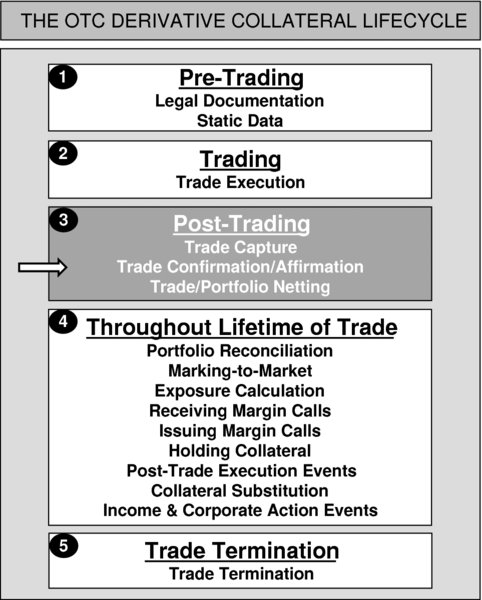

CHAPTER 29OTC Derivatives and Collateral – The Collateral Lifecycle – Post-Trading – Trade Confirmation/Affirmation

Once a trade has been executed and its details captured within a firm’s internal system(s), the next action to complete is the act of gaining formal agreement of the trade details with the counterparty.

29.1 TRADE CONFIRMATION/AFFIRMATION: INTRODUCTION

The act of trade confirmation/affirmation is necessary because, despite the fact that the firm and its counterparty may have executed the trade as required, there is no guarantee that the trade’s details have been captured correctly by either party.

If, for an individual trade, a difference exists in a trade component (e.g. different fixed rate in an interest rate swap, or different premium in a credit default swap), this must be identified immediately and corrected by the party at fault. If, instead, the trade details go unchecked (or unconfirmed) between the firm and its counterparty, such a situation will cause discrepancies subsequently in both operational trade processing

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.