Chapter 22

BUDGETARY CONTROL AND RESPONSIBILITY ACCOUNTING

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

1. Describe the concept of budgetary control.

2. Evaluate the usefulness of static budget reports.

3. Explain the development of flexible budgets and the usefulness of flexible budget reports.

4. Describe the concept of responsibility accounting.

5. Indicate the features of responsibility reports for cost centers.

6. Identify the content of responsibility reports for profit centers.

7. Explain the basis and formula used in evaluating performance in investment centers.

*8. Explain the difference between ROI and residual income.

*Note: All asterisked (*) items relate to material contained in the Appendix to the chapter.

PREVIEW OF CHAPTER 22

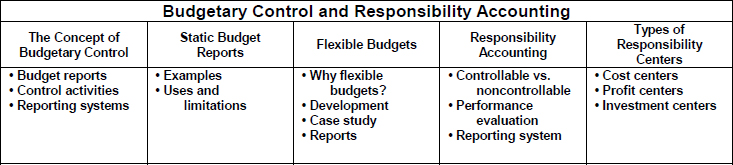

In contrast to Chapter 9, we now consider how budgets are used by management to control operations. This chapter focuses on two aspects of management control: (1) budgetary control and (2) responsibility accounting. The content and organization of this chapter are as follows:

CHAPTER REVIEW

Budgetary Control

- (L.O. 1) The use of budgets in controlling operations is known as budgetary control. Such control takes place by means of budget reports that compare actual results with planned objectives. The budget reports provide management with feedback on operations.

- Budgetary control involves:

- Developing ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.