Chapter 8. A Matter of Balance

In This Chapter

Choosing the account you want to balance

Telling Quicken to balance an account

Giving Quicken the bank statement balance

Entering monthly service charges and interest income

Marking account transactions as cleared or uncleared

Verifying that uncleared transactions explain the account difference

Checking for errors: What you should do if your account doesn't balance

I want to start this chapter with an important point: Balancing a bank account in Quicken is easy and quick.

I'm not just trying to get you pumped up about an otherwise painfully boring topic. I don't think balancing a bank account is any more exciting than you do. (At the Nelson house, we never answer the "What should we do tonight?" question by saying, "Hey, let's balance an account!")

My point is this: Because bank account balancing can be tedious and boring, use Quicken to speed up the drudgery.

Selecting the Account You Want to Balance

This step is easy. And you probably already know how to do it, too.

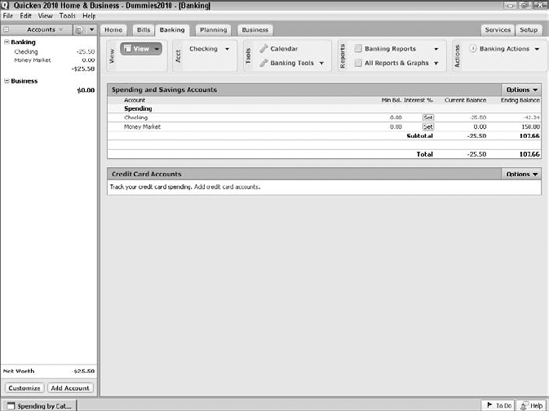

Click the Banking tab.

Quicken displays the Banking window.

The Banking window lists information about your bank accounts (as shown in Figure 8-1).

Click the account that you want to balance.

Quicken displays the transactions tab, or account register, for the account.

Figure 8-1. The Banking window.

Balancing a Bank Account

As I said, balancing a bank account is remarkably easy. In fact, I'll ...

Get Quicken® 2010 For Dummies® now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.