19

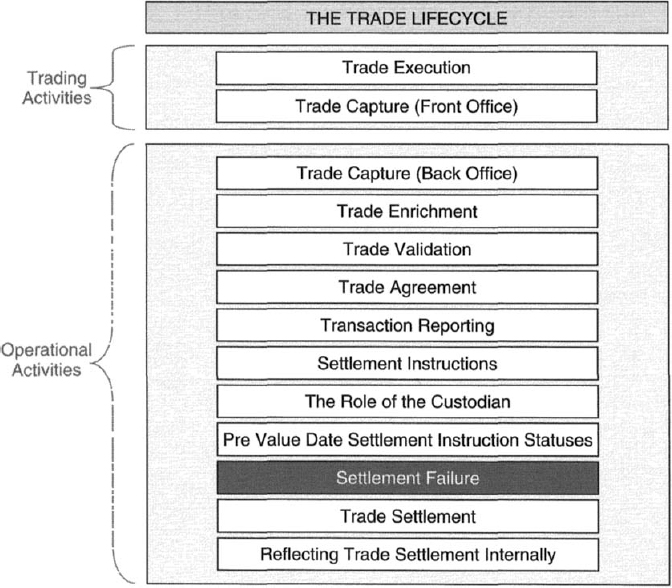

Settlement Failure

19.1 INTRODUCTION

Having reached the value date, a trade will either settle successfully, or it will fail to settle (although partial settlement may be possible) on the due date and settle later.

Trade settlement is the act of buyer and seller (or their respective custodians) exchanging securities and cash, on or after value date, in accordance with the contractual commitment made upon trade execution on trade date. Settlement is successful when the seller is able to deliver the securities and the buyer is able to pay the cash owing.

Historically, a common occurrence in some markets was to find that a minority of trades had not settled months, or in some cases years, after value date, typically because the seller was awaiting delivery of the physical certificates from their purchase and could not therefore deliver the certificates in order to settle the subsequent sale.

In the modern era, because settlement is increasingly effected by electronic book entry, the rate of successful settlement is also improving. In some marketplaces, it is normal (even mandatory) for all trades to settle on their value date, and whenever there is a settlement failure, the authorities may impose penalties on those who cause the failure.

However, in other markets no such regime exists, resulting in the seller not being paid the cash amount due and the buyer not receiving the securities ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.