Staying out of trouble with big data

Understanding the FTC’s role in policing analytics.

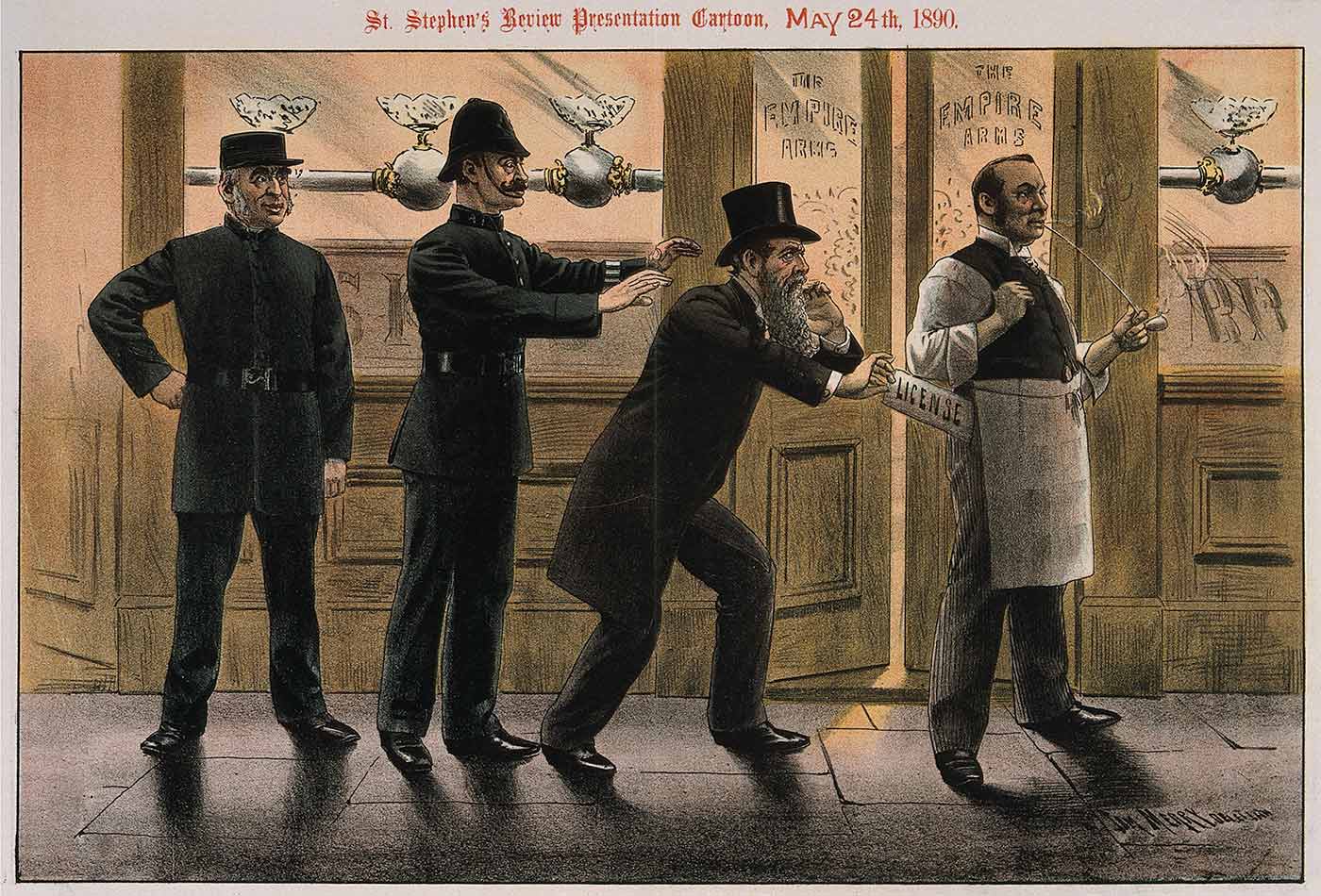

Caught in the Act, chromolithograph by T. Merry, 1890. (source: Wellcome Images on Wikimedia Commons)

Caught in the Act, chromolithograph by T. Merry, 1890. (source: Wellcome Images on Wikimedia Commons)

Federal and state regulators, private litigants, and consumer advocacy groups are all paying close attention to the ways that companies gather and analyze consumer data.

Specialized laws apply to certain types of data—like HIPAA for health data and COPPA for data related to children—but the closest thing the United States has to a comprehensive data regulation is the Federal Trade Commission’s “section 5,” which prohibits “unfair or deceptive acts or practices in or affecting commerce.”

Kristi Wolff and Crystal Skelton will be presenting at the Strata Business Summit on March 15, 2017, as a part of a series of executive briefings on best practices and transformative technologies for CDOs, CTOs, and leaders charged with finding value in data.

In this clip from Strata + Hadoop World New York 2016, Kristi Wolff, a partner at the law firm Kelley Drye & Warren, explains the FTC’s broad and flexible authority, as well as new regulatory concerns related to the use of data to unfairly exclude consumers from commercial opportunities.