CHAPTER 29 Insurance Policy and Company Selection

Thomas Warschauer, PhD, CFP®

San Diego State University

Andrew Head, MA, CFP®

Western Kentucky University

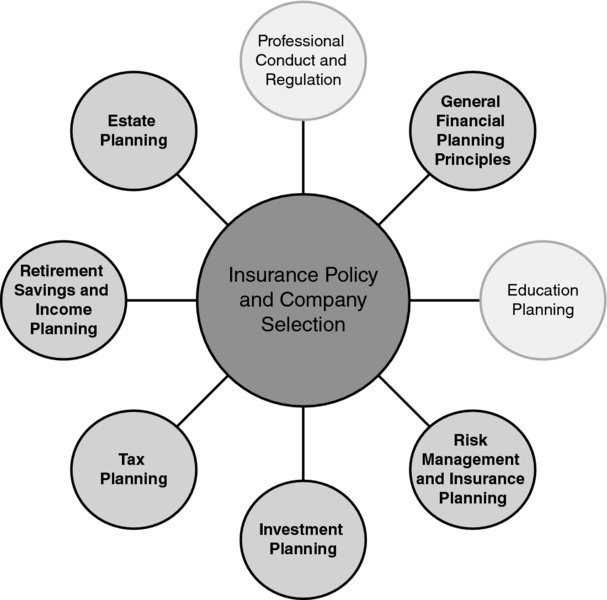

CONNECTIONS DIAGRAM

The selection of insurance policies and companies derives directly from the insurance needs analysis discussed in the previous chapter. These two topics taken together connect to various elements of the financial planning subject areas. Although most insurance products are not assets, cash-value type life insurance is and so it is reflected on the client’s statement of financial position (Chapter 7). As insurance costs are significant, there is an impact on the client’s cash flow (Chapter 8). Insurance recommendations and the ways they are presented to clients are regulated by state insurance commissioners and others, as described in Chapters 3 and 4. Insurance contracts in the form of cash-value life insurance as well as annuities of all forms would also potentially play a significant role in retirement planning. This discussion, of course, links to all areas of insurance (Chapters 20 through 30). The taxation of premiums and benefits is a significant consideration. Variable insurance products have investment characteristics based on the selection of alternatives chosen. And finally, insurance products are often used to effect estate planning goals.

INTRODUCTION

Policy selection is derived directly ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.