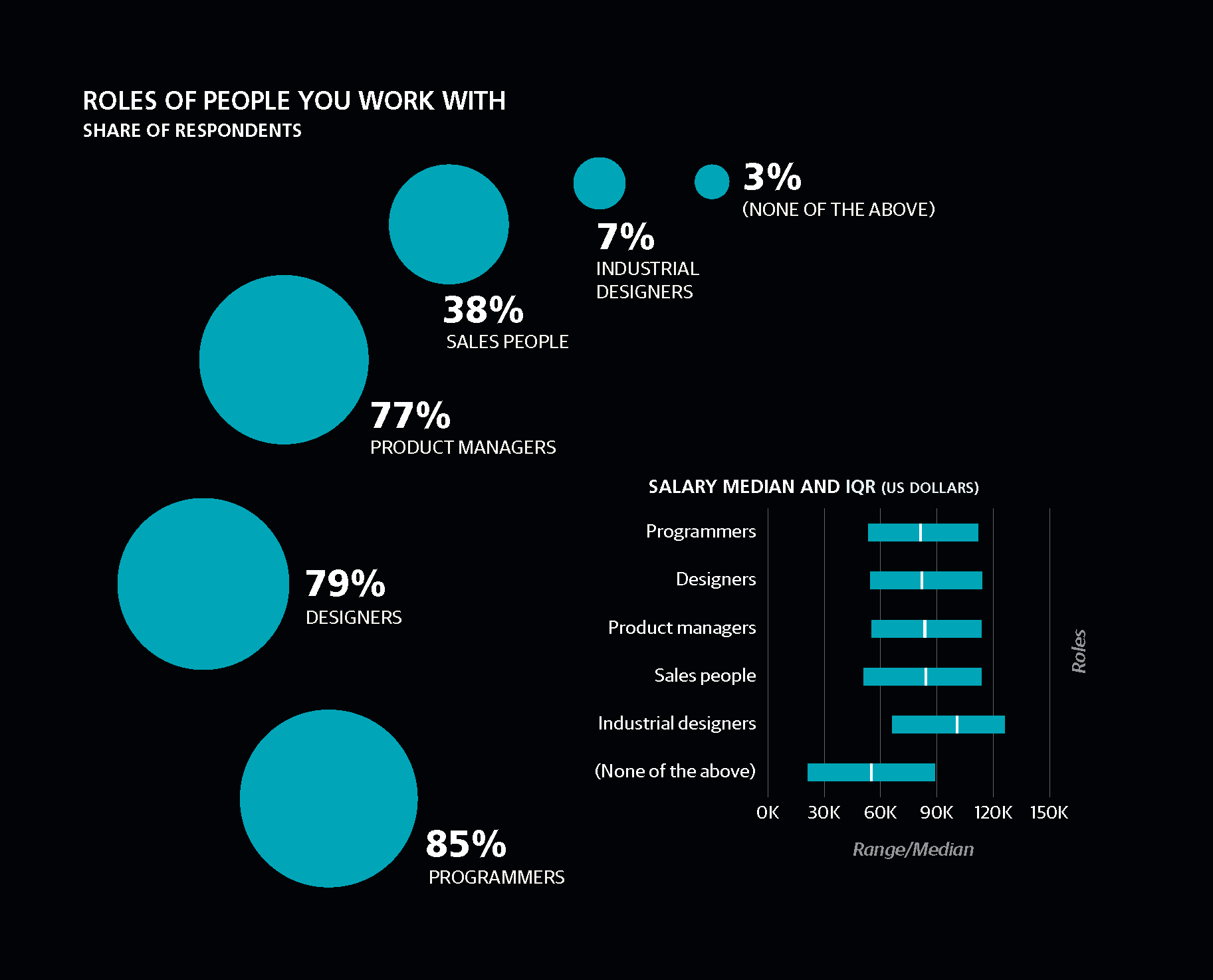

Working with Other People

MOST RESPONDENTS REPORT THAT THEY WORK WITH

PEOPLE IN A VARIETY OF ROLES. Only 3% of the sample

say they only work with (other) designers, and this group has

a median adjusted salary of $56K, far below the sample-wide

$77K. With five answer choices to pick

from (designers, programmers, product

managers, salespeople, and industrial designers),

most respondents chose three

or four.

The minority of respondents (7%) who

work with industrial designers earn

high salaries (median: $101K; adjusted

median: $82K), which is likely related

to the high wages in computers/hardware.

Aside from this, no single answer

stands out as having an effect on salary. However, it does

appear that interacting with a wider variety of roles correlates

positively with higher incomes: the adjusted median salaries

of respondents who interact with one, two, three, and four of

the listed roles are $60K, $68K, $77K, and $83K, respectively.

We also asked how many designers and programmers work

at the respondents’ organizations. Most respondents work

at companies with at least 5 designers and 20 programmers.

Generally, the more programmers and designers at a company,

the greater the salary, although

part of this gradient may be attributable

to company size, since there are higher

salaries at larger companies, and larger

companies tend to have more designers

and employees.

However, even among subsets of respondents

partitioned by company size, this

pattern remains, at least for designers.

For example, among respondents from

companies with more than 1,000 and

fewer than 10,000 employees, the adjusted median salaries

of respondents who work with no more than 10 designers

is $68K, while that of respondents who work with over 10

designers was $81K. Similar patterns are present with other

company sizes.

Note

The minority of

respondents (7%)

who work with

industrial designers

earn high salaries

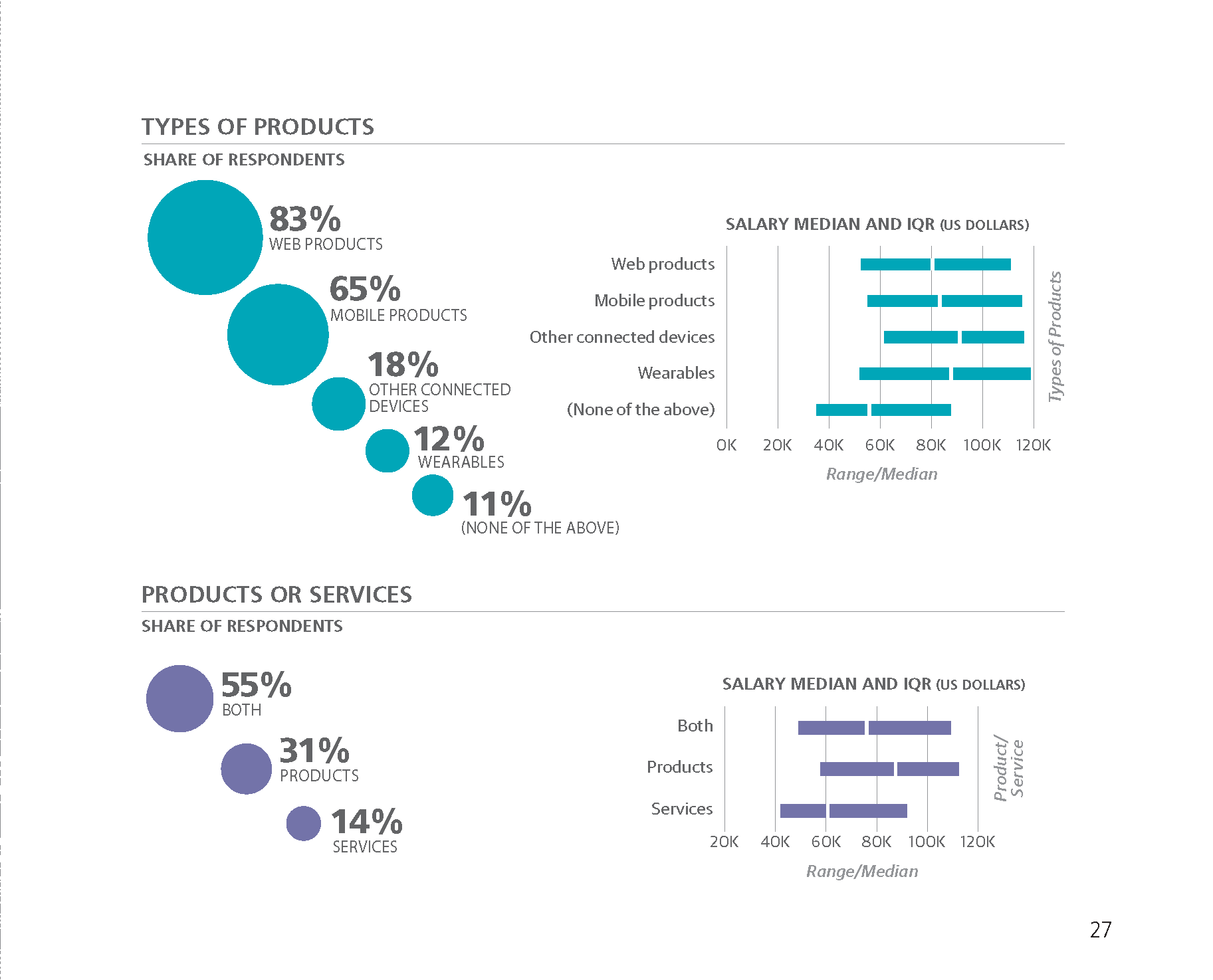

Types of Products, Products or Services

MOST OF THE SAMPLE WORKS ON BOTH PRODUCTS

AND SERVICES, with 31% working on products only and

14% on services only. Respondents who work in products

only have the highest salary (median: $87K; adjusted: $77K),

and those who work in services only have the lowest (median:

$61K; adjusted: $70K).

As for types of products, most respondents work on web

products (83%) and mobile products (65%). Few respondents

(3%) work only on mobile products. Many more work on

web products only (22%), but these respondents tend to earn

less (median: $70K; adjusted: $72K) than those who work on

web products and a different type of product (median: $84K;

adjusted: $78K).

Two other product categories (wearables and other connected

devices) are less common, with 12% and 18% of the sample,

respectively. However, respondents who work on one or both

of these product types earn higher salaries than those that

don’t, with a median salary of $90K (adjusted: $82K).

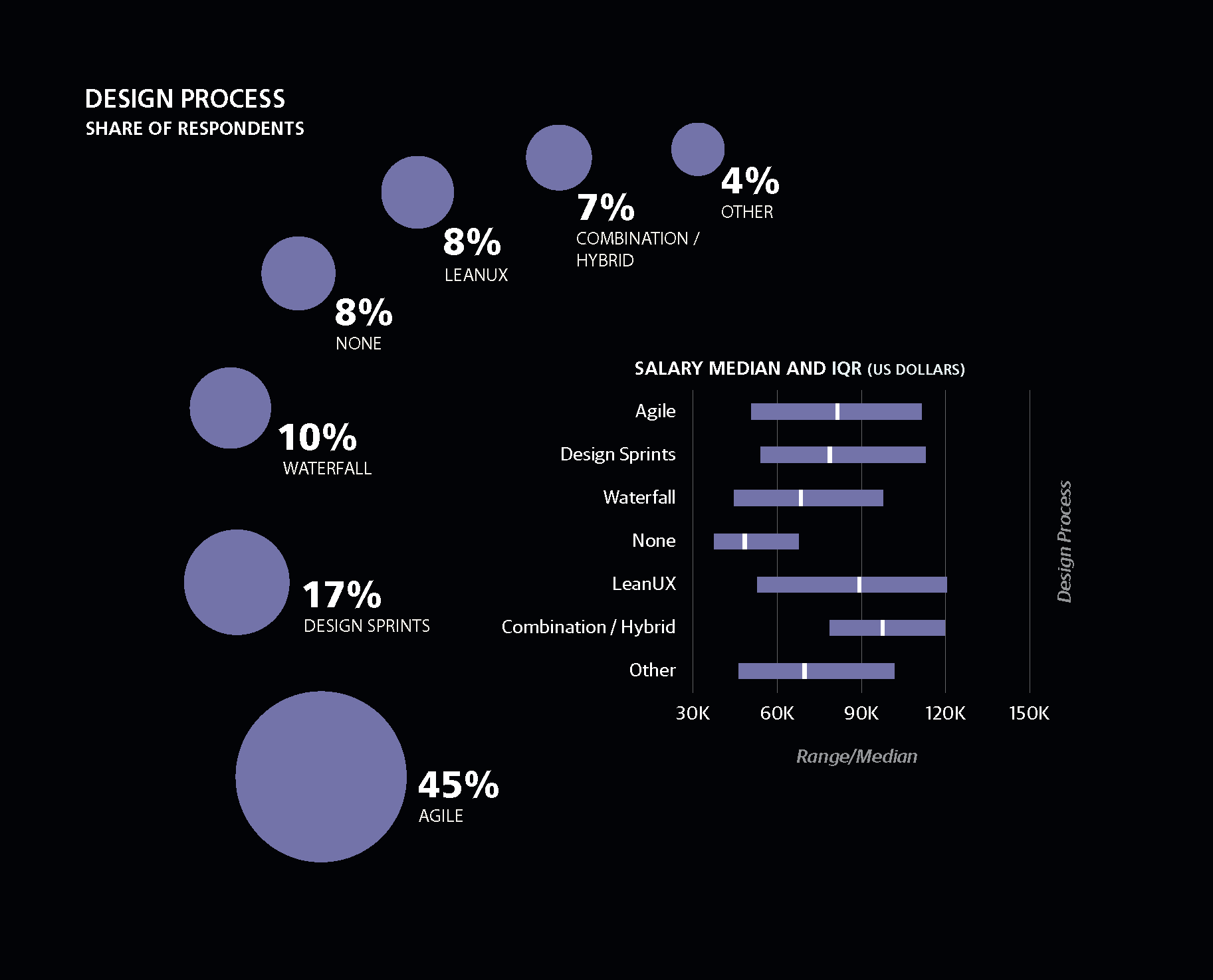

Design Process

THE TOP DESIGN PROCESS IS AGILE, with 45% of the

sample. Design sprints are a distant second (17%), followed by

waterfall (10%) and lean UX (8%). Practitioners of Agile tend

to earn above-average salaries (median: $81K; adjusted: $79K),

but not as much as those that practice lean UX (median: $89K;

adjusted: $83K) or the 7% of the sample who use a hybrid or

combination of design processes (median: $98K; adjusted: $83K).

A small subset (8%) report no design process, and these

respondents tend to earn rather low salaries: a median of

$48K, rising slightly to $53K after adjusting for geography

and experience. These respondents are more likely to come

from smaller companies with fewer designers, but this tendency

isn’t absolute: about 5% of respondents from large

companies (>1,000 employees) with over 50 designers say

that they have no design process.

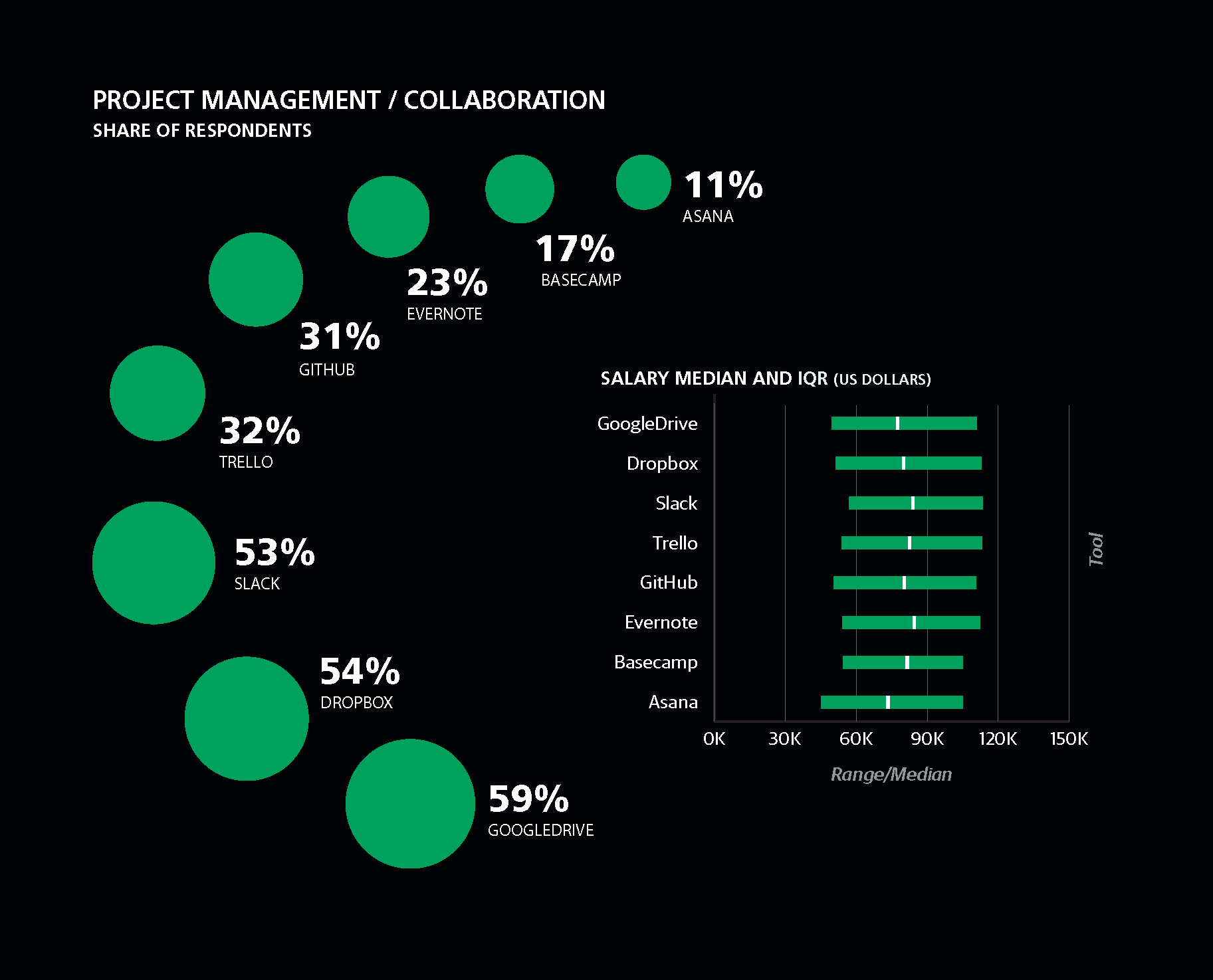

Tools

We asked about a variety of tool categories—for the most

part, software—from prototyping and wireframing to project

management and user research. The answer choices included

95 tools, but another 668 were entered in “other” fields:

clearly there’s a lot of variety from which to chose from in

design tools.

Respondents use an average of 12 tools, and salary generally

rises with the number of tools used. Users of 7 or fewer tools

have a median salary of just $58K, while those who use more

than 7 but less than 14 have a median of $78K, and those

who used 14 or more have $89K. The corresponding adjusted

medians preserve this upward pattern: $66K, $73K, $81K.

Even among designers with similar levels of experience, those

that have a larger set of tools earn more.

Some of the most ubiquitous tools are project management/

collaboration tools, such as Google Drive, Dropbox, and Slack.

Both the need to have consistent platforms across organizations

and these applications’ ease of use are likely contributors

to their higher usage rates. The variations in salary among

users of project management tools are not significant.

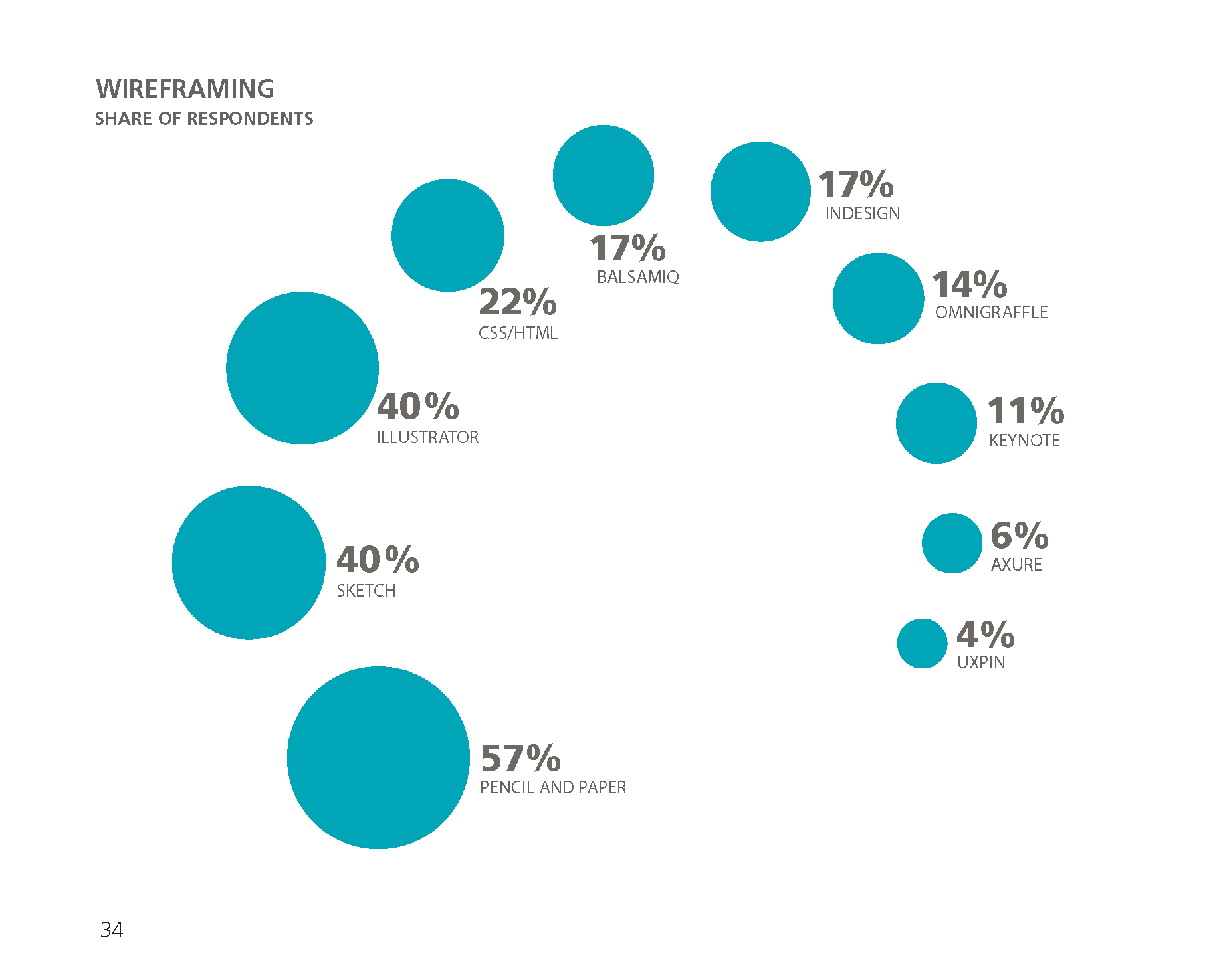

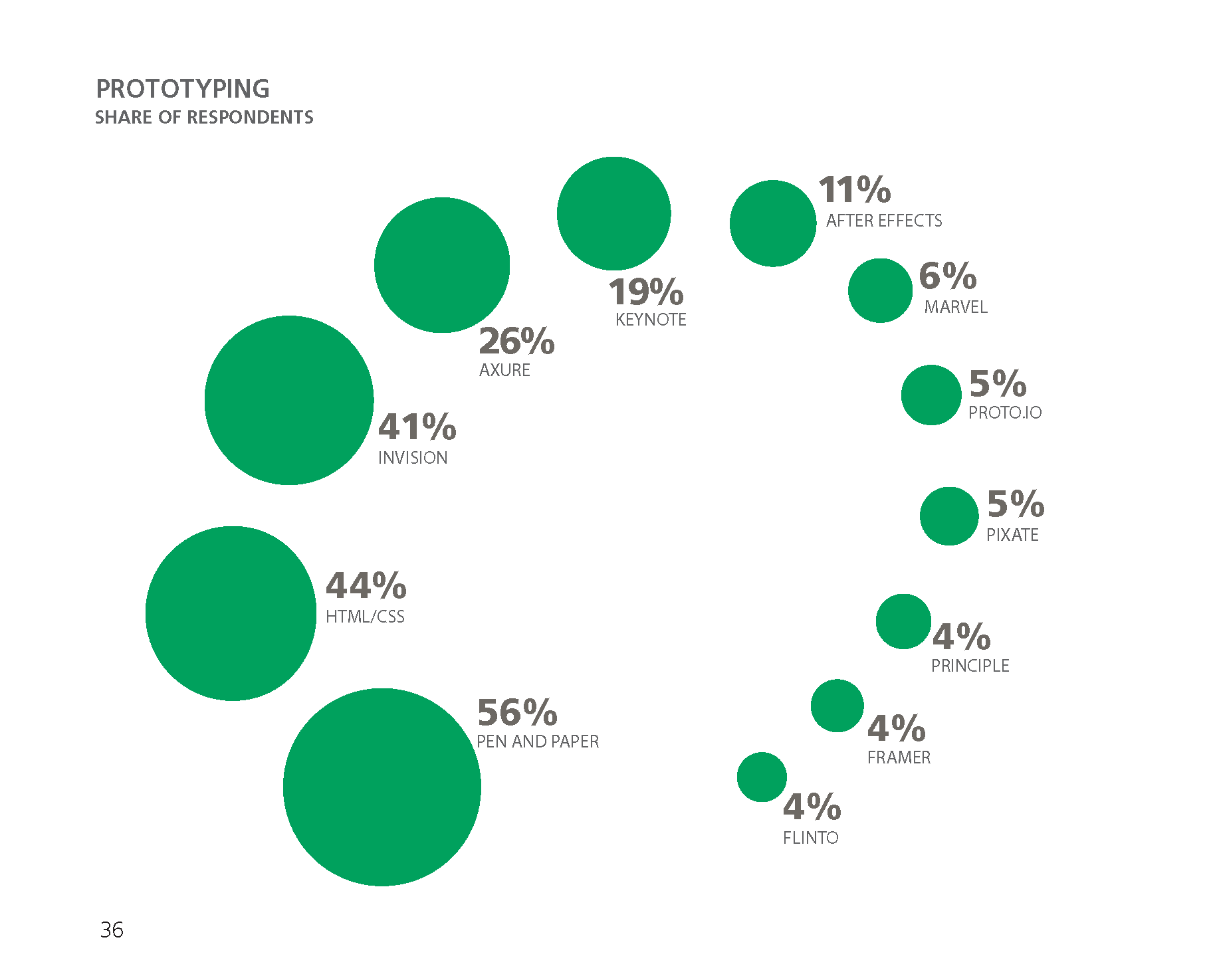

Tools: Wireframing and Prototyping

THE VAST MAJORITY OF RESPONDENTS

use at least wireframing or

prototyping tools (93%), and about

half use five or more. The most

popular wireframing and prototyping

tools are not software, but pen/

pencil and paper. These are used by

respondents of all ages and experience:

there is no indication that they

will be replaced by software anytime soon. CSS/HTML is also

frequently selected, especially for prototyping (44%), less for

wireframing (22%).

Other popular tools include Invision (41%), Axure (26%),

and Keynote (19%) for prototyping; and Sketch (40%), Illustrator (40%), Balsamiq (17%),

and InDesign (17%) for wireframing.

We find only two patterns

of strong co-usage between the

set of tools in the survey: users of

Adobe’s Illustrator and InDesign,

and between Sketch and Invision

users. Sketch/Invision users tend to

earn slightly above-average salaries,

while Illustrator/InDesign users tend to earn slightly

below average. In particular, the 6% of the sample that

use Illustrator and InDesign but not either Sketch or Invision

have an especially low median salary of $54K (median

adjusted salary: $55K).

Note

Sketch/Invision users

tend to earn slightly

above-average salaries,

while Illustrator/InDesign

users tend to earn slightly

below average.

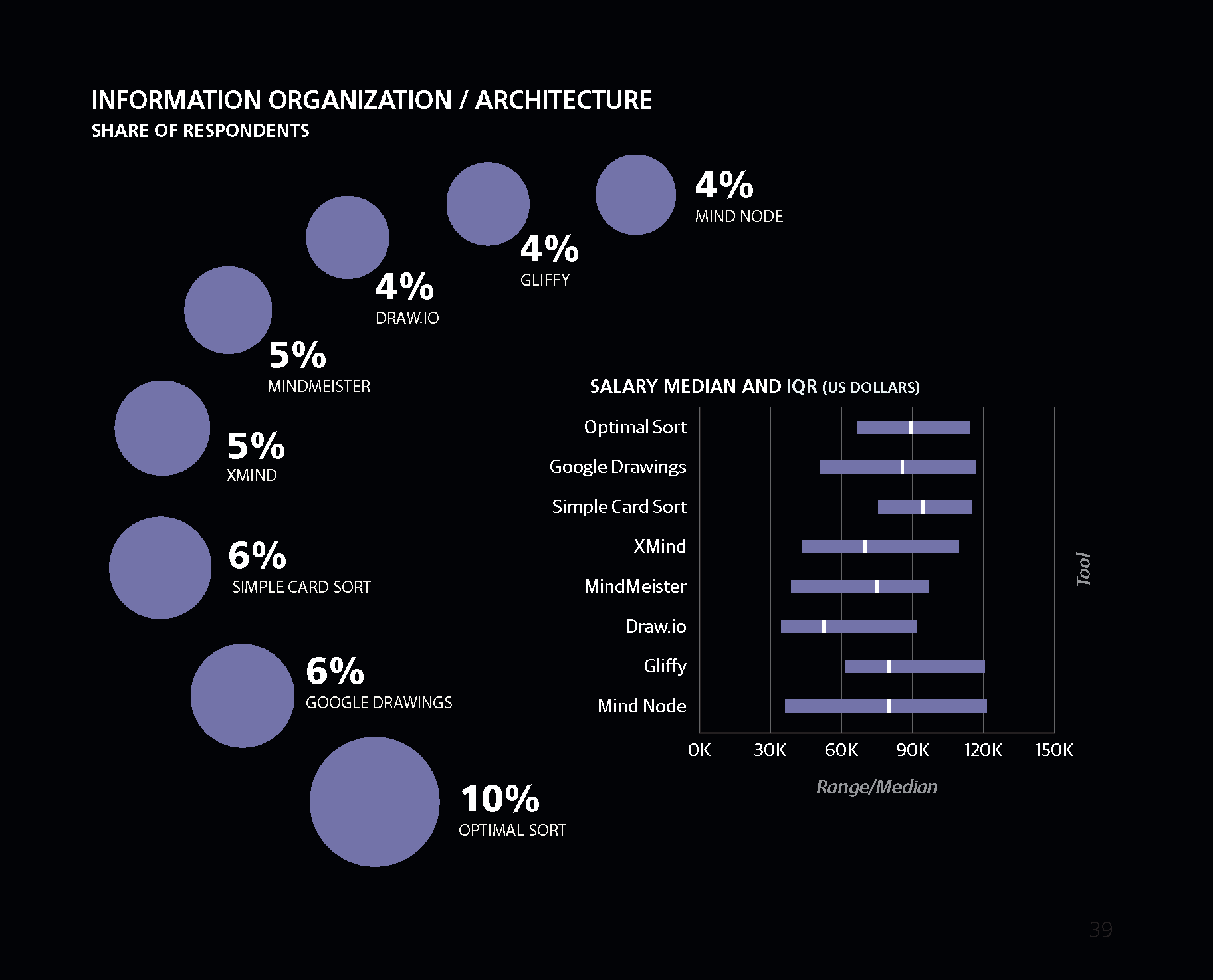

Tools: Information Organization / Architecture

THE NEXT TOOL CATEGORY IS INFORMATION

ORGANIZATION/ARCHITECTURE, including software for

card sorting and mind mapping. 45% of respondents use at

least one tool in this category, but most that did use just one.

No single information organization/

architecture tool is used by more

than 10% of the sample, in stark

contrast with some of the other

tool categories, such as wireframing

or project management.

The most commonly used

information organization/

architecture tools are OptimalSort, Google Drawings, Simple Card Sort, and XMind.

Users of each of these four tools have above-average

salaries. (For XMind, median salary was only $70K, but

median adjusted salary was $86K. The shift is due to

XMind being much more

popular outside of the US

than within the US.) More

generally, respondents who

use any information organization/

architecture tool earn

more than those that don’t:

the difference in median

adjusted salary is $9K.

Note

Respondents who use any

information organization/

architecture tool earn more

than those that don’t:

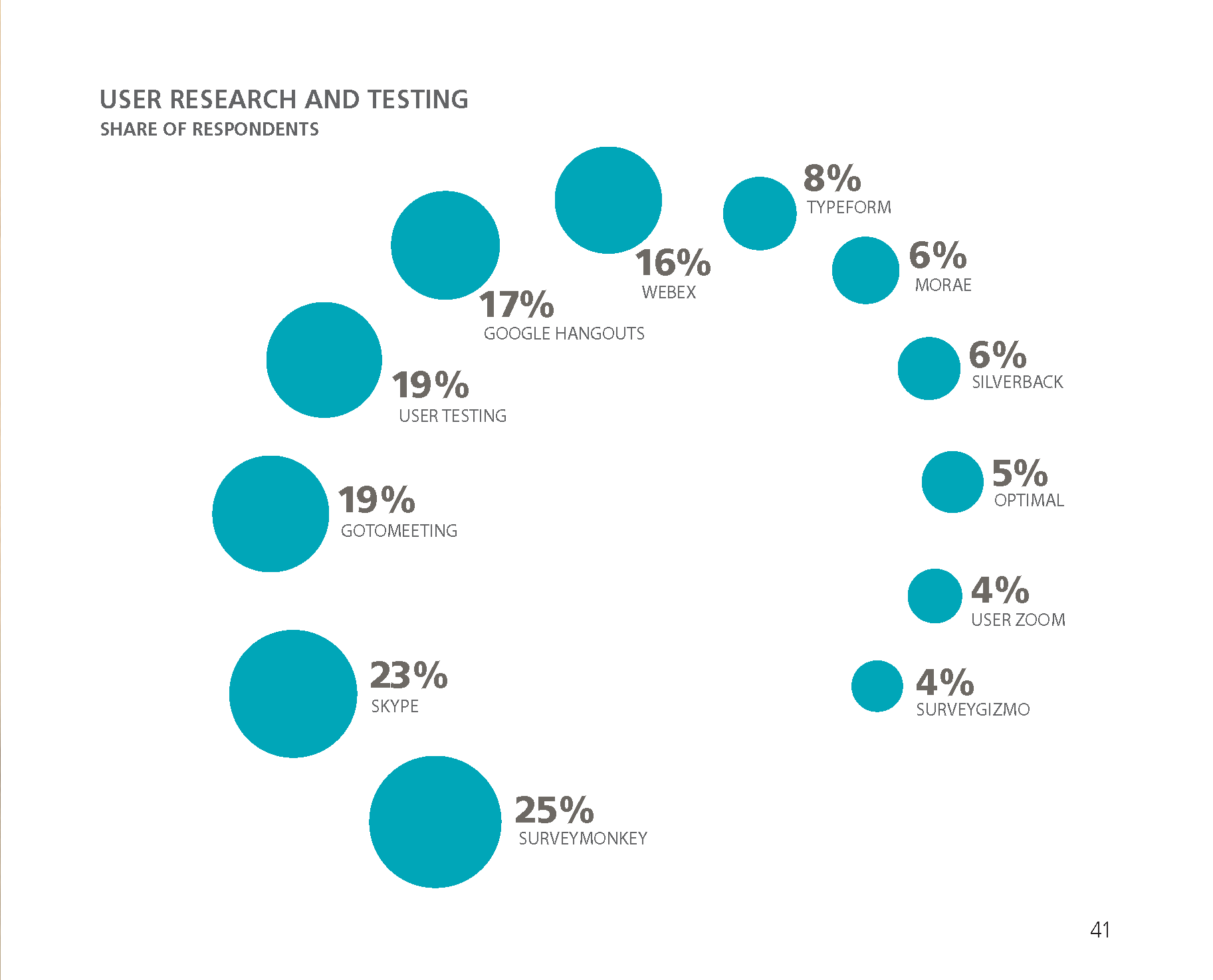

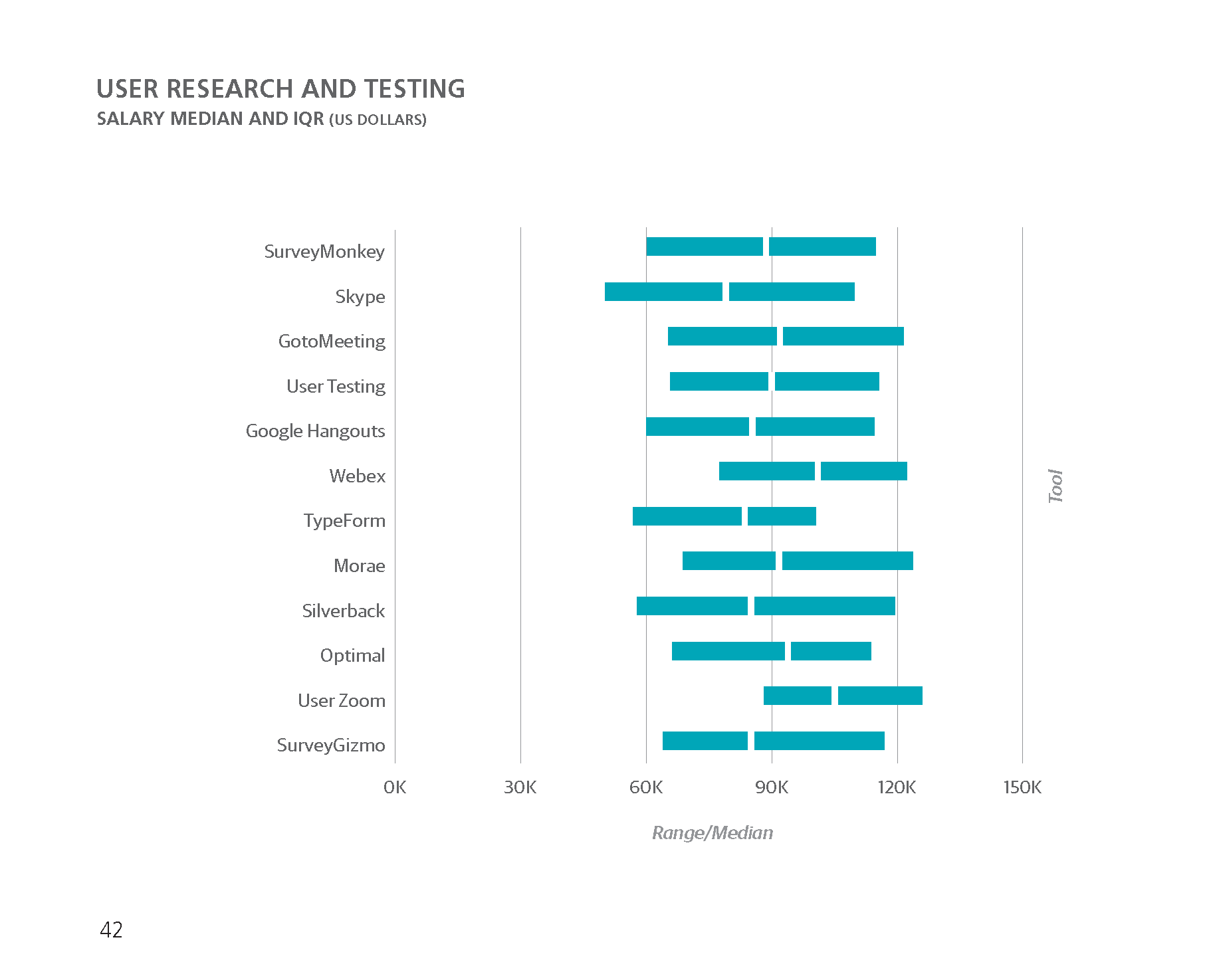

Tools: User Research and Testing

The category of user research and testing tools is notable for

its variety: 21 tools are used by at least 1% of the sample, far

more than any other category. About two-thirds of the sample

use one or more of these tools, although only 30% of the

sample use more than two.

The top tools in this category are SurveyMonkey, Skype,

GotoMeeting, User Testing, Google Hangouts, and Webex.

Differences in salaries among users of various user research

tools are not significant, although, as with information organization/

architecture tools, respondents who use at least one of

these tools tend to have higher salaries than those that don’t,

again by a margin of $9K.

Conclusion

THE FIELD OF DESIGN HAS SEEN PROFOUND CHANGES IN

THE LAST DECADE—new mediums, new tools, new frameworks

for thinking about design and how and where design

principles should be applied. Keeping up with the evolving tool

ecosystem can have an impact on one’s career development.

We see that those adopting particular tools and techniques,

e.g., Sketch and Invision, Agile, information management, and

testing, all correlating with higher salaries. We also see that

those who know more tools, work in larger organizations,

interact with a wider variety of roles, and work on multiple

platforms earn more—information that designers can use to

help expand their career horizons.

As design principles and design thinking move beyond the

world of designers, we see these findings as relevant well

beyond the world of design. Software developers, data scientists,

or anyone who does design work or works closely with

designers can benefit from understanding what designers use

and how they work.

When we quote statistics about salary, for example, that users

of this tool make this much more than users of that tool, it’s

important to remember that learning the “high salary” tool is

not guaranteed to give you a raise. This survey data is observational,

and we can’t assume cause and effect. On the other

hand, knowing that particularly well-paid designers frequently

use some tool might be a potential sign that this tool is especially

efficient or powerful, and that alone could be enough

justification for trying out a new tool.

This research is an ongoing project, and it depends on

your participation. If you’ve found this report useful, please

consider taking 5 to 10 minutes to complete the 2018 survey

yourself for next year’s report: http://www.oreilly.com/design/2018-design-salary-survey. Thank you!

Appendix A: Adjusted Median Salary

GEOGRAPHY AND EXPERIENCE CLEARLY MAKE A

DIFFERENCE IN SALARY, and this is fully expected. However,

since geography and experience can correlate with other

variables, unless we analyze all three variables together, it can

be hard to tell whether variations in salary are due to these

variables or to geography/experience.

For example, age correlates with experience and with salary, but

if we consider groups of respondents with equal experience,

then age no longer correlates with salary (at least, strongly or

monotonically). This is what we mean when we say that age and

salary don’t correlate when we “block” years of experience.

To give another example, this time with geography: the

median salary of the 9% of respondents who say they code

over 20 hours/week is $50K, while the rest of the sample

(those who spend less time coding, if any at all) is $80K.

However, the difference is attributable to the fact that most

of the people who code over 20 hours/week happen to come

from places that have lower salaries in general. For example,

36% of respondents from India, Russia, and Ukraine say that

they code over 20 hours/week, while only 1% of California respondents

do. This probably shouldn’t be taken to mean that

CA design professionals don’t code: correlations like this will

appear frequently on such surveys; namely, when there is little control over the sampling. This correlation is likely just noise

that we should try to filter out.

The solution we use in this report is to provide, when appropriate,

an additional metric, the adjusted mean salary. The

first step in computing this metric: is to create a simple model

to predict salary using country/state and experience. After trying

a few economic metrics to quantify geography, we found

that per capita GDP gave the best results.2] Using this survey’s

data, no complicated modeling technique or transformation

made a big improvement over a simple linear model, so we

stuck with the latter. The model is:

predicted_salary = 1.95 x years_of_experience + 1.26 x

per_capita_GDP – 1.29

where monetary values are in thousands of USD, and years of experience

is capped at 20 (for someone with more than 20 years

of experience, the value inserted into the model is 20). For example,

the predicted salary of someone with 7 years of experience

from Australia (where the per capita GDP is $51K) is $76.5K. This

model explains about half of salary variance in this sample.

We use this model to create the aforementioned “adjusted

median salary” statistic. This works by recalculating salaries

as if the respondents who received them were from a single,

fixed place and had the same amount of experience. The

actual fixed values are somewhat arbitrary, and we pick values

close to the sample averages: seven years of experience and

$51K for the per capita GDP, which is roughly the per capita

GDP of Australia, Denmark, Singapore, Ohio, North Carolina,

and Wisconsin. To adjust someone’s salary, we simply subtract

an amount that the model attributes to their experience and

geography, and then add a fixed amount for seven years of

experience and a per capita GDP of $51K.

Perhaps a simpler way of understanding the calculation is to consider

the residual, the difference between the observed (reported)

salary and the predicted salary. If someone earns much more

than we would expect given their experience and location, their

salary residual is high. We calculate the residual and then add it

to $76.7K, the predicted salary for someone with seven years of

experience living in a place with a per capita GDP of $51K.

For example, suppose someone from New York with five

years of experience earns $120K. According to the model, this

person is expected to earn $100.3K, so they “outperform”

the expectation by $19.7K (this is the residual). If we add this

$19.7K to the fixed $76.7K, we arrive at the adjusted salary,

$96.4K. It is worth noting that a single adjusted value in

isolation doesn’t have much relevance; the real purpose of

presenting these adjusted values is comparison. In a sense, we are really just including residuals, and the conversion

from residual to adjusted salary (i.e., the operation of adding

$76.7K) is performed to convert the number to something

less abstract and so that we don’t have to introduce technical

language (“residual”) into the text.

It is likely that with more data, a more complicated model (i.e.,

one that still just takes in experience and GDP, but is not a simple

linear model) would provide better results. For example, it seems

likely that not every incremental year of experience is the same

(e.g., 3 to 4 years versus 13 to 14 years) or that experience has

the same relation with salary in every place (e.g., one year of

experience adds as much in Switzerland as it does in Poland).

However, the simple linear model above performed just as

well as a few others we tried that attempted to explain a more

complicated relationship, and furthermore, the simplicity has the

major advantage that it is easier for you, the reader, to plug in

your own numbers. Unlike the models in other O’Reilly salary

surveys, including last year’s Design report, this model only takes

two variables, so insofar as there are other relevant variables that

affect salary, this model will miss them. More fundamentally,

the variance of salaries for any given experience and per capita

GDP is quite high: the predicted salary that the model outputs

is an average, and any particular salary may fall a ways from it.

For that reason, the real value of this model is not to predict

someone’s salary, but to allow us to compare groups of salaries

in a way that the comparison is minimally impacted by significant

differences in experience and geography.

2Both country and state numbers were taken from Wikipedia. Country figures are from the IMF column. http://bit.ly/2iCUvcD.[