Chapter 6. The Tri-Day Method

“It is called the Tri-Day Method because you need to know the price of the stock average on just three days in order to compute the level of the final bottom. The calculation can be made shortly after the bull market high.”1 —George Lindsay

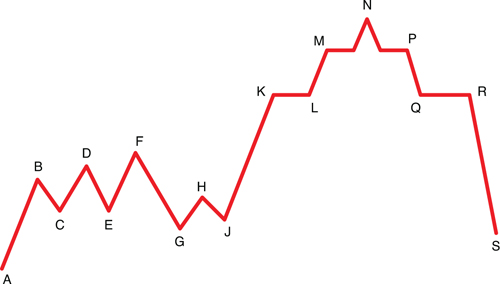

Lindsay explained his Tri-Day Method (see Figure 6.1) in a series of five supplements to his newsletter from May to September 1959. In them he described a new method of calculating the level of bear market lows using the Three Peaks and a Domed House formation.

Figure 6.1. Tri-Day Method.

The name “Tri-Day Method” comes from the fact that to forecast the price level of a bottom, ...

Get George Lindsay and the Art of Technical Analysis: Trading Systems of a Market Master now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.