Owner’s Equity in a Partnership

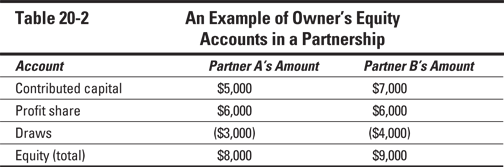

To track the equity for each partner in a partnership, you need to create three accounts for each partner: one for the partner’s contributed capital, one for the partner’s draws, and one for the partner’s share of the distributed income.

Amounts that a partner withdraws, of course, get tracked with the partner’s draws account.

Get QuickBooks 2013 For Dummies now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

The partner’s share of the partnership’s profits gets allocated to the partner’s profit share account. (Your partnership agreement, by the way, should say how the partnership income is distributed between the partners.) Table 20-2 gives an example of owner’s equity accounts in a partnership.

The partner’s share of the partnership’s profits gets allocated to the partner’s profit share account. (Your partnership agreement, by the way, should say how the partnership income is distributed between the partners.) Table 20-2 gives an example of owner’s equity accounts in a partnership.