2

Essentials of Credit Risk Analysis

Credit risk exists whenever a product or service is obtained without paying for it. In the business sector, credit risk is pervasive. Households also use credit extensively. For instance, individuals/households who are electricity consumers, telephone users and credit card holders expose respective suppliers to credit risks. Similarly, persons placing deposits with banks/financing companies are also exposed to credit risk.

2.1 MEANING OF CREDIT RISK

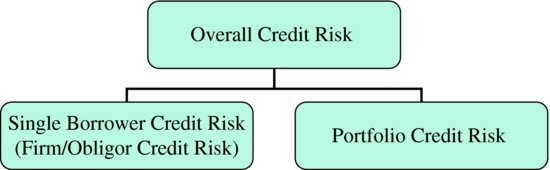

Credit risk can be defined as follows: ‘Credit risk refers to the probability of the loss (due to the non-recovery of) emanating from the credit extended as a result of the non-fulfilment of contractual obligations arising from unwillingness or inability of the counterparty or for any other reason.’ If the probability of the loss is high, the credit risk involved is also high and vice versa. The study of credit risk can be split into two, which facilitates better understanding of the term (see Figure 2.1).

Figure 2.1 Division of Credit Risk

A single borrower/obligor exposure is generally known as Firm Credit Risk or Obligor Credit Risk while the credit exposure to a group of borrowers, is called Portfolio Credit Risk. This bifurcation is important for the proper understanding and management of credit risk, inasmuch as the ultimate reasons for failure to pay can be traced to the economic, industry ...

Get Advanced Credit Risk Analysis and Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.