CHAPTER 3 Financial Services Regulations and Requirements

John E. Grable, PhD, CFP®

University of Georgia

Sonya L. Britt, PhD, CFP®

Kansas State University

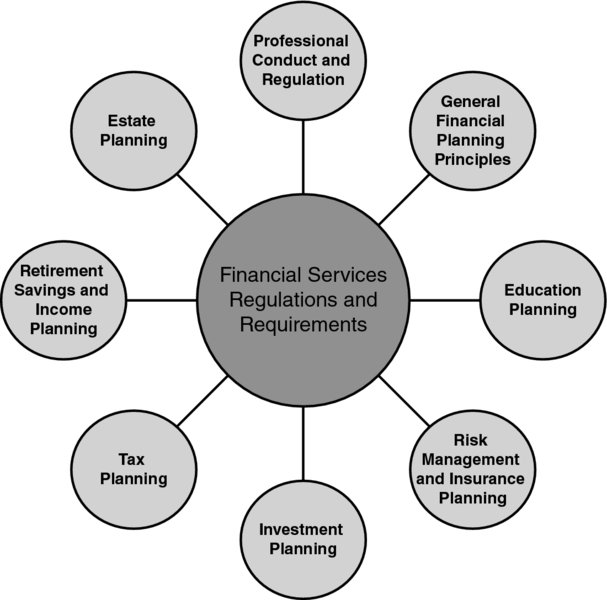

CONNECTIONS DIAGRAM

The regulation of financial services markets and professionals is integrated into nearly every aspect of the financial planning process. At its core, however, is the requirement that financial planners understand and determine how they interact with clients. Some planners provide advice for a fee. Others transact trades for clients. Some financial planners provide a number of related but technically different services. In general, those who provide services for a fee are considered investment advisors. Those who transact trades and other business for a commission are known as brokers, agents, or registered representatives. The form of regulation differs based on each financial planner’s responsibilities. The nature, type, and extent of regulation are briefly described in this chapter.

INTRODUCTION

The regulation and licensing of securities professionals has a long and vivid history. King Edward of England, in the thirteenth century, was the first to decree that brokers in London should be licensed.1 The United States was somewhat late in implementing regulations. The state of Massachusetts drafted the first securities regulation in 1852, but it was not until the early twentieth century that the regulation ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.