CHAPTER 5 Fiduciary

Martie Gillen, PhD

University of Florida

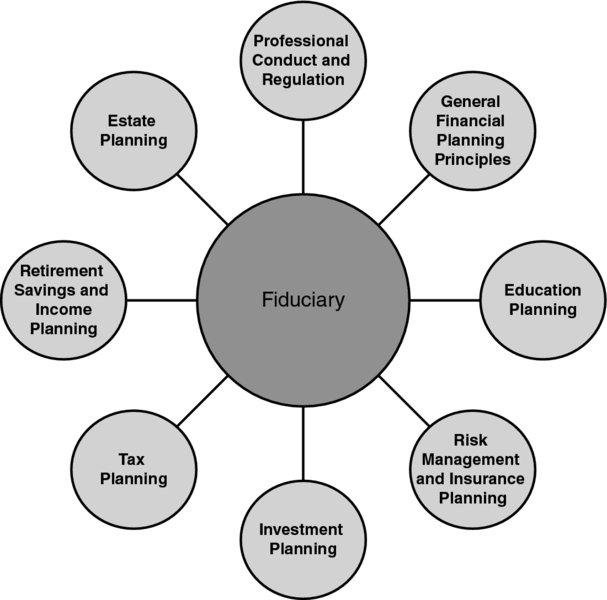

CONNECTIONS DIAGRAM

CFP Board’s Standards of Professional Conduct require that all CFP® professionals who provide financial planning services be held to the duty of care of a fiduciary. A fiduciary is defined by CFP Board’s Standards of Professional Conduct as “one who acts in utmost good faith, in a manner he or she reasonably believes to be in the best interest of the client” (p. 4). Individuals should always consider when the fiduciary standard applies. The Rules of Conduct address the fiduciary standard of care. Rule 1.4 provides direction to CFP® professionals who provide financial planning or material elements of financial planning to clients. The financial planner must adhere to ethical standards of professional conduct and fiduciary responsibility by providing unbiased recommendations that are in the best interest of the client. Violations may result in discipline of the CFP® professional.

INTRODUCTION

As defined by CFP Board’s Standards of Professional Conduct, a fiduciary is “one who acts in utmost good faith, in a manner he or she reasonably believes to be in the best interest of the client” (p. 4). CFP® professionals have a fiduciary responsibility to their clients when they are providing financial planning services or material elements of financial planning services. Professional judgment is at the forefront ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.