Chapter 6

Handling Payroll and Tax Reporting

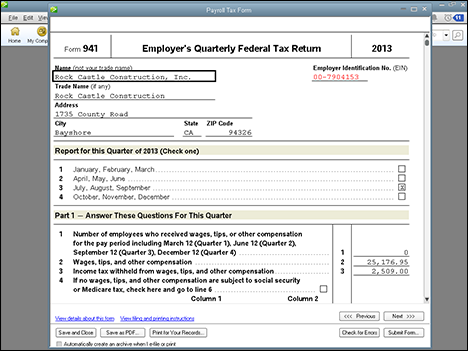

In this chapter, you learn to pay employees and payroll tax liabilities. You also learn to produce federal payroll tax returns such as the Federal Form 941 and to process W-2s, and you learn to summarize payroll data in Microsoft Excel.

Create Federal Payroll Tax Returns

Summarize Payroll Data in Excel

Pay Employees

After you complete all the sections in Chapter 5, you can pay your employees in QuickBooks. You select a pay schedule, employees to pay, ...

Get Teach Yourself VISUALLY QuickBooks 2015 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.