24

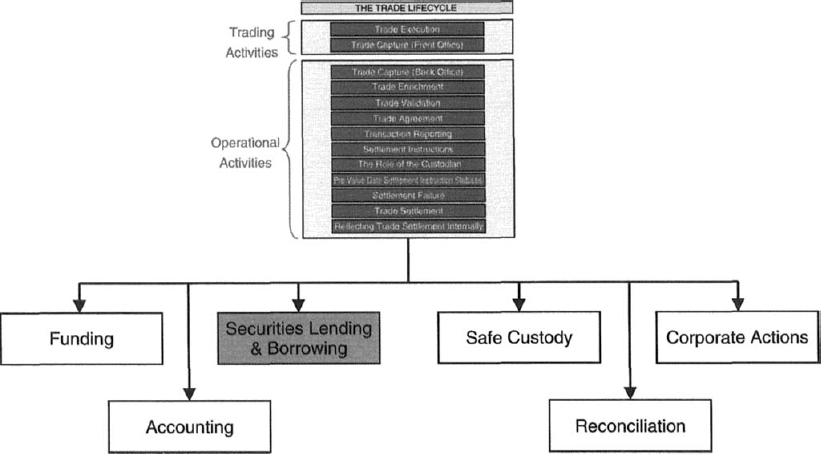

Securities Lending and Borrowing

24.1 INTRODUCTION

Investors who own securities can enhance the return on their investment by lending securities to those who wish to borrow.

Various investors have different outlooks on the subject of securities lending:

- some investors choose to lend their entire inventory of securities,

- some investors choose to lend their securities selectively, and

- other investors choose not to lend their securities at all.

For those who choose to lend their securities, the motivation is to increase the return on their investment.

Conversely, those who need to deliver securities (typically as a result of selling), but have none or an insufficient quantity of securities, may choose to borrow the necessary securities. Borrowing enables the delivery to be completed, in turn enabling the seller to receive the sale proceeds at the earliest opportunity. Refer to Section 19.4.

Where the value date of a sale has been reached, but the sale proceeds have not yet been received, the seller is losing cash. The primary motivation behind securities borrowing, therefore, is to enable timely receipt of sale proceeds. Incoming funds can then, for example:

- reduce the overall cash borrowing requirement, or

- be lent in the money market.

In addition, the continued failure of the seller to deliver securities to the buyer may cause the buyer to invoke buy-in procedures, when the ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.