CHAPTER 26 Life Insurance (Individual)

Dave Yeske, DBA, CFP®

Golden Gate University

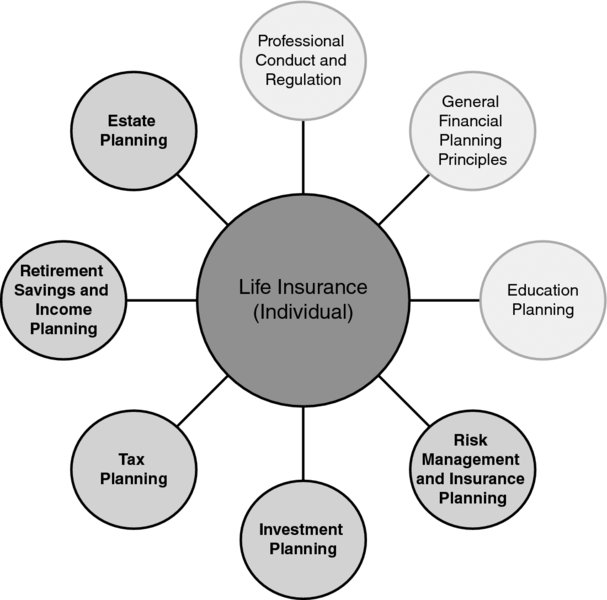

CONNECTIONS DIAGRAM

Variable life insurance policies have investment features that require investment management of internal subaccounts, and retirement plans may invest in life insurance policies (investment planning). There are many tax considerations to be managed with life insurance policies, including employer deductibility of premiums and the tax treatment of loans from and surrenders of cash-value life policies (tax planning). Life insurance policies may be used as investments within retirement plans and for plan completion purposes (retirement saving and income planning). Life insurance is a source of estate liquidity and can be used to meet the needs of financial dependents in case of a wage earner’s premature death (estate planning).

INTRODUCTION

Financial planning strategies for attaining future goals often vary depending on a client’s ability to save and invest from earned income. If those goals encompass financial dependents, the possibility of a client’s income ending as a consequence of premature death becomes a significant risk exposure. One of the most important methods for dealing with this exposure is to transfer the risk to a third party through the purchase of a life insurance policy. Therefore, financial planners must be capable of identifying the presence of this risk ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.