CHAPTER 42OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Collateral Substitution

42.1 INTRODUCTION

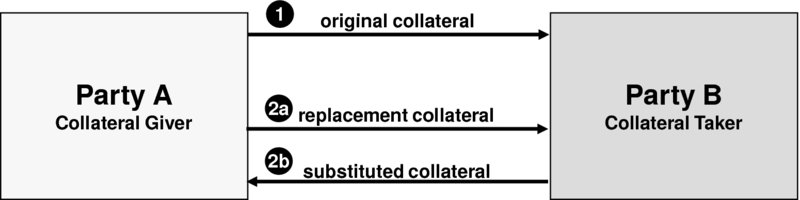

In a situation in which securities (usually bond, unusually equity) collateral is being held by a collateral taker, the collateral giver may require return of that particular bond, in exchange for other collateral. The common term for such an exchange is ‘collateral substitution’ (see Figure 42.1).

FIGURE 42.1 Collateral substitution

Providing the replacement collateral is eligible under the CSA with the particular counterparty, the replacement collateral may be:

- replacement bond or equity versus substituted bond or equity

- replacement bond or equity versus substituted cash

- replacement cash versus substituted bond or equity

- replacement currency versus substituted currency.

Furthermore, bond collateral used as replacement ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.