Determining the Long-Term Growth Rate

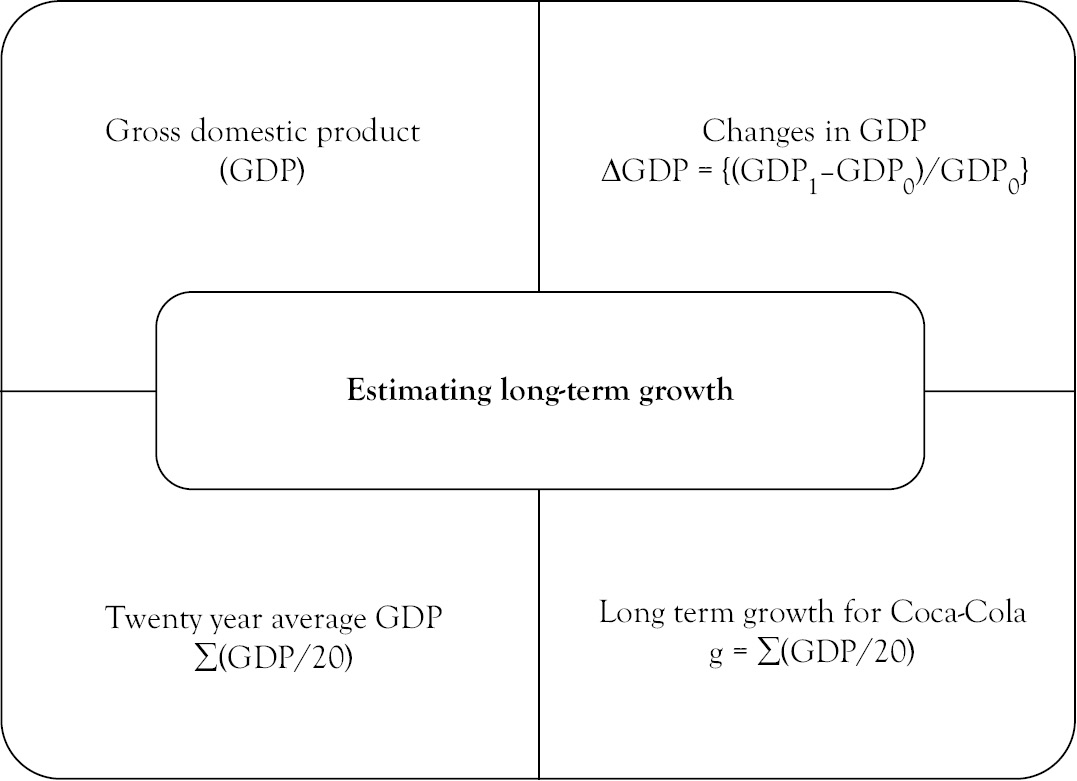

Valuation of a company requires the use of both intermediate-term growth rates for growth for the next five years. However, long-term growth rates should approximate the long-term growth rates of the economy as a whole. Figure 3.1 shows the process needed to compute the long-term growth rate of Coca-Cola based on GDP. It is not possible for the sales of a company to grow at a higher rate than the average growth rate of the economy forever. Large, mature companies will grow at the average growth rate of GDP eventually.

Figure 3.1 Shows the process used to compute the long-term growth rate of Coca-Cola ...

Get Corporate Valuation Using the Free Cash Flow Method Applied to Coca-Cola now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.