CHAPTER 11

Butterflies

In constructing a vertical spread, we bought one option and sold a very similar option. What happens if we take that thinking a step further and buy one vertical spread and sell a very similar vertical spread? We would reduce the cost of the trade dramatically, that means we would reduce risk, and we would potentially increase leverage if our cost falls but our maximum profit stays the same. Those are all good things.

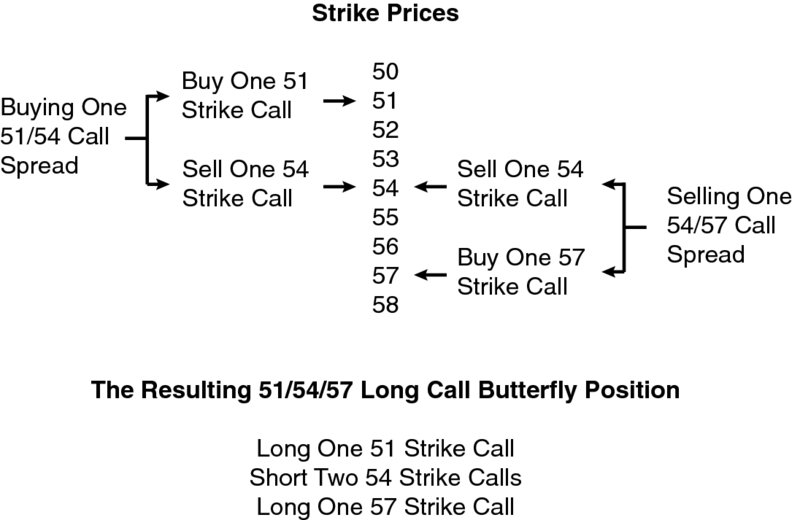

If we made it a point to select the strike prices of our vertical spreads carefully so that the long leg of the first vertical spread and the long leg of the second vertical spread are the same option, then we’ve created a butterfly spread. We’ve also created a butterfly if the short leg of the first vertical spread and the short leg of the second vertical spread are the same option. A butterfly is the first spread that we’re going to look at that’s really a spread or combination of other spreads. Figure 11.1 shows how we might execute a butterfly.

Figure 11.1 Creating a Long Call Butterfly

In this generic butterfly, we’re buying the 51/54 call spread and selling the 54/57 call spread. The resulting position is long one 51 call, short two 54 calls, and long one 57 call. This cumulative position is long one 51/54/57 call butterfly.

A long butterfly is a defined risk strategy that is generally very inexpensive to establish and has a defined ...

Get The Complete Book of Option Spreads and Combinations: Strategies for Income Generation, Directional Moves, and Risk Reduction, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.