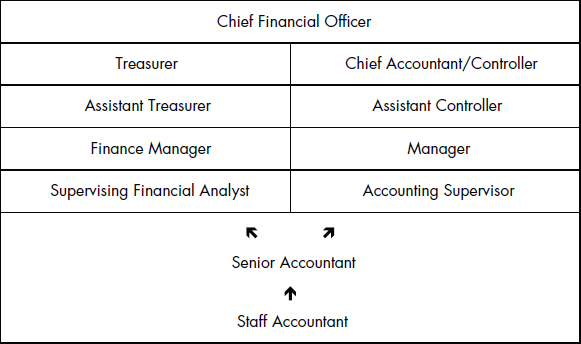

Appendix BCORPORATE ACCOUNTING CAREER PATHS

INITIAL YEARS IN CORPORATE ACCOUNTING

Numbers in parentheses are the minimum number of years usually required in a position before being eligible for promotion. The job descriptions and required years are intended only an overview. Every company has specific job requirements.

Staff accountant (1 year): Assists supervisors and managers with managing accounts payable, accounts receivable, payroll, general ledger, financial statements, account analysis and reconciliations, cash and cash balance sheet accounts, auditing cash and cash transactions, sales tax returns, and other work, as needed.

Senior Accountant (2-3 years): Supervises staff accountants and assists with reconciling various general ledger accounts, reviewing financial statements and trial balances for conformity to generally accepted accounting principles (GAAP), coordinating quarterly reviews and year-end audit, performing various account analyses and bank and other account reconciliations, and managing various projects as needed.

MANAGEMENT ACCOUNTING TRACK

Accounting supervisor (3-5 years):

Supervises accounts payable; payroll and accounts receivable

Monitors general ledger accounts to ensure accuracy and integrity

Supervises monthly and year-end closing process

Ensures accounting and closing routines are in compliance with corporate policies

Oversees timely and accurate ...

Get Communications now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.