APPENDIX Appendix A Special Message for Advisors

If you invested the time and read the 14 chapters intended for investors, you are likely an advisor who serves your private clients very well. You are meeting the challenges of rapid changes in our industry and remain steadfast in your dedication to excellence.

Having watched many of you who have met with great success over the years convinced me that each Principle of Principal for the investor naturally prompts action on your part.

These actions build a partnership—one that works as well for you as for the investors you advise.

1 Self‐awareness is critical

ADVISOR COROLLARY: A firm defines its ideal client and understands which types of investors it serves well and which investors should not become the firm’s clients. The firm truly knows what it stands for, how it wants to conduct business, and adheres to a meaningful code of conduct.

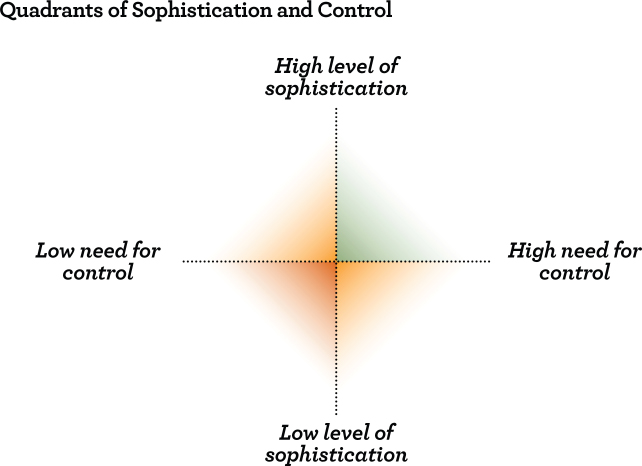

To fully engage with your client requires you both go on a journey of self‐discovery. You might use Quadrants of Sophistication and Control chart1 with both your clients and prospective clients. By performing the exercise and placing themselves on this schematic, suddenly they see the potential problems their family might cause you (or any advisor).

You’ve figured out whom you best serve, turn down inappropriate investors, and save time and aggravation in the process. You probably know where your ...

Get Wealth Management Unwrapped, Revised and Expanded now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.