APPENDIX B

Bond Math

This appendix reviews the mathematics underlying the mortgage models. For an underlying’s cash flows and a discount rate (yield), one would like to determine its present value or price. Alternatively, given an underlying’s cash flows and its price, one would like to find the discount rate. Given an underlying’s cash flows and either a price or discount rate, one would like to find the underlying’s modified duration. The valuation model underlying credit default swaps (CDSs) is also given. Finally, a credit card model is reviewed.

B.1 MORTGAGE PAYMENT

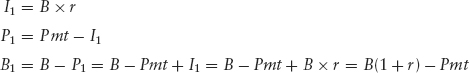

Let M be the number of periods in the loan and r be the constant periodic interest rate. Let B be the initial loan balance and Bk be the balance at the end of period k. Let Ik and Pk be the interest and principal payments made in period k. Let Pmt = Ik + Pk, the total payment made in any period. Our goal is to derive a closed-form expression for constant Pmt. In the first period:

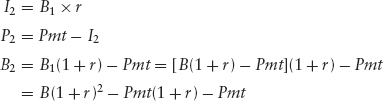

In the second period:

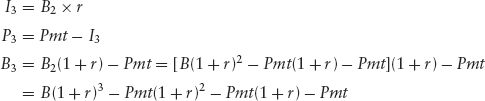

In the third period:

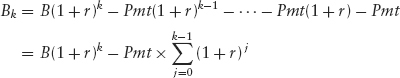

In general, the balance remaining at the end of period k is:

The terms inside the summation ...