CHAPTER 33OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Exposure Calculation

33.1 INTRODUCTION

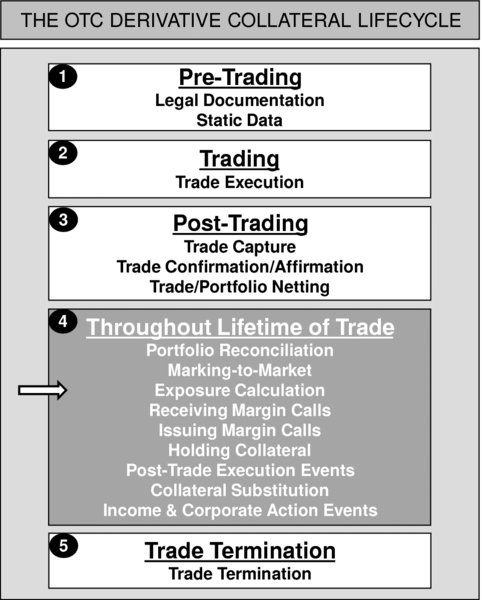

At this point in the collateral lifecycle, a firm should have 1) performed portfolio reconciliation with its various counterparties, and 2) completed the mark-to-market process.

A number of components comprise the determination of:

- whether an exposure exists ‘today’, and if so:

- the party that is exposed (whether the firm itself or its counterparty), leading to:

- issuance of a margin call by the exposed party.

The first two of these points are explored within this chapter, whilst the third point will be covered within the following two chapters.

33.2 CREDIT SUPPORT ANNEX

For OTC derivatives, each Credit Support Annex (CSA) that a firm has with its various counterparties is likely to contain details that, if not unique from one another, differ in many aspects. It is therefore essential that, for exposure calculation purposes, a firm ensures it utilises the exact information contained in the relevant CSA for each of its counterparties. For details comprising the CSA, please refer to Chapter 22 ‘OTC Derivatives and Collateral – Legal Protection – Credit Support Annex’. ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.