Chapter 8The Monetary Policy Transmission MechanismHow Changes in Interest Rates Affect Households, Firms, Financial Institutions, Economic Activity, and Inflation

- Describe how changes in interest rates can affect unemployment and inflation through households’ behavior.

- Describe how changes in interest rates can affect unemployment and inflation through firms’ behavior.

- Describe how changes in interest rates can affect unemployment and inflation through behavior of financial institutions.

- Explain why might there be uncertainty and time lags in the monetary policy transmission mechanism.

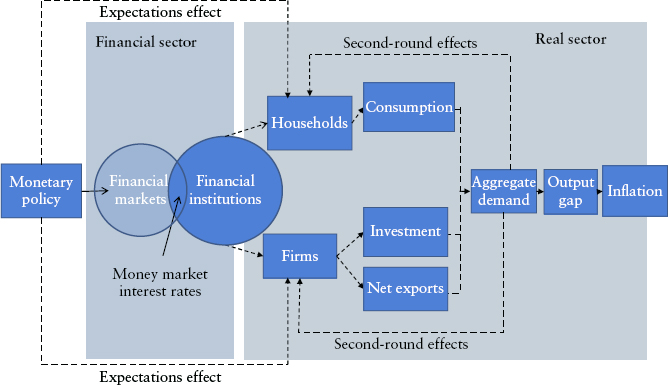

Chapter 7 discussed how the central bank’s conduct of monetary policy operations could affect interest rates in the financial markets. This section will discuss how changes in interest rates might affect the behavior of households, businesses, and financial institutions, and thus aggregate demand and general price levels in the economy. The transmission of effects to economic activity and inflation from the implementation of monetary policy is often known as the monetary policy transmission mechanism (see Figure 8.1).

FIGURE 8.1 Transmission of Monetary Policy through Households, Firms, and Financial Institutions

Through its conduct of monetary policy, the central bank uses the policy interest rate to signal its monetary policy stance and to try to influence interest ...

Get Central Banking: Theory and Practice in Sustaining Monetary and Financial Stability now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.