CHAPTER 1How to Value an Asset

Three Primary Components of Value

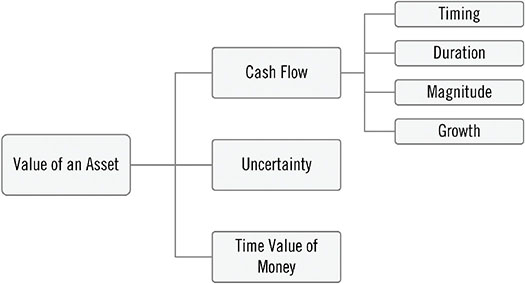

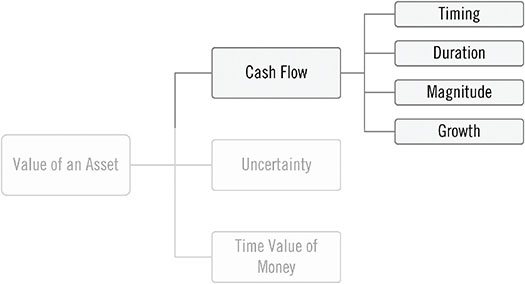

In this chapter, we discuss the three main components necessary to calculate the value of an asset: the cash flows, the uncertainty of receiving the cash flows, and the time value of money. We show these components in Figure 1.1

Figure 1.1 Primary Components to the Value of an Asset

Four Subcomponents of Cash Flow

The first part of the definition, “Cash flows produced by that asset, over its useful life,” includes four subcomponents: timing, duration, magnitude, and growth, as shown in Figure 1.2.

Figure 1.2 Four Cash Flow Subcomponents

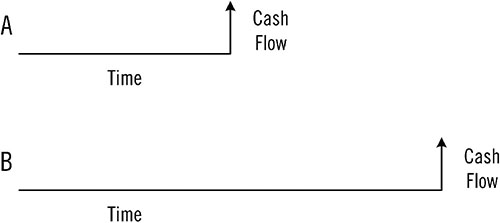

The first subcomponent, timing, addresses the question, “When will we get the cash?” Will we get the cash flow next year or in five years? While the amount of the cash flow is the same in Figures 1.3A and B, the cash flow is received sooner in A than in B. All else being equal, getting cash sooner is better than getting it later.

Figure 1.3 Getting Cash Sooner Is Preferable

The second subcomponent, duration, addresses the question, “How long will the cash flows last?” ...

Get Pitch the Perfect Investment now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.