CHAPTER 6 Financial Planning Process

John E. Grable, PhD, CFP®

University of Georgia

Ronald A. Sages, PhD, AEP®, CFP® , CTFA, EA

Kansas State University

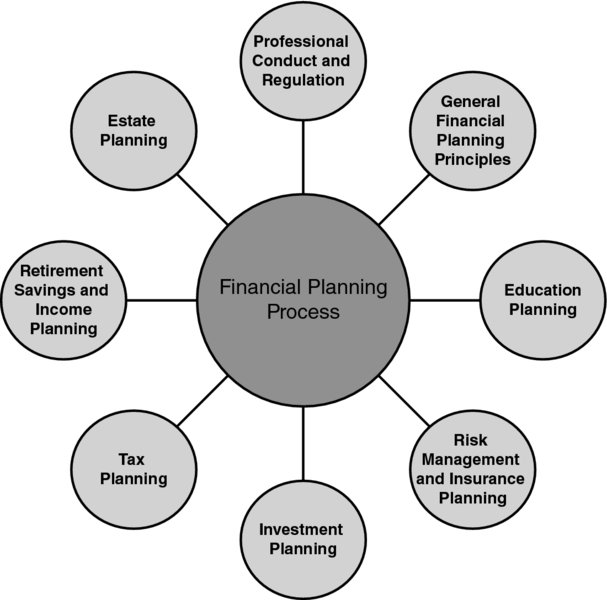

CONNECTIONS DIAGRAM

The financial planning process underlies the foundation of both comprehensive and modular financial planning.1 The process of financial planning is highly integrated into every aspect of financial advice giving. The systematic process is shaped and guided by many factors, including a financial planner’s commitment to disclosure, practice standards, professional conduct, and ethical standards. Communication and counseling skills also are essential to making the process work most effectively for clients. The financial planning process connects the core content areas of planning, including cash flow and net worth, tax, insurance, investment, retirement, and estate planning.

INTRODUCTION

The process of financial planning is generally conceptualized as a six-step activity, as described by the Certified Financial Planner Board of Standards, Inc. (CFP Board):2

- Establishing and Defining the Client–Planner Relationship: This first step in the financial planning process is important because it sets the stage for client–planner interactions by clarifying issues and concepts related to responsibilities of both parties in the relationship. CFP Board rules require financial planners to specify and document their services. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.