CHAPTER 12

The Gaps in GAAP

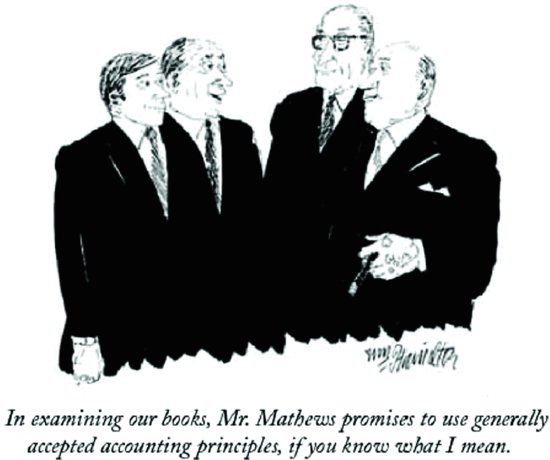

© William Hamilton/ The New Yorker Collection/ www.cartoonbank.com

Generally accepted accounting principles (GAAP) is the set of rules governing all aspects of the financial statements that companies publicly traded in the United States are required to provide to their stockholders. As a quantation professional, if you don't have to understand GAAP financial statements already, there will come a time when you will. However, as important as GAAP financial statements are to the efficient functioning of the U.S. capital markets, they are the tip of the business-quantation iceberg. GAAP financial statements comprise a minuscule fraction of the mass of numbers-based data, reports, plans, and analysis that managers depend on to run their businesses. Also, there is much in GAAP that is antithetical to the basic themes in this book. The rules of GAAP stress consistency, mathematical accuracy, and presenting information in tightly prescribed formats. Whereas these can be important goals, they are frequently less important (and occasionally much less important) than the other goals of effective quantation discussed in this book.

Much of this chapter will be devoted to a handful of detailed, but nontechnical, discussions of GAAP-related issues from my own career experience. We'll conclude with a brief discussion about how to reconcile the GAAP approach to financial ...