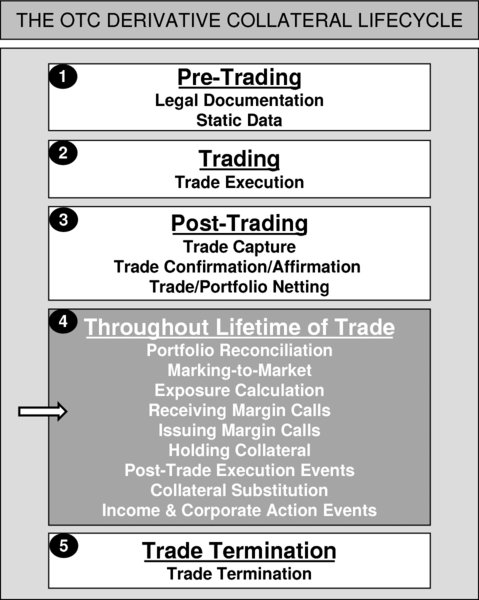

CHAPTER 34OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Receiving Margin Calls

34.1 INTRODUCTION

At this point in the collateral lifecycle, a firm should have completed (for each counterparty):

- portfolio reconciliation

- marking-to-market

- calculation of exposure amount, taking account of:

- CSA components

- existing collateral given or taken, including collateral in transit

in order to derive the firm’s view as to whether an exposure exists, and accordingly whether a margin call is to be 1) made by the firm on the counterparty, or 2) made by the counterparty on the firm.

Assume that the firm’s calculations show that the counterparty is the exposed party, and thus the firm is anticipating receipt of a margin call notification from the counterparty. Should the firm receive such a communication, and by the required deadline, and providing the firm agrees its contents, the firm will need to decide either to pay cash collateral ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.