Chapter 6

Margining1

A first-rate organizer is never in a hurry. He is never late. He always keeps up his sleeve a margin for the unexpected.

Arnold Bennett (1867–1931)

6.1 BASICS OF MARGIN

6.1.1 Rationale

Margin provides a means to reduce credit exposure and counterparty risk beyond the benefit achieved with other methods such as netting. Margin refers to an asset that offsets exposure in a legally enforceable way. The fundamental idea of margin is simply that cash or securities are transferred or pledged from one counterparty to another as security for a credit exposure. In the event of default, the surviving party may be able to keep their margin to offset losses that they may otherwise incur.

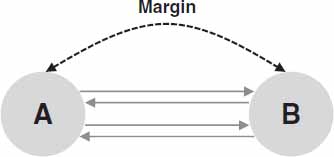

The basic idea of margining is very simple and illustrated in Figure 6.1. Parties A and B have one or more transactions between them and therefore agree that one or both of them will exchange margin in order to offset the exposure that will otherwise exist. The rules regarding the timings, amounts and type of margin posted should naturally be agreed before the initiation of the underlying trade(s).

Figure 6.1 Illustration of the basic role of margin.

Since exposures in derivatives are generally bilateral then margin is typically also posted bilaterally. Naturally, margin would reflect the mark-to-market of the underlying trades, which can generally be positive or negative from each ...

Get Central Counterparties: Mandatory Central Clearing and Initial Margin Requirements for OTC Derivatives now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.