CHAPTER 5

Supply and Demand, Candlestick Signals, and Point & Figure Chart, with Facebook Exhibits

CANDLESTICK SELL SIGNAL FOR FACEBOOK

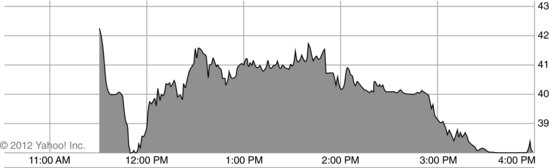

From day one of trading, Facebook (FB) provided an enormous, 1-day sell signal on the candlestick chart, showing extraordinary supply taking price down on monstrous volume. The candlestick in Exhibit 5.4 shows the bearish reversal sell signal with price going higher than the $42 open to the $45 high very briefly and then closing below the open at $38, on enormous volume. Look at Exhibit 5.1 to see what happened minute by minute on the first day of trading.

You know the reasons for this supply, and it has nothing to do with fundamentals but rather errors in pricing the initial public offering (IPO), and flooding the market with additional shares of the stock before it ever opened for trading. The IPO so completely satisfied demand before the open that when it opened there was nothing left but sellers looking for a quick profit. That supply took price down not only on opening day but for months thereafter.

This will become the classic IPO disaster case study at every business school, the Titanic of all IPOs that will be studied and talked about for years. It is a classical technical analysis case showing the basic forces of supply and demand in action rather than fundamentals, although egregious ...

Get Successful Stock Signals for Traders and Portfolio Managers: Integrating Technical Analysis with Fundamentals to Improve Performance, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.