CHAPTER 55 Other Tax-Advantaged Plans

Andrew Head, MA, CFP®

Western Kentucky University

Sharon A. Burns, PhD, CPA (Inactive)

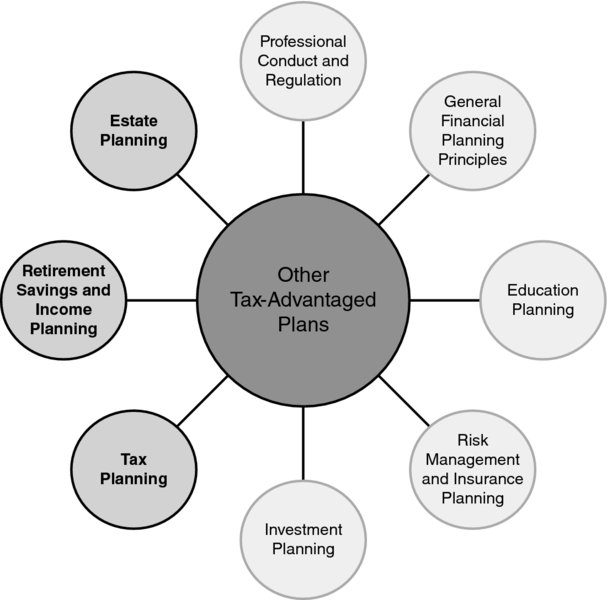

CONNECTIONS DIAGRAM

Tax-advantaged retirement plans play a key role in the financial stability of aging individuals. The distribution rules allow tax-advantaged retirement plans to serve as a unique estate-planning tool. Contribution and distribution rules force a financial planner to consider the income tax implications of saving and withdrawing funds to meet retirement needs. Tax-advantaged plans may also be used to meet long-term estate planning distribution goals.

INTRODUCTION

Since their introduction in 1974, individual retirement arrangements (IRAs) have played a pivotal role in the accumulation of assets for retirement. By the end of the third quarter of 2014, aggregate IRA assets stood at $7.3 trillion.1

A traditional IRA offers a worker or spouse of a worker a vehicle for retirement savings that enjoys tax benefits. Contributions to an IRA are tax deductible. The earnings on account assets (interest, dividends, capital gains) grow tax deferred.

Contributions are limited, and the contribution limits are increased from time to time. A non-working or underemployed spouse may contribute the same amount as a working spouse provided the couple’s total income is equal to or greater than the total contributions of the spouses.

Added forms of IRAs make ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.