CHAPTER 39OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Post-Trade Execution Events – Unwind

39.1 INTRODUCTION

Where a firm has a live and current OTC derivative trade (or position) with a particular counterparty, at any point during its lifetime that trade or position may be subject to an unwind.

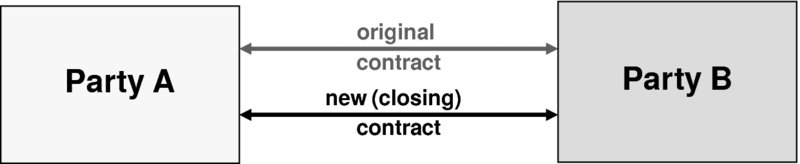

Unwinds arise where both parties mutually agree to exit the trade. The specific characteristic of this method of exiting a contract from a particular firm’s perspective is that it is the execution of an opposing trade to the existing trade, carried out with the same counterparty, the effect being to close (or to square-off) the original trade resulting in no outstanding trade and no ongoing exposure. This situation is depicted in Figure 39.1, which shows both the pre-unwind and post-unwind situation:

FIGURE 39.1 Pre- and post-unwind trade situations

Following unwind:

- Party A has no ongoing contract and therefore no exposure with Party B

- Party ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.