13BUDGETS, OPERATING PLANS, AND FORECASTS

CHAPTER INTRODUCTION

This chapter will focus on projections that estimate performance over a 3‐ to 18‐month period, including budgets, operating plans, and forecasts. Many of the techniques and practices utilized in this chapter were introduced in Chapter 12.

THE BUDGETING PROCESS

In spite of its shortcomings, the budgeting process lives on in many organizations. In some cases, it is required by charter or statute. In other cases, it either suffices or has not been evaluated against new tools, and against best practices and techniques in financial management. We will review the typical budget process and tools in this section to serve as a foundation for improved planning tools for the twenty‐first century.

Traditional Budgeting Process

In chapter 12 we described the traditional budget process that became a cornerstone of management systems in the twenty‐first century. While many organizations have adopted more evolved methods of developing business projections explored later in this chapter, others continue to use the traditional budget process.

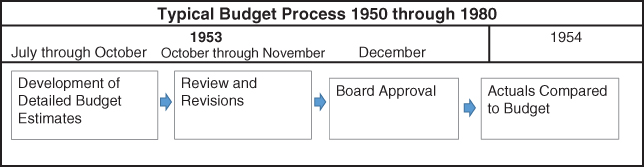

The traditional budget process follows an annual cycle. The budget for next year would be developed several months before the new year begins. It is characterized by a very detailed and financially oriented process illustrated in Figure 13.1.

FIGURE 13.1 Traditional Budget and Control ...

Get Financial Planning & Analysis and Performance Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.