Chapter 25

Wealth Management

ValuFocus Investing has suggested throughout this book that cash and intrinsic valuation should form the core of any investment strategy. What are the implications of cash intrinsic valuation for you, as a wealth manager? What are practical approaches for using tools arising from this book's insights in your continuing dialogue with clients?

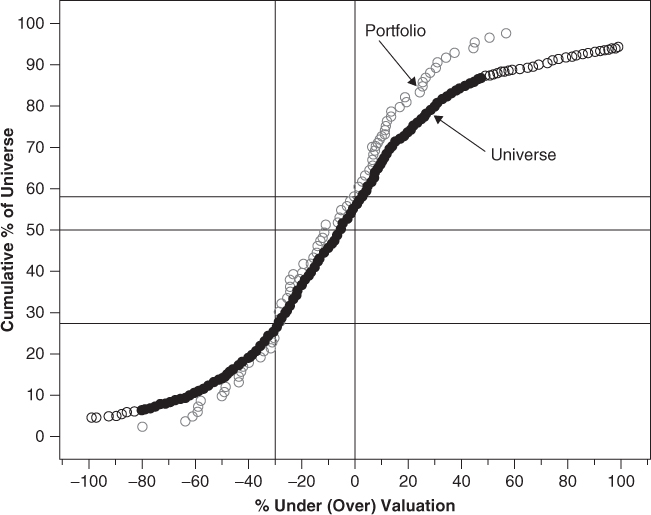

LCRT's consulting work produces a most powerful tool for you to employ with your clients. Figure 25.1 displays the percentage under- or overvaluation for every stock in the portfolio compared with the universe from which it was drawn. The horizontal axis is the percent under- or overvaluation. The vertical axis is the cumulative percentage of the universe.

Figure 25.1 Intrinsic Valuation Comparison of Portfolio to Universe

This particular long portfolio does not appear to be based on intrinsic valuation principles at its core. In fact, it appears to be a safe portfolio with a significantly narrower distribution of fair-valued stocks compared with the universe. Actually, a majority of the stock selections are overvalued. To compound the problem, the portfolio appears to avoid the upper tail of the most undervalued stocks, while becoming somewhat of a closet indexer close to the fair-valued part of the universe.

From an intrinsic valuation perspective, this portfolio management style is not worth the fees paid to ...

Get ValuFocus Investing: A Cash-Loving Contrarian Way to Invest in Stocks now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.