CHAPTER 25 Annuities

Andrew Head, MA, CFP®

Western Kentucky University

John Gilliam, PhD, CFP®

Texas Tech University

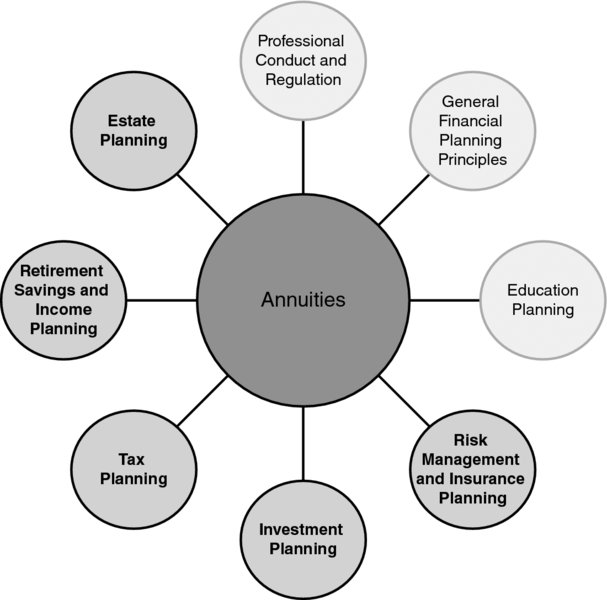

CONNECTION DIAGRAM

While an annuity is a packaged product of an insurance company, it affects numerous areas of the financial planning process. Annuities of course connect with the risk management and insurance planning content areas in that they provide protection against longevity on their most basic levels. They are often used as investment and retirement income products either as a replacement for or complement to traditional means of portfolio construction and management. Annuities come with unique tax advantages and complexities of which the financial planner must be aware. Finally, they may be used as an estate planning tool in certain circumstances, such as probate avoidance or legacy planning.

INTRODUCTION

At its heart, the annuity contract is longevity insurance. In exchange for a premium or series of premiums, the annuitized contract provides an income to the purchaser for his or her life regardless of how long the person may live. The annuity contract is often used as a tax-deferred retirement savings strategy once other qualified options have been exhausted. Annuities provide investment structures that may be viable alternatives to portfolio strategies outside of an annuity contract. These alternatives may come with various company-backed guarantees ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.