CHAPTER 4

Vertical Spreads and the Iron Condor

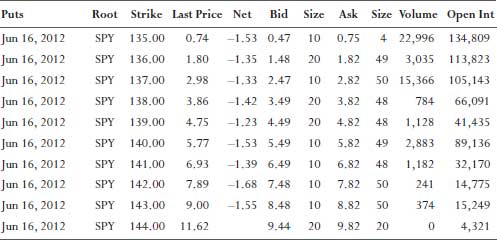

A vertical spread is the workhorse of the 1.8 Standard Deviation Solution strategy. It is comprised of the buying and selling of the same number of options contracts that have the same expiration date but different strike prices. The name becomes obvious when you look at the option chain in Table 4.1.

TABLE 4.1 Put Option Chain

The strike prices are listed in a vertical column. All of these options have an expiration date of June 16, 2012. All of these options are also put options. To build a vertical spread, you need to purchase at least one option contract from the above list and sell the same number of contracts from this options chain. A vertical spread is made up of either calls or puts. You buy a call and you sell a call or you buy a put and you sell a put.

■ Why Use Vertical Spreads?

The magic of vertical spreads is that your maximum loss is predefined for you. If you buy a call or put without the protection inherent in a spread, then your risk is 100 percent. You can lose all of the money you invested in that option if the market moves against you. Using the diagram above, imagine you buy one put contract at $137 strike. This would cost you $282 because options contracts control 100 shares of stock and buyers pay the ask price. (Sellers get the bid price.) “Ask” is the amount the market is offering to sell for and “bid” is ...

Get Vertical Option Spreads: A Study of the 1.8 Standard Deviation Inflection Point, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.