CHAPTER 85 Aging Clients: Special Considerations

Deanna L. Sharpe, PhD, CFP®

University of Missouri

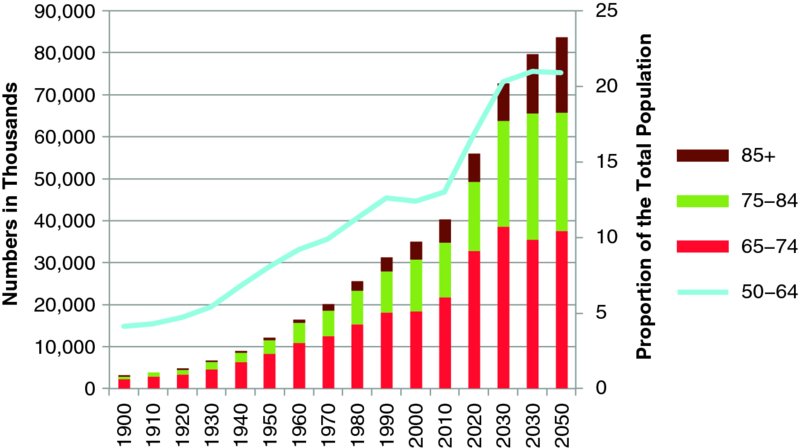

Beginning in 2011 and continuing for 18 years, 3 million baby boomers a year will turn 65.1 Dubbed the “silver tsunami,” these successive waves of individuals reaching retirement age will be profoundly altering the demographic structure of the United States, the face of financial planning clients, and the focus of financial planning conversations (see Figure 85.1).

Figure 85.1 Population 65+ in the United States, 1900–2050

Source: Adapted from L. A. West, S. Cole, D. Goodkind, and W. He. (2014). 65+ in the United States: 2010. U.S. Census Bureau. P23-212. www.census.gov/content/dam/Census/library/publications/2014/demo/p23-212.pdf.

The number of people aged 65 and older in the United States is growing faster than younger age groups. By 2030, more than one in five U.S. residents will be aged 65 or older versus one in eight in 2010 and one in 10 in 1970.2

Two-thirds of all individuals who have lived to be age 65 are alive today.3 In the past, living to an advanced age was uncommon. In 1900, U.S. life expectancy was 47. By 2010, improved living conditions had extended life expectancy at birth to 76 years for men and 81 years for women. Today’s 65-year-old has a life expectancy of 20 years. For a 75-year-old, life expectancy is 12 years.4

Reaching advanced age is no longer ...

Get Financial Planning Competency Handbook, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.