CHAPTER 4

Covered Calls

You probably own stocks. If you do, and someone was willing to pay you money now but they got a portion of the potential appreciation of that stock, the appreciation above a certain level if your stock rallied within a certain time period, would you take that deal? Would you take their money now and sell a portion of your future potential appreciation? You might if you liked the stock for the long term but thought that it was going to be stuck in neutral for some time, either because of the stock itself or because of the broader market. Or you might just think that the value of the cash now is greater than the value of the appreciation you’re potentially giving up once you’ve discounted what you might give up by the probability that you actually have to give it up.

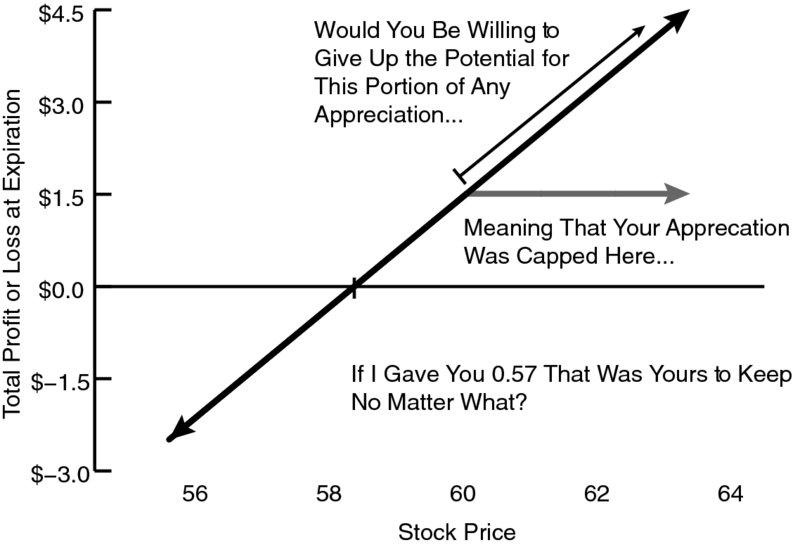

This deal, you receiving cash now and giving up a portion of the potential appreciation of a stock you already own, would look something like Figure 4.1.

Figure 4.1 Would You Make This Trade?

Would you be willing to make that trade, giving up potential appreciation above 60.00 for 0.57 in cash now given that the stock is at 58.50? What if I told you the odds of giving up any appreciation above 60.00 were only 33 percent and that the odds of giving up more appreciation than you’ve received in cash were only 27 percent? Would you make the trade now? You might choose not to if you thought ...

Get The Complete Book of Option Spreads and Combinations: Strategies for Income Generation, Directional Moves, and Risk Reduction, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.