CHAPTER 32OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Marking-to-Market

32.1 INTRODUCTION

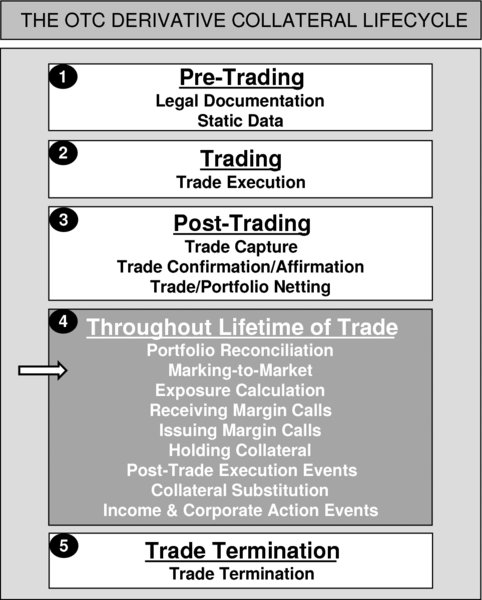

At this point in the collateral lifecycle, a firm should have performed portfolio reconciliation, resulting in the firm having knowledge that it has an agreed population of OTC derivative trades with its various counterparties.

The next step is to apply current market prices to trades and positions, from which it can be determined whether exposure exists, and if so whether it is the firm or its counterparty that has the exposure and therefore which party should make the margin call.

The process of discovering current market prices and of applying such prices to underlying trades and positions is commonly known as marking-to-market. In plain English, this means applying (marking) the current market price to a trade or to an existing position.

The process of ‘marking-to-market’ (or ‘mark-to-market’) is highly generic as it is applicable to many types of financial product, including securities positions, OTC derivatives, and securities collateral.

In addition, current market prices are used by ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.