model [11] was modified to describe the arrival of news in the market,

which affects the fundamental price. This process was modeled with

the Gaussian random variable e(t) so that

ln P

f

(t) ln P

f

(t 1) ¼ e(t) (12:3:9)

The modeling results exhibited the power-law scaling and temporal

volatility dependence in the price distributions.

12.4 THE OBSERVABLE VARIABLES MODEL

12.4.1 T

HE FRAMEWORK

The models discussed so far are capable of reproducing important

features of financial market dynamics. Yet, one may notice a degree

of arbitrariness in this field. The number of different agent types and

the rules of their transition and adaptation vary from one model to

another. Also, little is known about optimal choice of the model

parameters [15, 16]. As a result, many interesting properties, such as

deterministic chaos, may be the model artifacts rather than reflections

of the real world.

5

A parsimonious approach to choosing variables in the agent-based

modeling of financial markets was offered in [17]. Namely, it was

suggested to derive agent-based models exclusively in terms of observ-

able variables. Note that the notion of observable data in finance

should be discerned from the notion of publicly available data. While

the transaction prices in regulated markets are publicly available, the

market microstructure is not (see Section 2.1). Still, every event in the

financial markets that affects the market microstructure (such as

quote submission, quote cancellation, transactions, etc.) is recorded

and stored for business and legal purposes. This information allows

one to reconstruct the market microstructure at every moment. We

define observable variables in finance as those that can be retrieved or

calculated from the records of market events. Whether these records

are publicly available at present is a secondary issue. More import-

antly, these data exist and can therefore potentially be used for

calibrating and testing the theoretical models.

The numbers of agents of different types generally are not observ-

able. Indeed, consider a market analog of ‘‘Maxwell’s Demon’’ who is

136 Agent-Based Modeling of Financial Markets

able to instantly parse all market events. The Demon cannot discern

‘‘chartists’’ and ‘‘fundamentalists’’ in typical situations, such as when

the current price, being lower than the fundamental price, is growing.

In this case, all traders buy rather than sell. Similarly, when the

current price, being higher than the fundamental price, is falling, all

traders sell rather than buy.

Only price, the total number of buyers, and the total number of

sellers are always observable. Whether a trader becomes a buyer or

seller can be defined by mixing different behavior patterns in the

trader decision-making rule. Let us describe a simple non-equilibrium

price model derived along these lines [17]. We discern ‘‘buyers’’ (þ)

and ‘‘sellers’’ (). Total number of traders is N

N

þ

(t) þ N

(t) ¼ N (12:4:1)

The scaled numbers of buyers, n

þ

(t) ¼ N

þ

(t)=N, and sellers, n

(t)

¼ N

(t)=N, are described with equations

dn

þ

=dt ¼ v

þ

n

v

þ

n

þ

(12:4:2)

dn

=dt ¼ v

þ

n

þ

v

þ

n

(12:4:3)

The factors v

þ

and v

þ

characterize the probabilities for transfer

from seller to buyer and back, respectively

v

þ

¼ 1=v

þ

¼ n exp (U), U ¼ ap

1

dp=dt þ b(1 p) (12:4:4)

Price p(t) is given in units of its fundamental value. The first term in

the utility function, U, characterizes the ‘‘chartist’’ behavior while the

second term describes the ‘‘fundamentalist’’ pattern. The factor n has

the sense of the frequency of transitions between seller and buyer

behavior. Since n

þ

(t) ¼ 1 n

(t), the system (12.4.1)–(12.4.3) is re-

duced to the equation

dn

þ

=dt ¼ v

þ

(1 n

þ

) v

þ

n

þ

(12:4:5)

The price formation equation is assumed to have the following

form

dp=dt ¼ gD

ex

(12:4:6)

where the excess demand, D

ex

, is proportional to the excess number of

buyers

D

ex

¼ d(n

þ

n

) ¼ d(2n

þ

1) (12:4:7)

Agent-Based Modeling of Financial Markets 137

12.4.2 PRICE-DEMAND RELATIONS

The model described above is defined with two observable vari-

ables, n

þ

(t) and p(t). In equilibrium, its solution is n

þ

¼ 0:5 and

p ¼ 1. The necessary stability condition for this model is

adgn 1 (12:4:8)

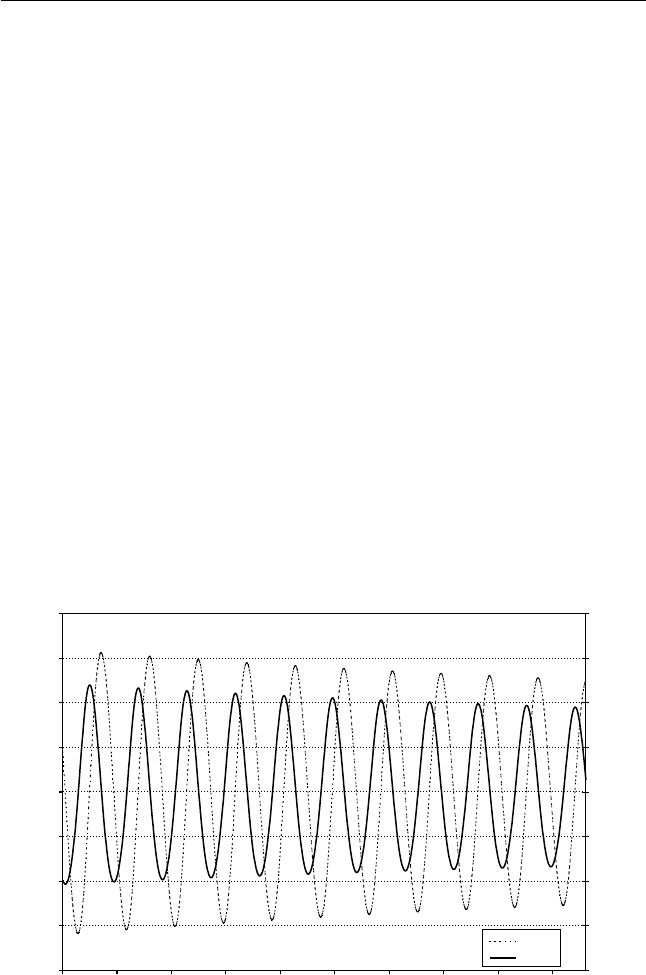

The typical stable solution for this model (relaxation of the initially

perturbed values of n

þ

and p) is given in Figure 12.1. Lower values of

a and g suppress oscillations and facilitate relaxation of the initial

perturbations. Thus, the rise of the ‘‘chartist’’ component in the utility

function increases the price volatility. Numerical solutions with the

values of a and g that slightly violate the condition (12.4.8) can lead to

the limit cycle providing that the initial conditions are very close to

the equilibrium values (see Figure 12.2). Otherwise, violation of the

condition (12.4.8) leads to system instability, which can be interpreted

as a market crash.

The basic model (12.4.1)–(12.4.7) can be extended in several

ways. First, the condition of the constant number of traders (12.4.1)

0.8

0.85

0.9

0.95

1

1.05

1.1

1.15

1.2

0 5 10 15 20 25 30 35 40 45

Time

Price

−0.4

−0.3

−0.2

−0.1

0

0.1

0.2

0.3

0.4

Dex

Price

Dex

Figure 12.1 Dynamics of excess demand (Dex) and price for the model

(12.4.5)–(12.4.7) with a ¼ b ¼ g ¼ 1, n

þ

(0) ¼ 0.4 and p(0) ¼ 1.05.

138 Agent-Based Modeling of Financial Markets

Get Quantitative Finance for Physicists now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.