126 Mining Your Own Business in Telecoms Using DB2 Intelligent Miner for Data

6.6.2 CVF

As described earlier, the steps to generate customer values for each customer

are:

Using IM for Data application mode, apply the prediction model to your entire

customer database, then you’ll get a credit risk for each customer.

Using IM for Data application mode, apply the behavioral segmentation model

to your entire customer database, assign a segment to each customer, then

you can calculate behavior measure from that.

Based on that credit risk, behavior measure, you’ll get customer values for

each customer using the formula:

CVF = Average (Revenue for each customer, Behavior measure)

multiplied by (Credit score

)

Where, Credit score is 1 - Credit risk.

Now, you can interpret the customer values which are now assigned for your

customer. You can see the distribution associated with customer value to check

whether the customer value is meaningful.

CVF value per each segment

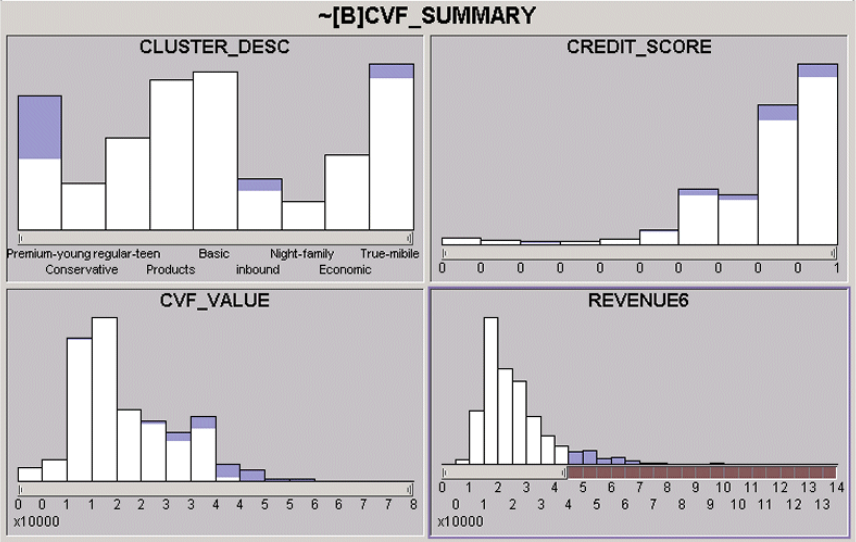

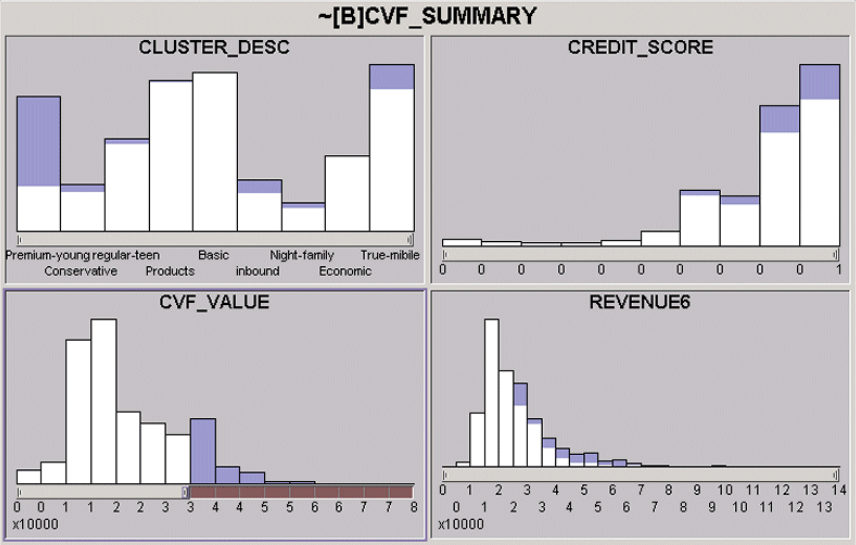

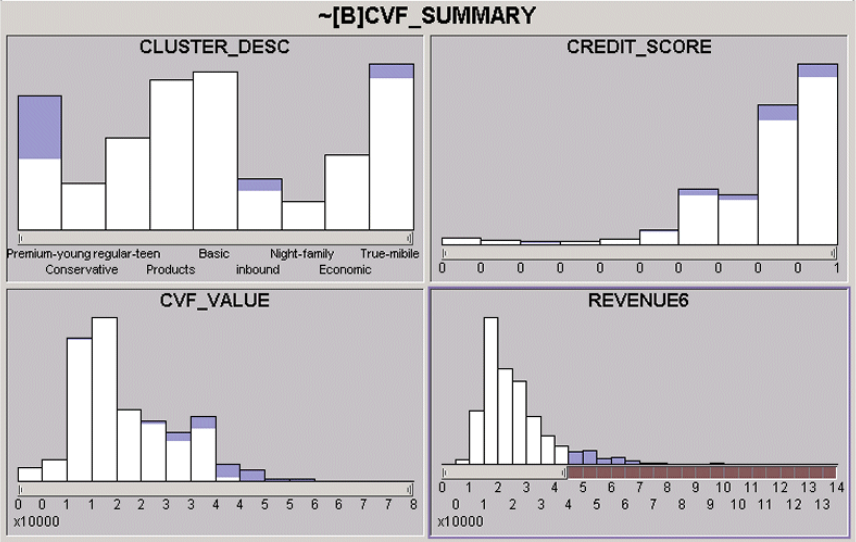

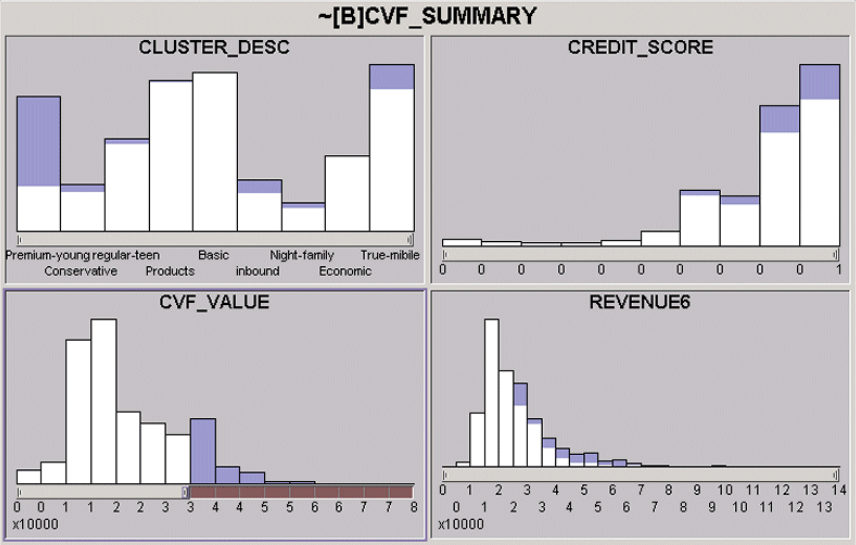

Figure 6-7 shows the distribution of customer value and credit risk and revenue

by each segment. If you look at the segment 4-Night family, which is at the

bottom of the picture in Figure 6-7, customer value distribution is much higher

than revenue and has a relatively high credit score. Night family is a good

customer group in terms of customer value, which may not be found if revenue is

only used as a customer value measurement.

Revenue share compared to credit risk

The revenue was not used as an input variable inside the credit risk prediction

model. However, an inverse relationship between revenue and credit score is

straightforward as shown in Table 6-4. The high revenue share clusters appear,

in average, with high credit risk (low credit score). This important result shows

the dangers of using only revenue as a customer value measure.

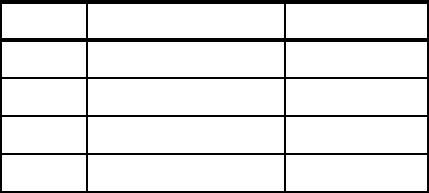

Table 6-4 Segment rank by revenue share and credit score

Rank Revenue share Credit score

1 Segment0 (21.8%) Segment5

2 Segment3 (15.0%) Segment7

3 Segment1 (13.9%) Segment8

4 Segment6 (11.1%) Segment1