Chapter 12Forecasting in Troubled Times

When sorrows come, they come not single spies, But in battalions.

—William Shakespeare, Hamlet, Act IV, Scene V

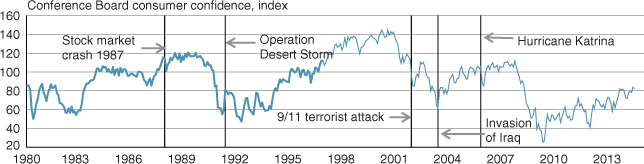

Although interest rates may be the most difficult variable to forecast, the most challenging environments for prognostication involve unanticipated crises—terrorism threats, natural disasters, sudden oil price swings, stock market crashes, and foreign economic turmoil. These events have prompted some major mistakes by all forecasters—including myself. When they occur, the public is taken by surprise, the media often overreacts, and our clients demand fast answers. The world, in other words, is thrown into a bit of a tizzy. (Figure 12.1 illustrates how crises of the past few decades have affected consumer confidence.) Although no one knows when these crises will occur, everyone knows that occur they will. To cite three obvious examples:

- Spurred by global warming, aberrant weather patterns may spawn more frequent hurricanes and floods.

- Terrorist threats and attacks on civilian populations are, unfortunately, more than a passing trend.

- Stock market and oil prices are apt to remain volatile and full of surprises.

Figure 12.1 Public Confidence at Times of Crisis

Source: Conference Board.

Thus, a successful forecaster must be prepared to address these expected developments.

Natural Disasters: The Economic Cons and Pros

In recent ...

Get Inside the Crystal Ball: How to Make and Use Forecasts now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.