CHAPTER 53 Types of Retirement Plans

John E. Grable, PhD, CFP®

University of Georgia

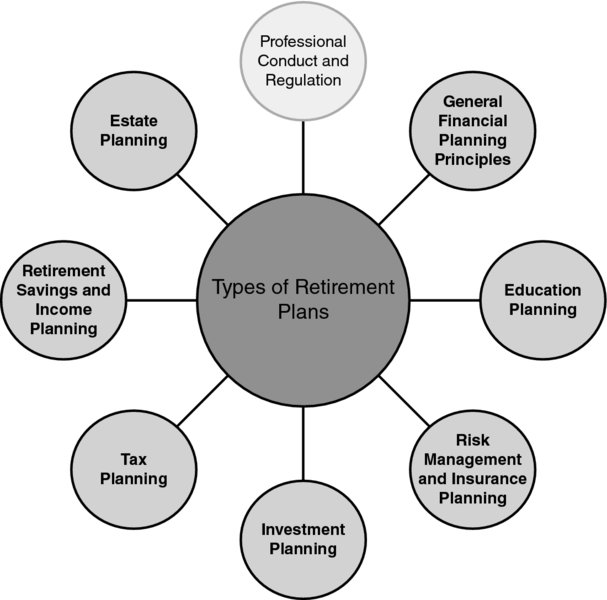

CONNECTIONS DIAGRAM

Retirement planning is interrelated with nearly every other element of the financial planning process, including cash flow and net worth, tax, investment, and estate planning. For example, it is important for financial planners to have a high level of competence in relation to tax code issues, investment selection criteria, and portfolio management techniques when making retirement plan recommendations to either a business owner or a client who requests retirement plan guidance. Additionally, the ability to estimate the manner in which a client’s cash flow, net worth, and estate situation will likely change as a result of retirement plan decisions is one characteristic separating the best and brightest financial planners from others.

INTRODUCTION

The first public pension arrangement in the United States was implemented by the state of Massachusetts during the seventeenth century.1 Colonists who were unable to work due to wounds received in battle received a pension, which was funded through public tax collections. It was not until the mid-nineteenth century that retirement plans, as public and private social benefits, began to take shape in a form recognizable in the twenty-first century. Retirement was a remote concept for most Americans prior to the Industrial Revolution. ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.