Non-CRRA Preferences

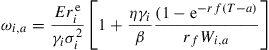

Non-CRRA preferences may generate rebalancing over the life-cycle. For instance, if individuals have hyperbolic Bernoulli utility

![]()

Merton (1971) shows that the optimal portfolio risky share depends on age even without labor income:

(4.2)

(4.2)

With ![]() , older investors take less financial risk than the young. Gollier and Zeckhauser (2002) consider a general characterization of risk tolerance and show that departure from linearity generates ...

, older investors take less financial risk than the young. Gollier and Zeckhauser (2002) consider a general characterization of risk tolerance and show that departure from linearity generates ...

Get Handbook of the Economics of Finance SET:Volumes 2A & 2B now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.