marketplace. We also look at the remaining types under the example of

the auto loan market for the reason that they are relatively homogenous

and stable. These activities are likely to serve as a template for the con-

tinued development of the European market.

4.2 Mortgage-backed securities

Most of you have familiarity with the mortgage arrangement. A loan is

provided which is backed with the underlying property of the subse-

quent purchase. Mortgages can be either fixed or floating rate. In the

US mortgages are generally amortizing. This means that the monthly

payment is composed both of interest and principal redemption.

Within the UK, possibly more heterogeneous than either the US or

Europe as a whole, there is a wide variety of possibilities including

184 Credit risk: from transaction to portfolio management

Fixed payments to the indenture

Receives

floating

Floating payments to the SPV

Pays fixed

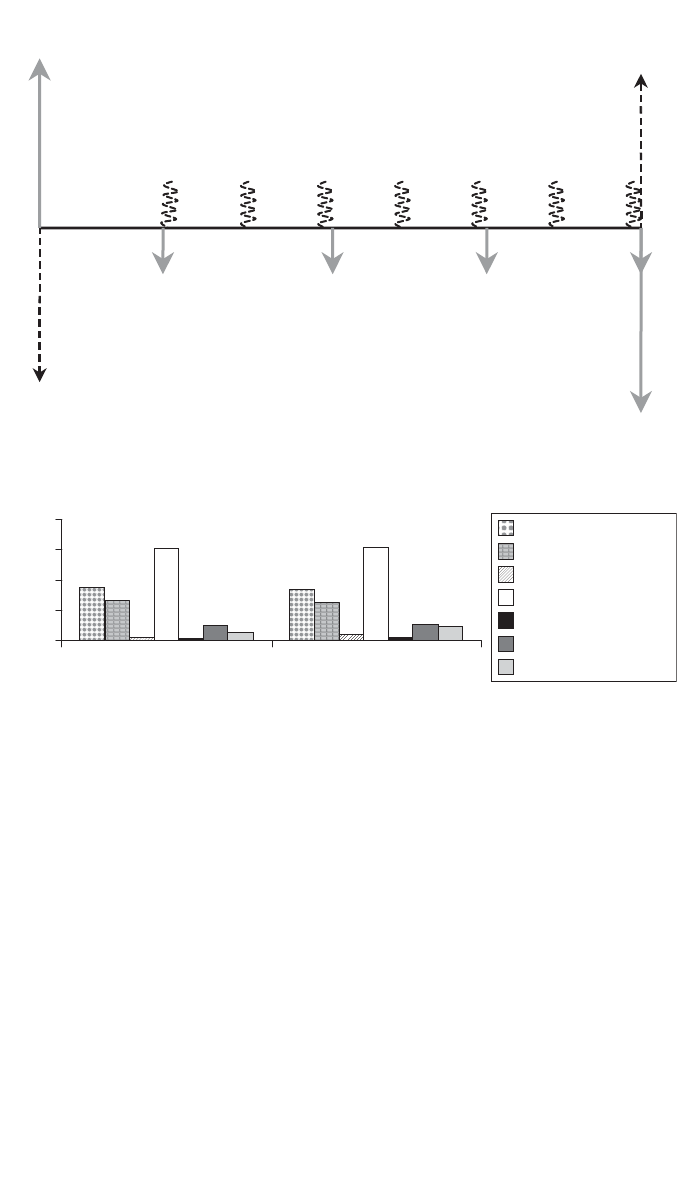

Figure 4.3 The cash flows of an interest rate swap.

0

50

100

150

200

2002 2003E

Year

$ billion

Auto

Credit card

Equipment loan/lease

Home equity

Manuf. housing

Student loan

Other

Figure 4.4 Relative importance of different asset type by supply (May 2003).

Source: Barclays Capital.

interest only, typically with an endowment policy, or straight repay-

ment mortgages, also common are capped and fixed rate.

The capital markets, obviously, are not interested in individual debt

obligations. However if all of these obligations are pooled together then

the characteristics of the collection are often attractive. Such then is

the motive behind MBSs. In the US certain MBSs enjoy government

sponsorship; in which case the credit rating will be AAA. There are three

agencies which are either owned by, or have government association.

These are the Government National Mortgage Association (GNMA), the

Federal Home Loan Mortgage Corporation (FHLMC) and the Federal

National Mortgage Association (FNMA). The overwhelming majority of

mortgages will be financed by these agencies. Do not think however

that the consumer goes directly to the agency. They lend to intermedi-

aries. Table 4.1 illustrates the development of this phenomenon.

MBSs are issued both as ‘pass through’ and ‘pay through’ securities,

often referred to as CMOs. The latter formed by pooling ‘pass throughs’,

and redistributing the principal and interest according to a pre-set

formula.

‘Pass throughs’ represent an undiluted claim on the asset base. Cash

received by the vehicle (no distinction is made between interest and

principal) is passed directly on to the underlying securities. These all

have a single class structure, that is no holder has rights to the cash

flow that are senior or subordinated to the other holders (Figure 4.5).

There are a number of varieties of pass through which can be categor-

ized as ‘straight pass through’ whereby interest and principal is paid

directly to investors as it is received in the pool. ‘Partially modified pass

through’, where some payments may be delayed but ultimately covered

by the guarantee

2

and then the ‘modified pass through’ whereby all pay-

ments are made regardless of whether there is money in the pool. There

is also a type of pass through which categorizes the investors into two

groups the ‘callable’ and the ‘call class’. The latter receive nothing but

hold the right to call the security at a certain price and date in the future.

Securitization 185

Table 4.1 Issuance of MBSs ($ billion).

2003* 2002 2001 2000 1999

FHLMC 198 531 379 159 226

FNMA 410 727 524 213 299

GNMA1 51 111 109 59 108

GNMA2 19 63 67 46 46

Source: Bloomberg LP. *Until April 2003.

2

The guarantee must supply the extra funds.

Get Credit Risk: From Transaction to Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.