25

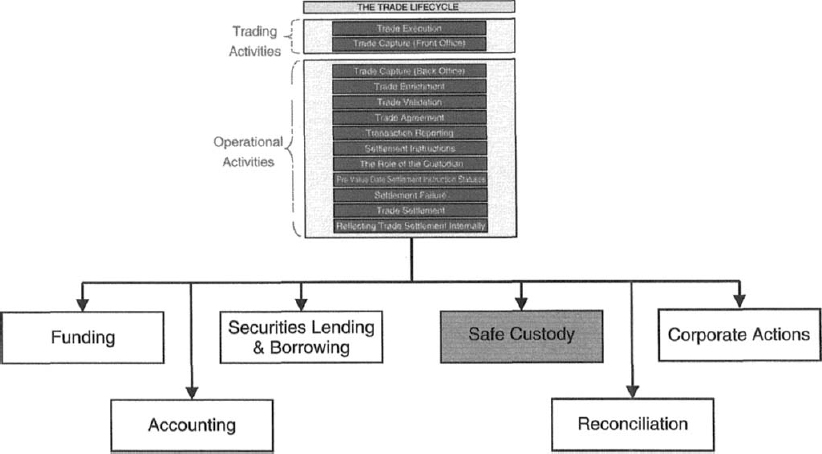

Safe Custody

25.1 INTRODUCTION

Some STOs provide a service to their institutional clients, whereby securities (and sometimes cash) owned by the client are held and managed by the STO.

Most commonly, this arrangement comes about when the STO sells securities to an institutional client who does not have an external custodian for the securities in question. Under such circumstances, the STO may offer to hold the securities (and cash) on the client's behalf.

The STO offering a safe custody service to its clients is, in a number of respects, acting in a similar capacity as the specialist custodian organisations used by the STO, but usually on a much smaller scale. As far as the safe custody client is concerned, the STO is the custodian of their securities (and cash), and therefore the STO must have the necessary infrastructure in place to provide such a service successfully.

Some STOs do not offer a safe custody service. This may prevent execution of trades by institutional clients with such STOs, as the client may be prepared to trade only if the STO is able to hold the securities purchased by the client, in safe custody.

Other STOs provide a limited safe custody service, designed to cater for institutional clients who will trade only if the STO holds the securities on the client's behalf. Offering such a service ensures that the STO does not lose the relationship with the client. ...

Get Securities Operations: A Guide to Trade and Position Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.