Default Record for Unrated Bonds

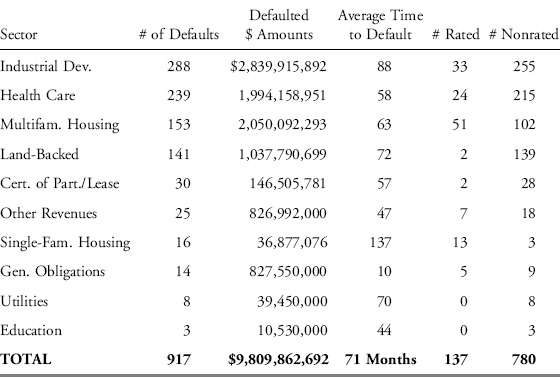

Since the default experience for rated municipals has limited relevance to the high yield universe, the record for unrated issues must now be examined. An older study, which was done by Standard & Poor’s/J.J. Kenny in June 2000,5 did take into account unrated issues. Unfortunately, the data only covered the 1990s and no recent update has been published, to our knowledge. Nevertheless, some useful historical perspective may be gleaned from the distribution of defaults by sector during the 1990s, as shown in Table 4.2.

TABLE 4.2 Monetary Defaults in the 1990s by Sector

Source: Standard & Poor’s/J.J. Kenny

One of the few sources of current default data that does include unrated paper is Richard Lehmann’s Income Securities Advisors (ISA) group. According to ISA, the top four sectors with the highest default rates for the last 3, 5, and 10 years (through 9/30/11) have been taxing districts, housing, health/congregate care, and retirement housing. ISA’s findings are summarized in Figures 4.2, and 4.3 and Table 04.3. The reader is reminded that technical defaults are counted by ISA as defaults, which may overstate the numbers. In Figure 4.2, we combine the number on nonrated defaults, as compiled by ISA, and the rated speculative-grade defaults, as reported by S&P. This composite picture shows once again that the overwhelming number of defaults since 1986 ...

Get Investing in the High Yield Municipal Market: How to Profit from the Current Municipal Credit Crisis and Earn Attractive Tax-Exempt Interest Income now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.