CHAPTER 8

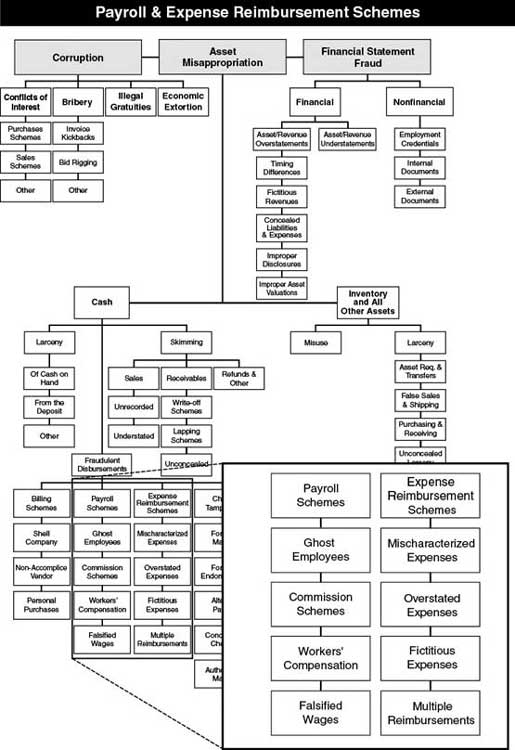

Payroll and Expense Reimbursement Schemes

Case Study: Say Cheese!

Every once in a while, a person devises a fraud scheme so complex that it is virtually undetectable. Intricate planning allows the person to cheat a company out of millions of dollars with little chance of getting caught.

Jerry Harkanell

1 is no such person.

Harkanell's payroll scheme put only about $1, 500 in his pocket before a supervisor detected his fraud, less than half a year after it began.

Harkanell worked as an administrative assistant for a unit of a large San Antonio hospital. His duties consisted mostly of clerical tasks, including the submission of payroll information for the unit.

An exception report for the month of March listed some unusual activity on Harkanell's time sheet. He had posted eight hours that resulted in overtime wages for a particular pay period. The pay period coincided with a time of low occupancy in Harkanell's unit. During times of low occupancy, there is no need for anyone—especially an administrative assistant—to work overtime.

When his supervisor confronted Harkanell about the eight hours, he confessed. He said he posted the time because of financial problems and threats from his wife to leave him. He immediately submitted his resignation, a hospital administrator accepted it, and Jerry Harkanell became a former hospital employee.

The hospital administrator ...