Burning Coal and Other Energy Investors

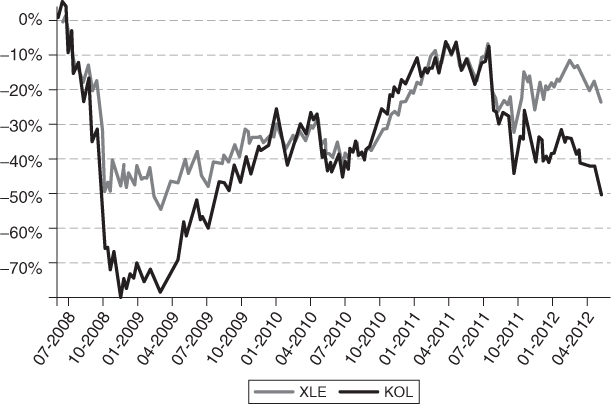

These two industries were not the only ones to be affected by the election. There are many others. To pick another one, for example, let's look at portions of the energy industry. From June 2008 through February 2009, as oil prices plunged, the price of all energy-related stocks fell. Compare the Oil & Gas Index (XLE) to the Coal Index (KOL) in Figure 5.14, and you will see a sharply higher fall-off in the value of the coal industry in the immediate aftermath of the 2008 election.

As you can see from the chart, the oil and gas industry has suffered a 24 percent drop since June 2008, while the coal industry has suffered a 50 percent drop. Because both produce energy, and because most energy products can be substituted over time to some degree for other forms of energy, the difference is largely explainable by government regulation developments. In the case of oil and gas, there was a moratorium in the Gulf of Mexico on drilling in conjunction with the BP oil spill, but it was lifted.

But the coal industry has been singled out as one that should be subject to particularly severe regulation. In fact, the Environmental Protection Agency (EPA), with the support of the administration and Congress, has subjected the coal industry to very costly new regulations, and as ...

Get Trade the Congressional Effect: How To Profit from Congress's Impact on the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.