Chapter 5

Netting

I’m more concerned about the return of my money than with the return on my money.

Will Rogers (1879–1935)

5.1 BILATERAL NETTING

5.1.1 Origins of netting

Derivatives markets are fast-moving, with participants regularly changing their positions and where a large number of transactions may partially offset (hedge) one another. If a derivatives counterparty defaults, then it is possible that a given institution may have hundreds or even thousands of separate derivatives transactions with that counterparty. For OTC transactions that are not exchange-traded or centrally cleared, this is potentially a major issue.

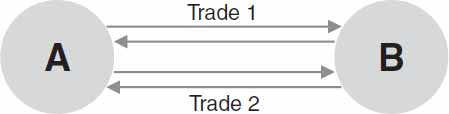

The need for netting is illustrated in Figure 5.1. Suppose parties A and B trade bilaterally and have two transactions with one another, each with its own set of cashflows. Without netting, this situation is potentially over-complex for two reasons:

Figure 5.1 Illustration of the need for netting in bilateral markets.

- Cashflows: Parties A and B are exchanging cashflows or assets on a periodic basis in relation to Trade 1 and Trade 2. However, where cashflows occur on the same day, this requires exchange of gross amounts, giving rise to settlement risk. It would be preferable to amalgamate payments and exchange only a net amount (see discussion on settlement risk in section 7.1.3).

- Close out: In the event that either party A or B defaults, the surviving ...

Get Central Counterparties: Mandatory Central Clearing and Initial Margin Requirements for OTC Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.